Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Raina decided to transfer her life insurance policy with a $100,000 death benefit to an Irrevocable Life Insurance Trust (ILIT) today for the benefit of

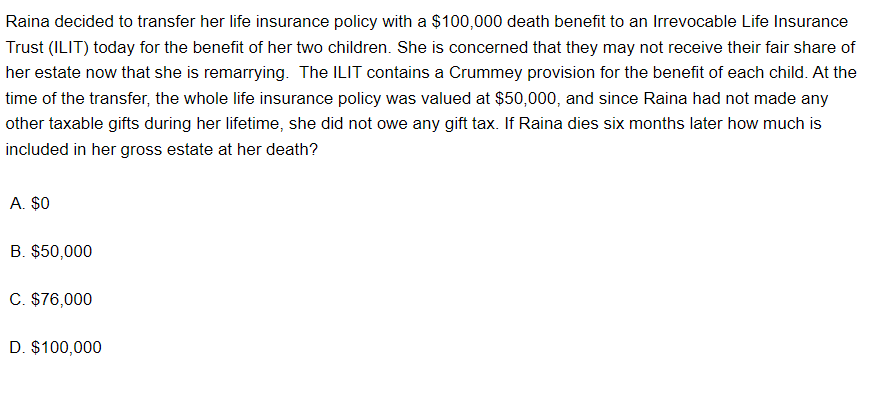

Raina decided to transfer her life insurance policy with a $100,000 death benefit to an Irrevocable Life Insurance Trust (ILIT) today for the benefit of her two children. She is concerned that they may not receive their fair share of her estate now that she is remarrying. The ILIT contains a Crummey provision for the benefit of each child. At the time of the transfer, the whole life insurance policy was valued at $50,000, and since Raina had not made any other taxable gifts during her lifetime, she did not owe any gift tax. If Raina dies six months later how much is included in her gross estate at her death? A. $0 B. $50,000 C. $76,000 D. $100,000

Raina decided to transfer her life insurance policy with a $100,000 death benefit to an Irrevocable Life Insurance Trust (ILIT) today for the benefit of her two children. She is concerned that they may not receive their fair share of her estate now that she is remarrying. The ILIT contains a Crummey provision for the benefit of each child. At the time of the transfer, the whole life insurance policy was valued at $50,000, and since Raina had not made any other taxable gifts during her lifetime, she did not owe any gift tax. If Raina dies six months later how much is included in her gross estate at her death? A. $0 B. $50,000 C. $76,000 D. $100,000 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started