Answered step by step

Verified Expert Solution

Question

1 Approved Answer

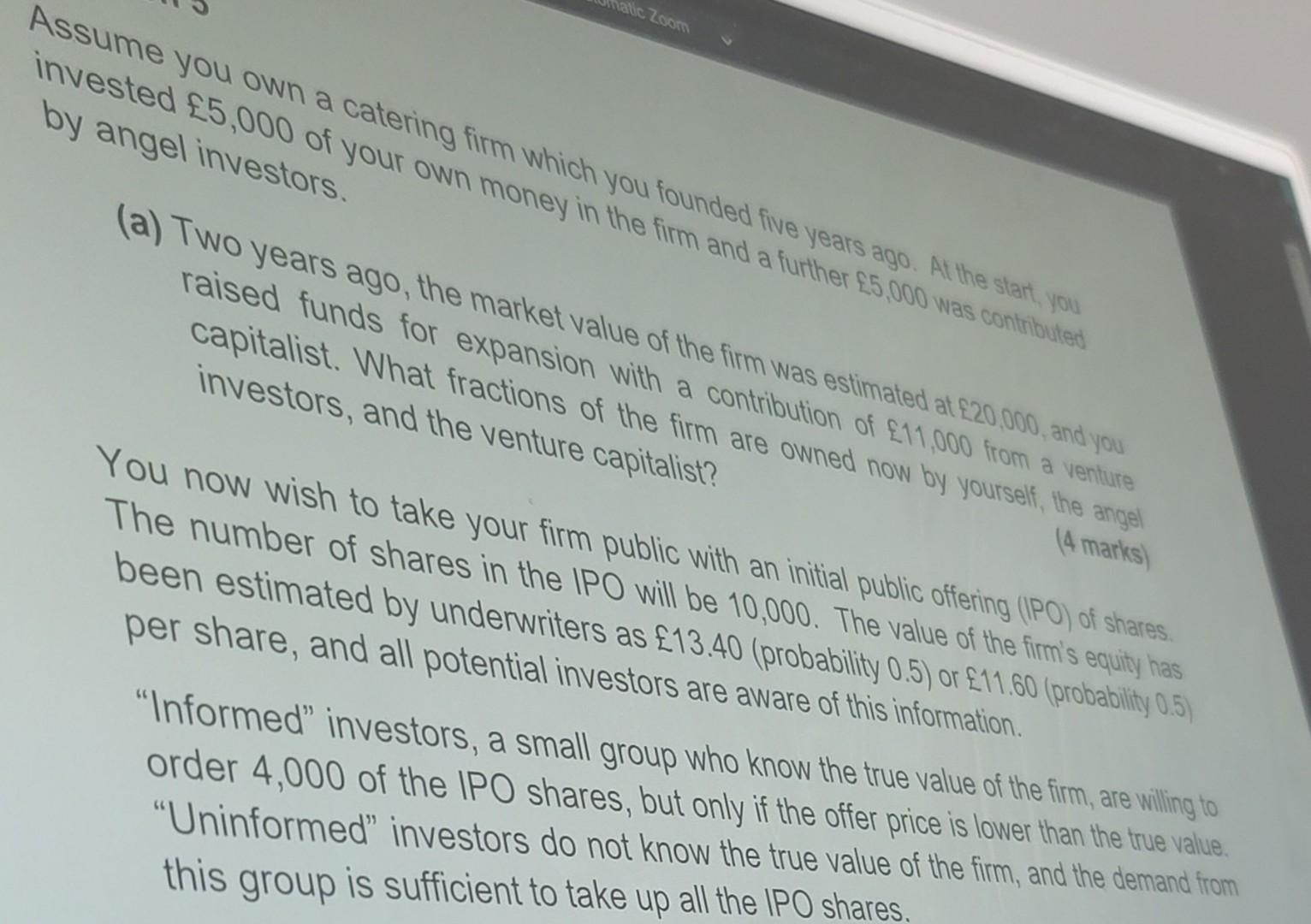

raised fund capitalist. What fractions of the venture capitalist? are owned now by yourself, the angel investors, and wish to take your firm public with

