Answered step by step

Verified Expert Solution

Question

1 Approved Answer

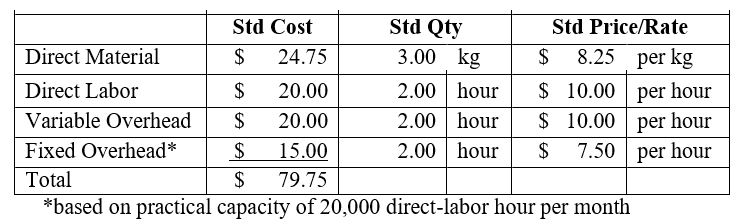

Rakuten Co establishes the following standards for the costs of 1 unit of its product. The standard production overhead costs per unit are based on

Rakuten Co establishes the following standards for the costs of 1 unit of its product. The standard production overhead costs per unit are based on direct-labor hours. Calculation for standard per unit cost is as follows:

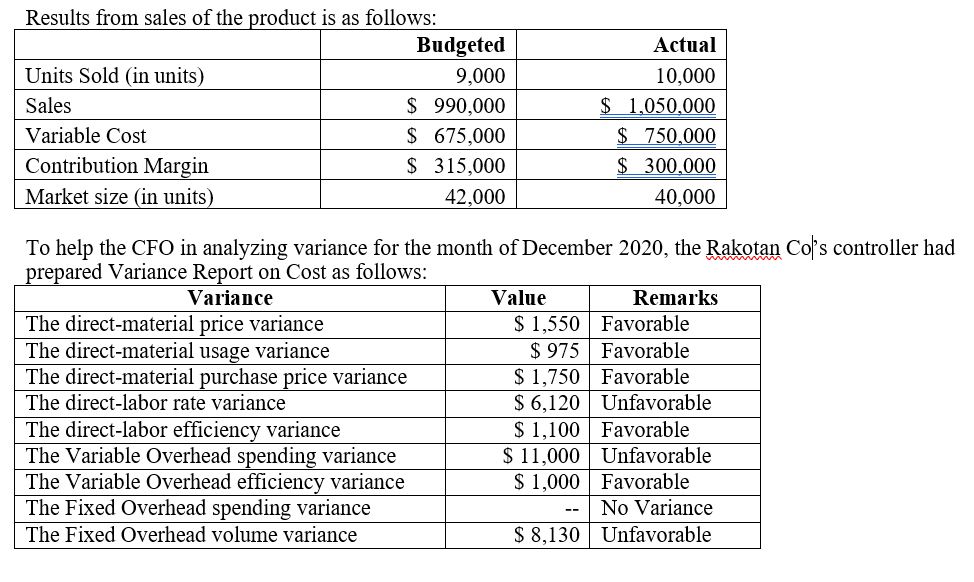

Results from sales of the product is as follows: Units Sold (in units) Sales Variable Cost Contribution Margin Market size (in units) Budgeted 9,000 Actual 10,000 $ 1,050,000 $ 990,000 $ 675,000 $ 750,000 $ 315,000 42,000 $ 300,000 40,000 To help the CFO in analyzing variance for the month of December 2020, the Rakotan Co's controller had prepared Variance Report on Cost as follows: Variance The direct-material price variance The direct-material usage variance The direct-material purchase price variance The direct-labor rate variance The direct-labor efficiency variance The Variable Overhead spending variance The Variable Overhead efficiency variance The Fixed Overhead spending variance The Fixed Overhead volume variance Value Remarks $ 1,550 Favorable $975 Favorable $ 1,750 Favorable $ 6,120 Unfavorable $ 1,100 Favorable $ 11,000 $1,000 Unfavorable -- Favorable No Variance $ 8,130 Unfavorable

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started