Answered step by step

Verified Expert Solution

Question

1 Approved Answer

At January 1, 2021, Transit Developments owed First City Bank Group $730,000, under an 10% note with three years remaining to maturity. Due to

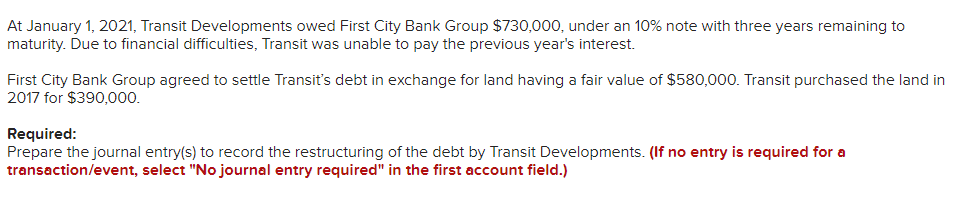

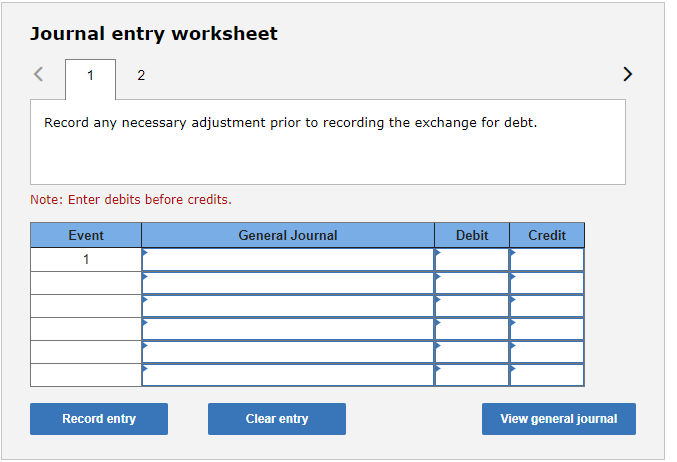

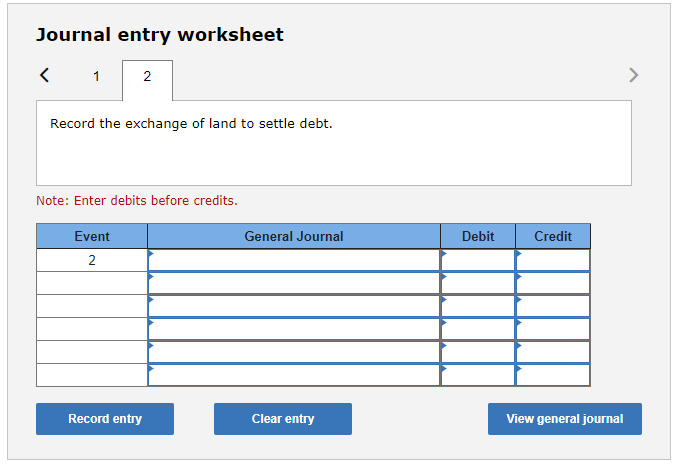

At January 1, 2021, Transit Developments owed First City Bank Group $730,000, under an 10% note with three years remaining to maturity. Due to financial difficulties, Transit was unable to pay the previous year's interest. First City Bank Group agreed to settle Transit's debt in exchange for land having a fair value of $580,000. Transit purchased the land in 2017 for $390,000. Required: Prepare the journal entry(s) to record the restructuring of the debt by Transit Developments. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Journal entry worksheet 1 2 > Record any necessary adjustment prior to recording the exchange for debt. Note: Enter debits before credits. Event General Journal Debit Credit 1 Record entry Clear entry View general journal Journal entry worksheet 1 2 Record the exchange of land to settle debt. Note: Enter debits before credits. Event General Journal Debit Credit 2 Record entry Clear entry View general journal

Step by Step Solution

★★★★★

3.41 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Event fasthicelass Debit Creelit laned S8oo0o 190000 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started