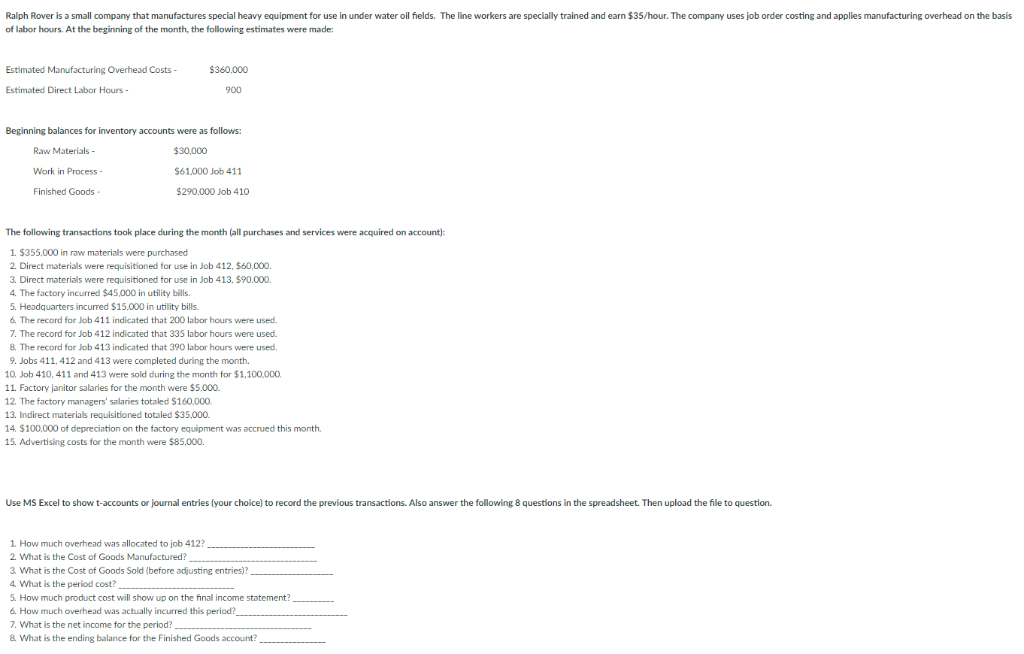

Ralph Rover is a small company that manufactures special heavy equipment for use in under water oil fields. The line workers are specially trained and earn $35/hour. The company uses job order costing and applies manufacturing overhead on the basis of labor hours. At the beginning of the month, the following estimates were made Estimated Manufacturing Overhead Costs $360,000 Estimated Direct Labor Hours 900 Beginning balances for inventory accounts were as follows: Raw Materials - Work in Process Finished Goods $6100 Job 411 $290,000 Job 410 The following transactions took place during the month (all purchases and services were acquired on account: 1. $355,000 in raw materials were purchased 2. Direct materials were requisitioned for use in Job 412, $60,000. 3. Direct materials were requisitioned for use in Job 413, $90,000. 4 The factory incurred $45,000 in utility bills 5. Headquarters incurred $15,000 in utillity bills 6. The record for Job 411 indicated that 200 labor hours were used. 7. The record for Job 412 indicated that 335 labor hours were used. 8. The record for Job 413 indicated that 390 labor hours were used 9. Jobs 411., 412 and 413 were completed during the month. 10. Job 410, 411 and 413 were sold during the month for $1,100,000 11. Factory janitor salaries for the month were $5,000. 12. The factory managers' salaries totaled $160,000 13. Indirect materials requisitioned totaled $35,000. 14 $100,000 of depreciation on the factory equipment was accrued this month 15. Advertising costs for the month were $85,000. Use MS Excel to show t-accounts or journal entries (your choice) to record the previous transactions. Also answer the following 8 questions in the spreadsheet. Then upload the file to question. 1. How much overhead was allocated to job 412? 2. What is the Cost of Goods Manufactured? 3. What is the Cost of Goods Sold (before adjusting entries)? 4 What is the period cost? 5. How much product cost will show up on the final income statement? 6. How much overhead was actually incurred this period? 7. What is the net income for the period? 8. What is the ending balance for the Finished Goods account