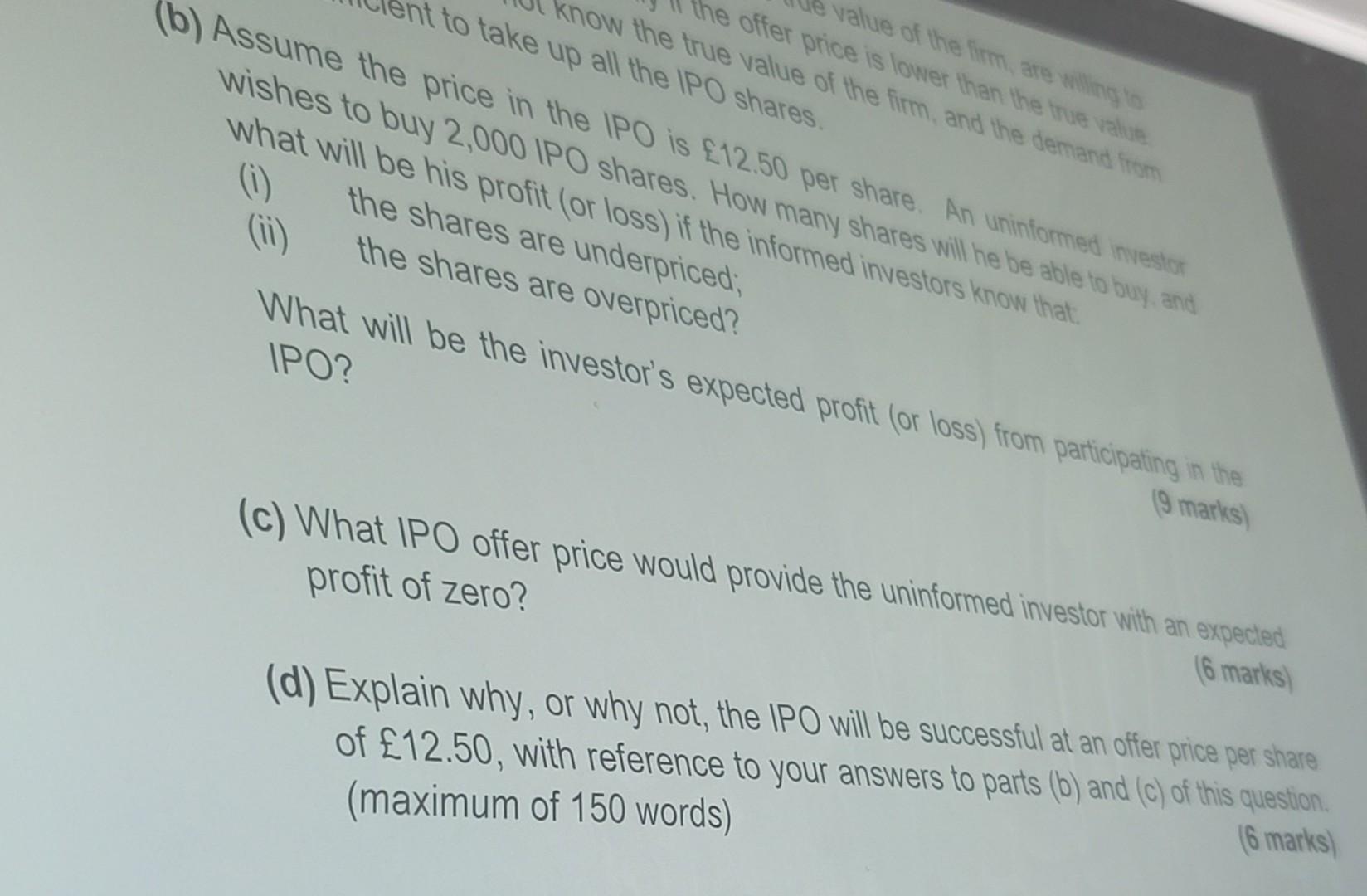

raised fund capitalist. What fractions of the venture capitalist? are owned now by yourself, the angel investors, and wish to take your firm public with an inith pubic otrome (4marks) You now wish to take your firm public with an initial public offering (IPO) of shares. The number of shared by underwriters as 13.40 (probability value of the firm's equity has been estimated by underware, and all potential investors are aware of thi 0.5 ) or 11.60 (probability 0.5) per share, and all potential investors are aware of this information. "Informed" investors, a small group who know the true value of the firm, are willing to order 4,000 of the IPO shares, but only if the offer price is lower than the true value "Uninformed" investors do not know the true value of the firm, and the demand fror this group is sufficient to take up all the IPO shares. wishes to price in the the IPO shares. of the firm, and the dernand trom What will be 2,000 IPO IPO is 12.50 per share. An uninformed investor (i) the she profit (or loss) if the many shares will he be able to buy, and (ii) the shares are underpriced; What will be the are overpriced? IPO

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started