Answered step by step

Verified Expert Solution

Question

1 Approved Answer

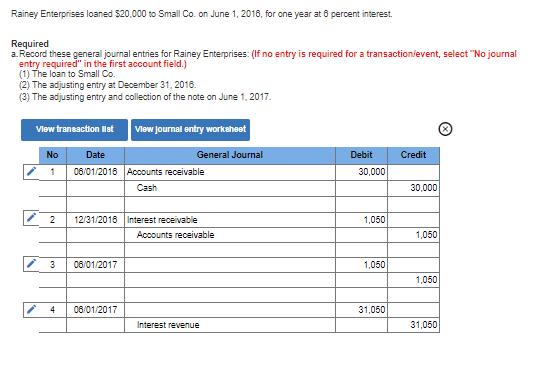

Rainey Enterprises loaned 520,000 to Smail Co. on June 1, 2018, for one year at 8 percent interest. Required a. Record these general journal

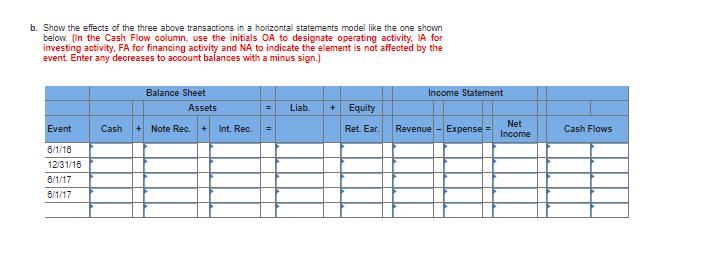

Rainey Enterprises loaned 520,000 to Smail Co. on June 1, 2018, for one year at 8 percent interest. Required a. Record these general journal entries for Rainey Enterprises: (If no entry is required for a transactionievent, select "No journal entry required" in the first account field.) (1) The loan to Small Co. (2) The adjusting entry at December 31, 2016. (3) The adjusting entry and collection of the note on June 1. 2017. Vlew transaction IHat Vlew journal entry workaheet No Date General Journal Debit Credit 1 06/01/2016 Accounts receivable 30,000 Cash 30,000 12/31/2016 Interest receivable 1,050 Accounts receivable 1,050 08/01/2017 1,050 1,050 4 08/01/2017 31,050 Interest revenue 31,050 b. Show the effects of the three above transactions in a horizontal statements model like the one shown below. (In the Cash Flow column, use the initials OA to designate operating activity. IA for investing activity, FA for financing activity and NA to indicate the element is not affected by the event. Enter any decreases to account balances with a minus sign.) Income Statement Balance Sheet Assets Liab. Equity Net Event Cash + Note Rec. Int. Rec. Ret. Ear. Revenue - Expense Cash Flows Income 6/1/18 12/31/18 8/1/17 6/1/17

Step by Step Solution

★★★★★

3.46 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

No Date General journal Debit Credit 1 612016 Note r...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started