Answered step by step

Verified Expert Solution

Question

1 Approved Answer

RADIUS sells radiators which it buys from a wholesaler. Its clientele consists mainly of individuals. In this sector, profitability is 4%. The Manager asks you

RADIUS sells radiators which it buys from a wholesaler. Its clientele consists mainly of individuals. In this sector, profitability is 4%. The Manager asks you to make forecasts for 2021.

Information relating to 2020 :

The company has sold 3,000 watches at a unit selling price of 80. The wholesaler invoiced the watches at the average unit cost of 32. The annual rent was 12,000. The gross annual salaries amounted to 70,200 with employer contributions of 45%. The other annual fixed costs were 24,792.

Forecast for 2021:

RADIUS wonders if it would not be wise to move to a more commercial street. An analysis of the market indeed suggests that it could sell 3,380 radiators with a unit selling price that could increase by 5%. The annual amount of the new rent would be 16,000. The company is also forecasting a 3% wage increase as of January 01. The other fixed costs will increase by 6% as of January 01. The wholesaler will increase his price which will rise to 35.87 from 01 January. An advertising campaign will have to be planned for an amount of 7,000.

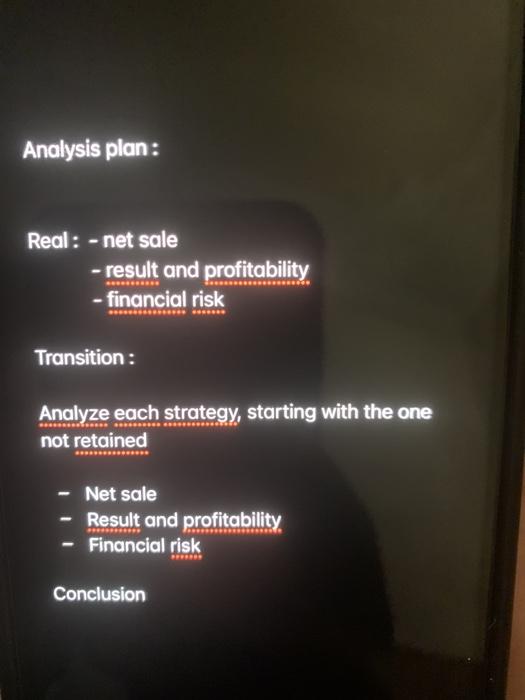

1. Calculate for 2020 and 2021 the different elements necessary for the analysis (net sales ,variable cost fixed price result break even, margine on varibale cost , break even point in quantity, break even in value ,security index, leeway, dead point and safety margine, unit saling price , quantity

2. Analyze the situation for 2020

3. Analyze the forecasts for 2021

4. Wishing profitability of 6%, the company plans to increase its sales volume.

What do you think ?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started