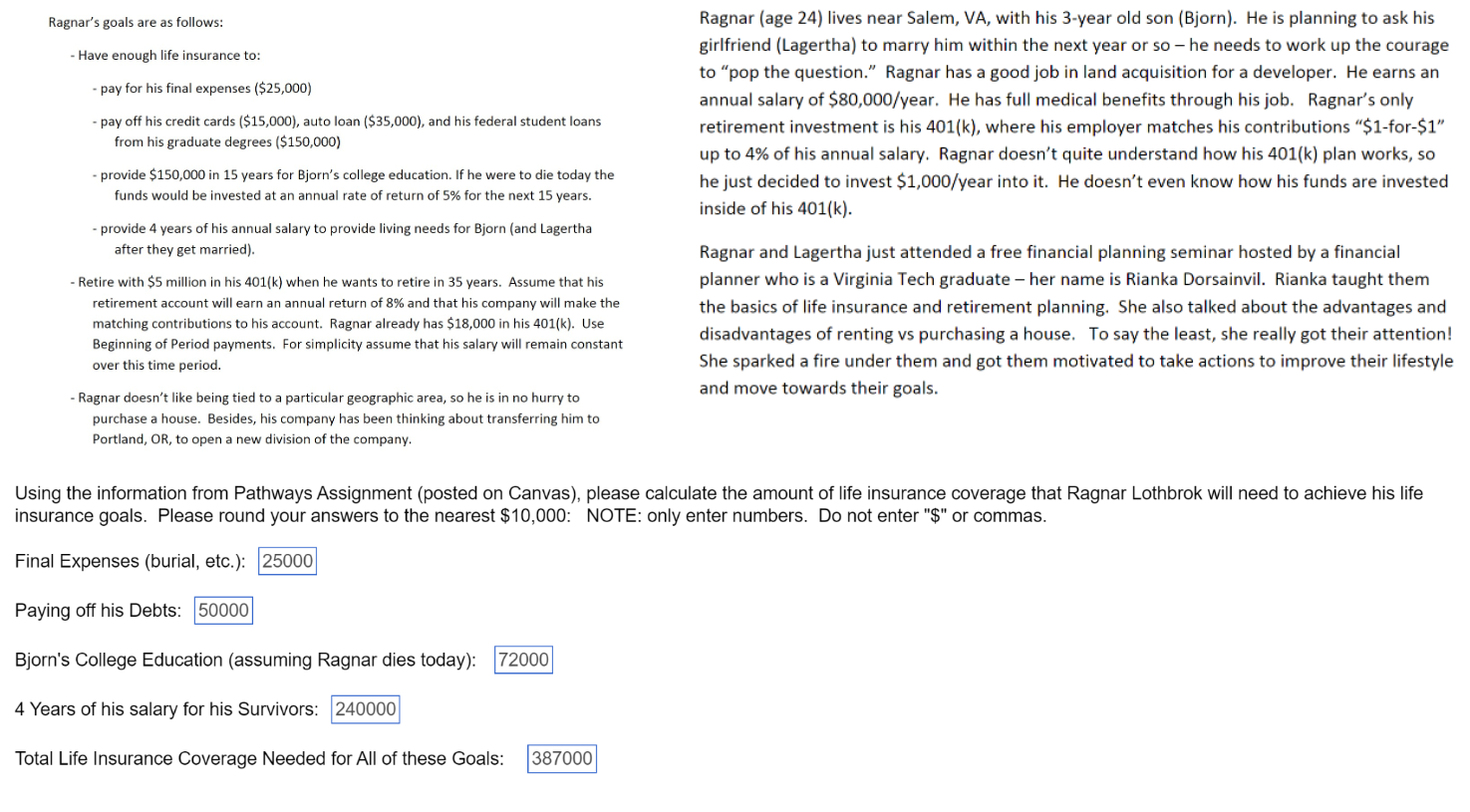

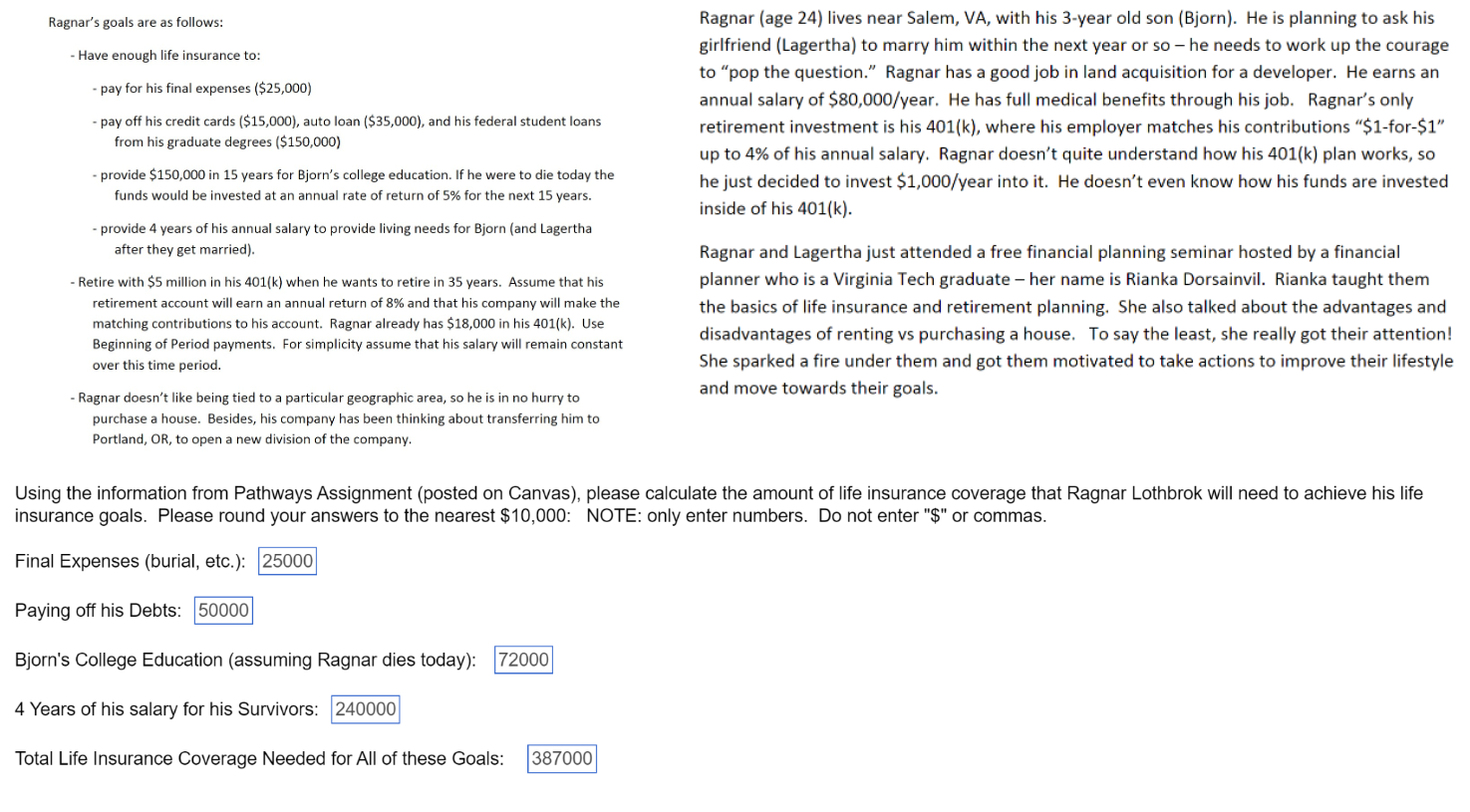

Ragnar's goals are as follows: Have enough life insurance to: - pay for his final expenses ($25,000) pay off his credit cards ($15,000), auto loan ($35,000), and his federal student loans from his graduate degrees ($150,000) provide $150,000 in 15 years for Bjorn's college education. If he were to die today the funds would be invested at an annual rate of return of 5% for the next 15 years. Ragnar (age 24) lives near Salem, VA, with his 3-year old son (Bjorn). He is planning to ask his girlfriend (Lagertha) to marry him within the next year or so - he needs to work up the courage to "pop the question." Ragnar has a good job in land acquisition for a developer. He earns an annual salary of $80,000/year. He has full medical benefits through his job. Ragnar's only retirement investment is his 401(k), where his employer matches his contributions "$ 1-for-$1" up to 4% of his annual salary. Ragnar doesn't quite understand how his 401(k) plan works, so he just decided to invest $1,000/year into it. He doesn't even know how his funds are invested inside of his 401(k). provide 4 years of his annual salary to provide living needs for Bjorn (and Lagertha after they get married). Retire with $5 million in his 401(k) when he wants to retire in 35 years. Assume that his retirement account will earn an annual return of 8% and that his company will make the matching contributions to his account. Ragnar already has $18,000 in his 401(k). Use Beginning of Period payments. For simplicity assume that his salary will remain constant over this time period. Ragnar and Lagertha just attended a free financial planning seminar hosted by a financial planner who is a Virginia Tech graduate - her name is Rianka Dorsainvil. Rianka taught them the basics of life insurance and retirement planning. She also talked about the