Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Ragnetto Ltd, a British exporter, distributes U.K. animated movies in the United States. Last year Ragnetto sold five million DVDs in the U.S. at

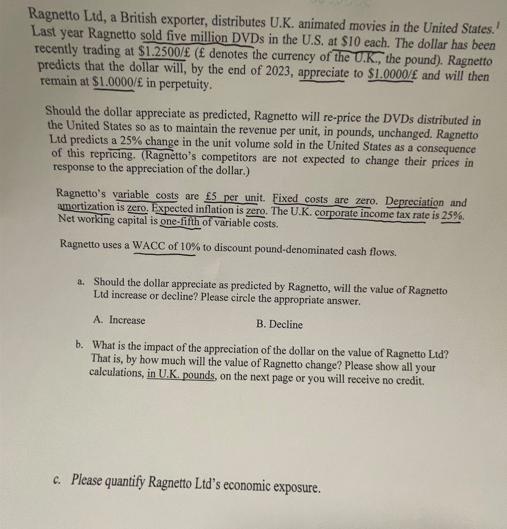

Ragnetto Ltd, a British exporter, distributes U.K. animated movies in the United States. Last year Ragnetto sold five million DVDs in the U.S. at $10 each. The dollar has been recently trading at $1.2500/ ( denotes the currency of the U.K., the pound). Ragnetto predicts that the dollar will, by the end of 2023, appreciate to $1.0000/ and will then remain at $1.0000/ in perpetuity. Should the dollar appreciate as predicted, Ragnetto will re-price the DVDs distributed in the United States so as to maintain the revenue per unit, in pounds, unchanged. Ragnetto Ltd predicts a 25% change in the unit volume sold in the United States as a consequence of this repricing. (Ragnetto's competitors are not expected to change their prices in response to the appreciation of the dollar.) Ragnetto's variable costs are 5 per unit. Fixed costs are zero. Depreciation and amortization is zero. Expected inflation is zero. The U.K. corporate income tax rate is 25%. Net working capital is one-fifth of variable costs. Ragnetto uses a WACC of 10% to discount pound-denominated cash flows. a. Should the dollar appreciate as predicted by Ragnetto, will the value of Ragnetto Ltd increase or decline? Please circle the appropriate answer. A. Increase B. Decline b. What is the impact of the appreciation of the dollar on the value of Ragnetto Ltd? That is, by how much will the value of Ragnetto change? Please show all your calculations, in U.K. pounds, on the next page or you will receive no credit. c. Please quantify Ragnetto Ltd's economic exposure.

Step by Step Solution

★★★★★

3.58 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

a Increase b Impact of dollar appreciation on value of Ragnetto Ltd Currently Revenue per unit 1...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started