Question

Radulski Corporation issued $ 500,000 of 14 %, 10 -year bonds payable on January 1, 2019. The market interest rate at the date of issuance

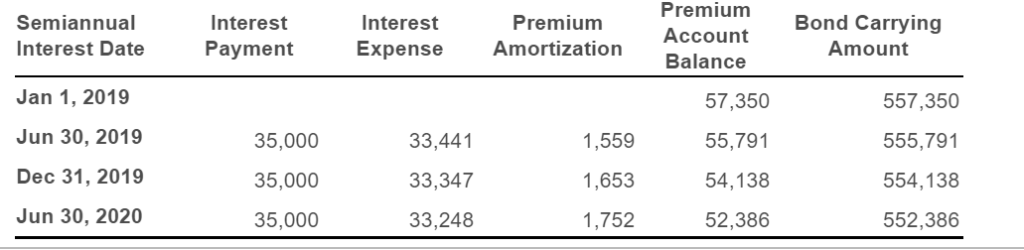

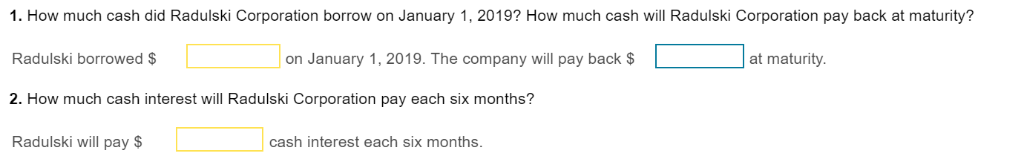

Radulski Corporation issued $ 500,000 of 14 %, 10 -year bonds payable on January 1, 2019. The market interest rate at the date of issuance was 12 %, and the bonds pay interest semiannually (on June 30 and December 31). Radulski Corporation's year-end is June 30. Radulski prepared an effective-interest amortization table for the bonds through the first three interest payments as follows:

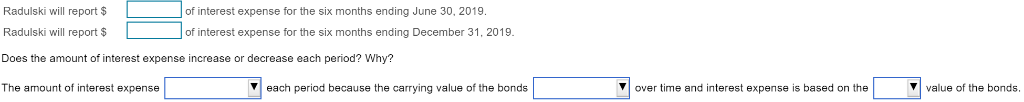

3. How much interest expense will Radulski Corporation report on June 30, 2019 , and on December 31, 2019 ? Does the amount of interest expense increase or decrease each period? Why?

Premium Bond Carrying Amount Semiannual Interest Date Jan 1, 2019 Jun 30, 2019 Dec 31, 2019 Jun 30, 2020 Interest Payment Interest Expense Premium Amortization Account Balance 35,000 35,000 35,000 33,441 33,347 33,248 1,559 1,653 1,752 57,350 55,791 54,138 52,386 557,350 555,791 554,138 552,386 1. How much cash did Radulski Corporation borrow on January 1, 2019? How much cash will Radulski Corporation pay back at maturity? Radulski borrowed $ 2. How much cash interest wil Radulski Corporation pay each six months? Radulski will pay $ on January 1,2019. The company will pay back $ at maturity cash interest each six months Radulski will report $ Radulski will report $ Does the amount of interest expense increase or decrease each period? Why? The amount of interest expense of interest expense for the six months ending June 30, 2019 of interest expense for the six months ending December 31, 2019 each period because the carrying value of the bonds Vover time and interest expense is based on the V value of the bonds value of the bonds carrying face maturity par

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started