advantages and disadvantages of renting vs purchasing a house. To say the least, she really got their attention! She sparked a fire under them and got them motivated to take actions to improve their lifestyle and move towards their goals. Ragnar doesn't like being tied to a particular geographic area, so he is in no hurry to purchase a house. Besides, his company has been thinking about transferring him to Portland, OR, to open a new division of the company. Using the information from Pathways Assignment (posted on Canvas), please calculate the amount of life insurance coverage that Ragnar Lothbrok will need to achieve his life insurance goals. Please round your answers to the nearest $10,000: NOTE: only enter numbers. Do not enter "$" or commas. Final Expenses (burial, etc.): 25000 Paying off his Debts: 50000 Bjorn's College Education (assuming Ragnar dies today): 72000 4 Years of his salary for his Survivors: 240000 Total Life Insurance Coverage Needed for All of these Goals: 387000 Ragnar's goals are as follows: Have enough life insurance to: - pay for his final expenses ($25,000) pay off his credit cards ($15,000), auto loan ($35,000), and his federal student loans from his graduate degrees ($150,000) provide $150,000 in 15 years for Bjorn's college education. If he were to die today the funds would be invested at an annual rate of return of 5% for the next 15 years. Ragnar (age 24) lives near Salem, VA, with his 3-year old son (Bjorn). He is planning to ask his girlfriend (Lagertha) to marry him within the next year or so - he needs to work up the courage to "pop the question." Ragnar has a good job in land acquisition for a developer. He earns an annual salary of $80,000/year. He has full medical benefits through his job. Ragnar's only retirement investment is his 401(k), where his employer matches his contributions "$ 1-for-$1" up to 4% of his annual salary. Ragnar doesn't