Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Radio Inc. is a leading Multimedia company that wants to expand its business internationally. The proposed expansion would require the firm to raise about $20.2

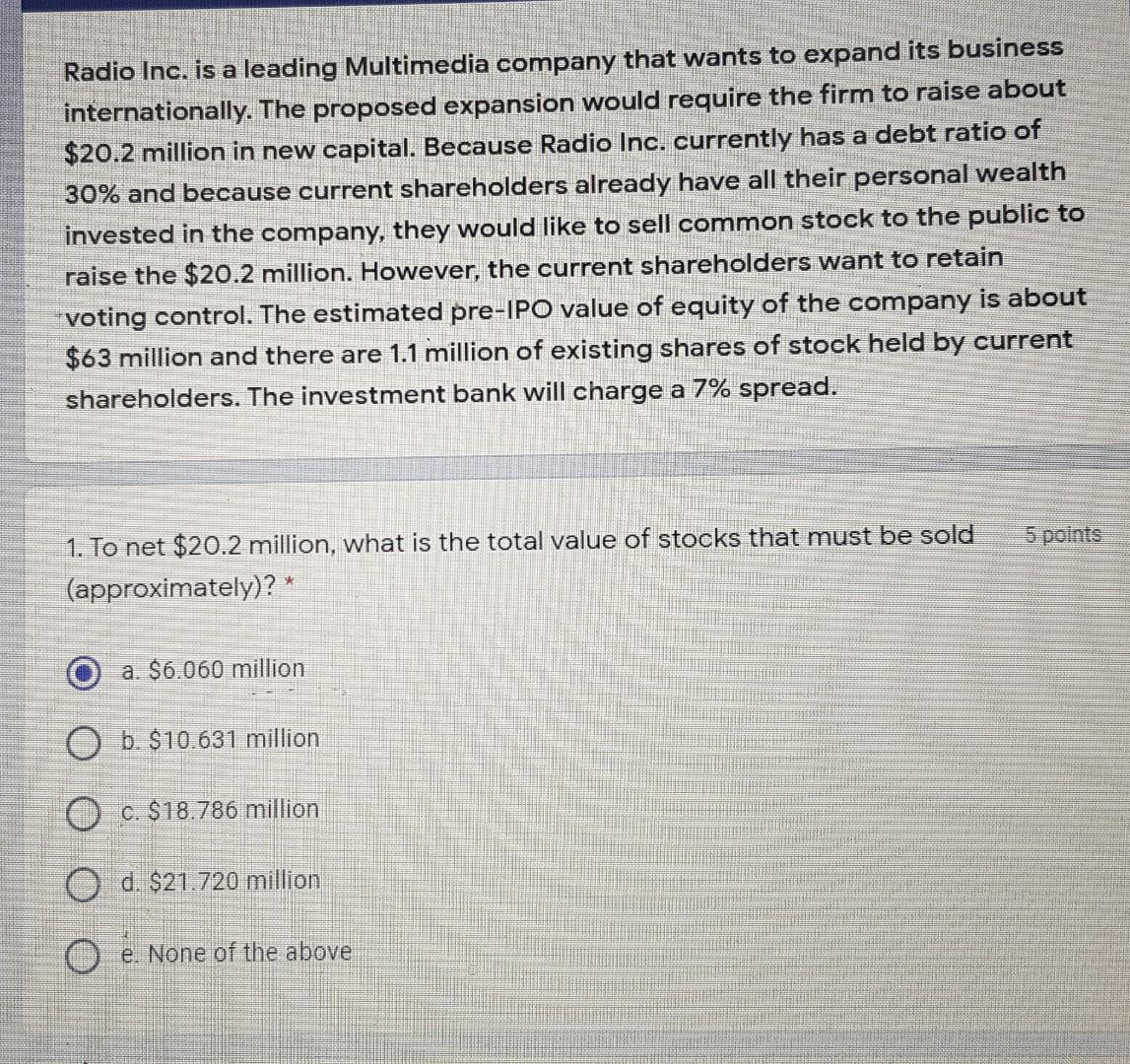

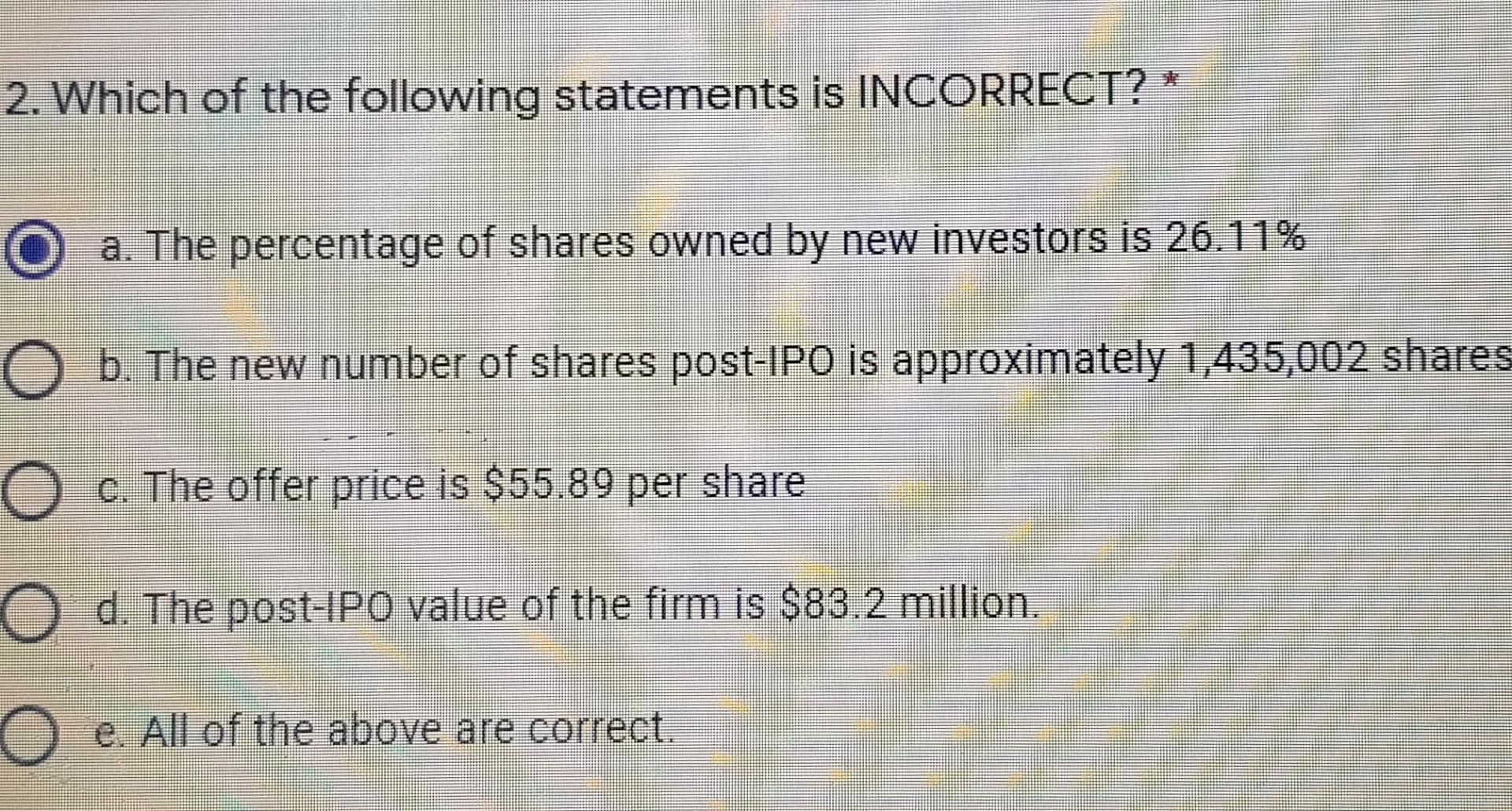

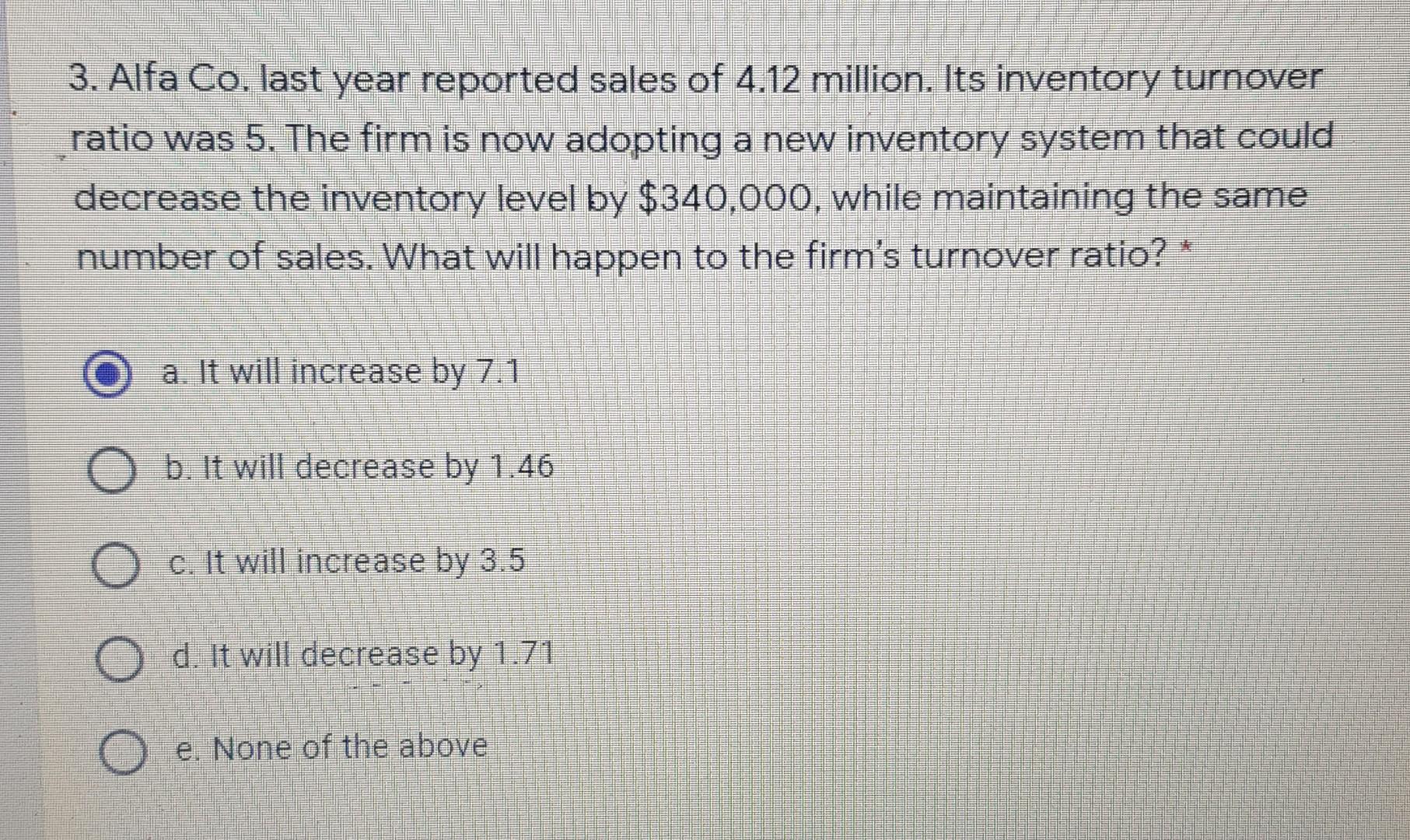

Radio Inc. is a leading Multimedia company that wants to expand its business internationally. The proposed expansion would require the firm to raise about $20.2 million in new capital. Because Radio Inc. currently has a debt ratio of 30% and because current shareholders already have all their personal wealth invested in the company, they would like to sell common stock to the public to raise the $20.2 million. However, the current shareholders want to retain voting control. The estimated pre-IPO value of equity of the company is about $63 million and there are 1.1 million of existing shares of stock held by current shareholders. The investment bank will charge a 7% spread. 5 points 1. To net $20.2 million, what is the total value of stocks that must be sold (approximately)? * a. $6.060 million O b. $10.631 million O c. $18.786 million O d. $21.720 million O e. None of the above 2. Which of the following statements is INCORRECT? * a. The percentage of shares owned by new investors is 26.11% b. The new number of shares post-IPO is approximately 1,435,002 shares O c. The offer price is $55.89 per share d. The post-IPO value of the firm is $83.2 million. O e. All of the above are correct. 3. Alfa Co. last year reported sales of 4.12 million. Its inventory turnover ratio was 5. The firm is now adopting a new inventory system that could decrease the inventory level by $340,000, while maintaining the same number of sales. What will happen to the firm's turnover ratio? * a. It will increase by 7.1 b. It will decrease by 1.46 O c. It will increase by 3.5 O d. It will decrease by 1.71 O e. None of the above

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started