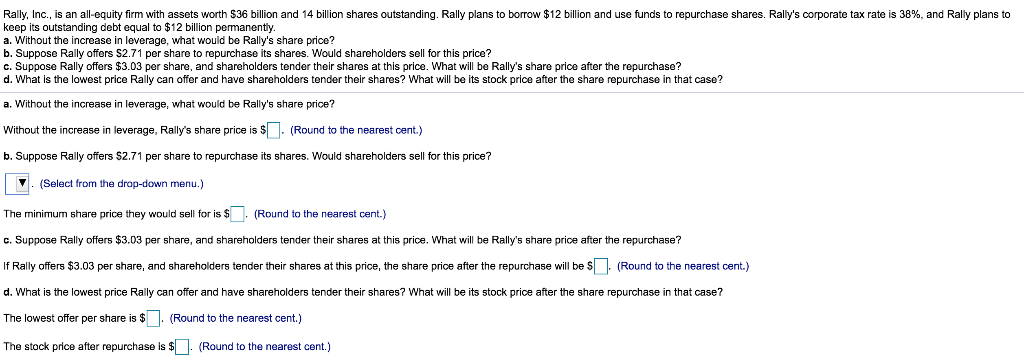

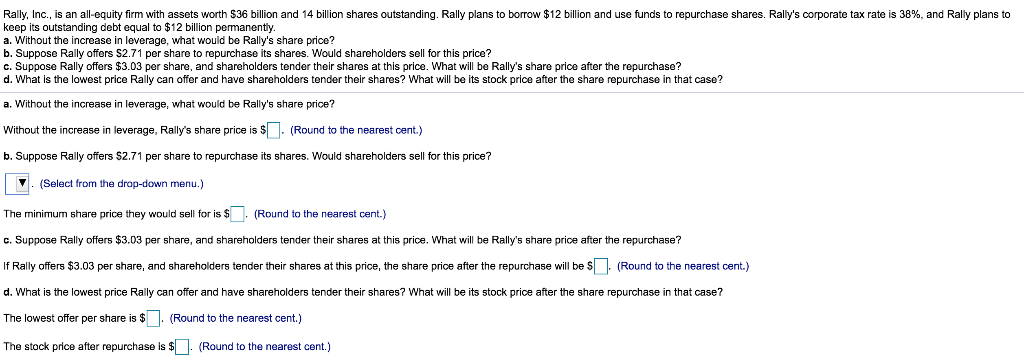

Rally, Inc., is an all-equity firm with assets worth $36 billion and 14 billion shares outstanding. Rally plans to borrow $12 billion and use funds to repurchase shares. Rally's corporate tax rate is 38%, and Rally plans to keep its outstanding debt equal to $12 billion permanently. a. Without the increase in leverage, what would be Rally's share price? b. Suppose Rally offers S2.71 per share to repurchase its shares. Would shareholders sell for this price? c. Suppose Rally offers $3.03 per share, and shareholders tender their shares at this price. What will be Rally's share price after the repurchase? d. What is the lowest price Rally can offer and have shareholders tender their shares? What ill be its stock price after the share repurchase in that case? a. Without the increase in leverage, what would be Rally's share price? Without the increase in leverage, Raly's share price is s (Round to the nearest cent.) b. Suppose Rally offers $2.71 per share to repurchase its shares. Would shareholders sell for this price? V. (Select from the drop-down menu.) The minimun share price they would sell for is $Round to the nearest cent.) c. Suppose Rally offers $3.03 per share, and shareholders tender their shares at this price. What will be Rally's share price after the repurchase? If Rally offers $3.03 per share, and shareholders tender their shares at this price, the share price after the repurchase will be s (Round to the nearest cent.) d. What is the lowest price Rally can offer and have shareholders tender their shares? What will be its stock price after the share repurchase in that case? The lowest offer per share is $. (Round to the nearest cent.) The stock price after repurchaseis (Round to the nearest cent.) Rally, Inc., is an all-equity firm with assets worth $36 billion and 14 billion shares outstanding. Rally plans to borrow $12 billion and use funds to repurchase shares. Rally's corporate tax rate is 38%, and Rally plans to keep its outstanding debt equal to $12 billion permanently. a. Without the increase in leverage, what would be Rally's share price? b. Suppose Rally offers S2.71 per share to repurchase its shares. Would shareholders sell for this price? c. Suppose Rally offers $3.03 per share, and shareholders tender their shares at this price. What will be Rally's share price after the repurchase? d. What is the lowest price Rally can offer and have shareholders tender their shares? What ill be its stock price after the share repurchase in that case? a. Without the increase in leverage, what would be Rally's share price? Without the increase in leverage, Raly's share price is s (Round to the nearest cent.) b. Suppose Rally offers $2.71 per share to repurchase its shares. Would shareholders sell for this price? V. (Select from the drop-down menu.) The minimun share price they would sell for is $Round to the nearest cent.) c. Suppose Rally offers $3.03 per share, and shareholders tender their shares at this price. What will be Rally's share price after the repurchase? If Rally offers $3.03 per share, and shareholders tender their shares at this price, the share price after the repurchase will be s (Round to the nearest cent.) d. What is the lowest price Rally can offer and have shareholders tender their shares? What will be its stock price after the share repurchase in that case? The lowest offer per share is $. (Round to the nearest cent.) The stock price after repurchaseis (Round to the nearest cent.)