quite understand how his 401(k) plan works, so he just decided to invest $1,000/year into it. He doesn't even know how his funds are invested inside of his 401(k). provide 4 years of his annual salary to provide living needs for Bjorn (and Lagertha after they get married). Retire with $5 million in his 401(k) when he wants to retire in 35 years. Assume that his retirement account will earn an annual return of 8% and that his company will make the matching contributions to his account. Ragnar already has $18,000 in his 401(k). Use Beginning of Period payments. For simplicity assume that his salary will remain constant over this time period. Ragnar and Lagertha just attended a free financial planning seminar hosted by a financial planner who is a Virginia Tech graduate - her name is Rianka Dorsainvil. Rianka taught them the basics of life insurance and retirement planning. She also talked about the advantages and disadvantages of renting vs purchasing a house. To say the least, she really got their attention! She sparked a fire under them and got them motivated to take actions to improve their lifestyle and move towards their goals. Ragnar doesn't like being tied to a particular geographic area, so he is in no hurry to purchase a house. Besides, his company has been thinking about transferring him to Portland, OR, to open a new division of the company. Using the information from Pathways Assignment (posted on Canvas), please calculate the amount of life insurance coverage that Ragnar Lothbrok will need to achieve his life insurance goals. Please round your answers to the nearest $10,000: NOTE: only enter numbers. Do not enter "$" or commas. Final Expenses (burial, etc.): 25000 Paying off his Debts: 50000 Bjorn's College Education (assuming Ragnar dies today): 72000 4 Years of his salary for his Survivors: 240000 Total Life Insurance Coverage Needed for All of these Goals: 387000