Answered step by step

Verified Expert Solution

Question

1 Approved Answer

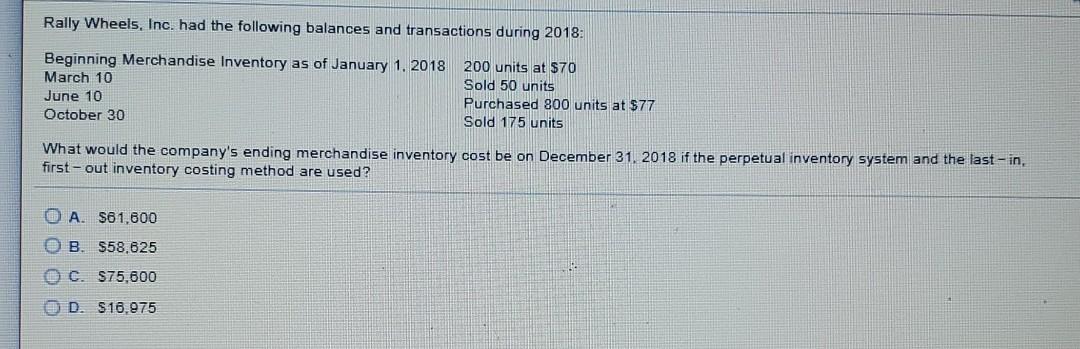

Rally Wheels, Inc. had the following balances and transactions during 2018: Beginning Merchandise Inventory as of January 1, 2018 March 10 June 10 October 30

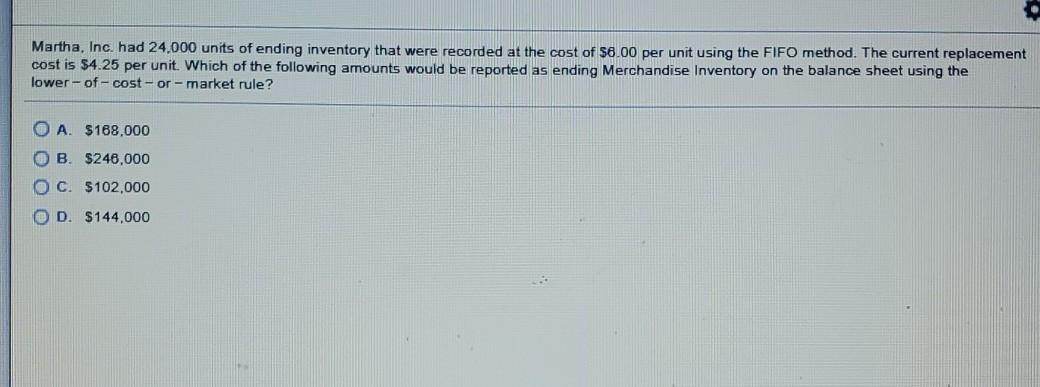

Rally Wheels, Inc. had the following balances and transactions during 2018: Beginning Merchandise Inventory as of January 1, 2018 March 10 June 10 October 30 200 units at $70 Sold 50 units Purchased 800 units at $77 Sold 175 units What would the company's ending merchandise inventory cost be on December 31, 2018 if the perpetual inventory system and the last - in, first-out inventory costing method are used? O A. $61,600 OBS58,625 O C. $75,600 OD S16.975 Martha, Inc. had 24,000 units of ending inventory that were recorded at the cost of $6.00 per unit using the FIFO method. The current replacement cost is $4.25 per unit. Which of the following amounts would be reported as ending Merchandise Inventory on the balance sheet using the lower-of-cost-or-market rule? A. $168.000 . $248.000 OC. $102,000 D. $144,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started