Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Raja and Sam were partners in a firm sharing profits in the ratio of their capitals contributed on commencement of business which were RO.

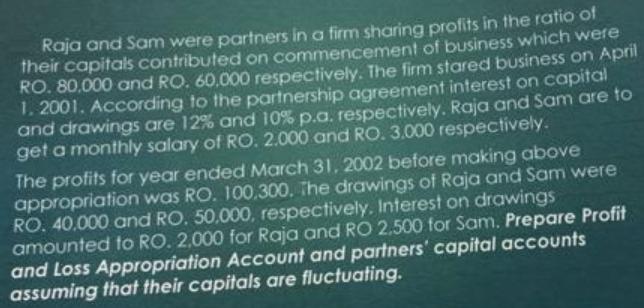

Raja and Sam were partners in a firm sharing profits in the ratio of their capitals contributed on commencement of business which were RO. 80,000 and RO. 60.000 respectively. The firm stared business on April 1. 2001. According to the partnership agreement interest on capital and drawings are 12% and 10% p.a. respectively. Raja and Sam are to get a monthly salary of RO. 2.000 and RO. 3.000 respectively. The profits for year ended March 31, 2002 before making above appropriation was RO. 100,300, The drawings of Raja and Sam were RO. 40,000 and RO. 50,000, respectively, Interest on drawings amounted to RO. 2.000 for Raja and RO 2.500 for Sam. Prepare Profit and Loss Appropriation Account and partners' capital accounts assuming that their capitals are fluctuating.

Step by Step Solution

★★★★★

3.37 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Step 1 Partnership according to section 3 1 of the partnersh...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started