Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Ralph's Bow Works (RBW) is planning to add a new line of bow ties that will require the acquisition of a new knitting and

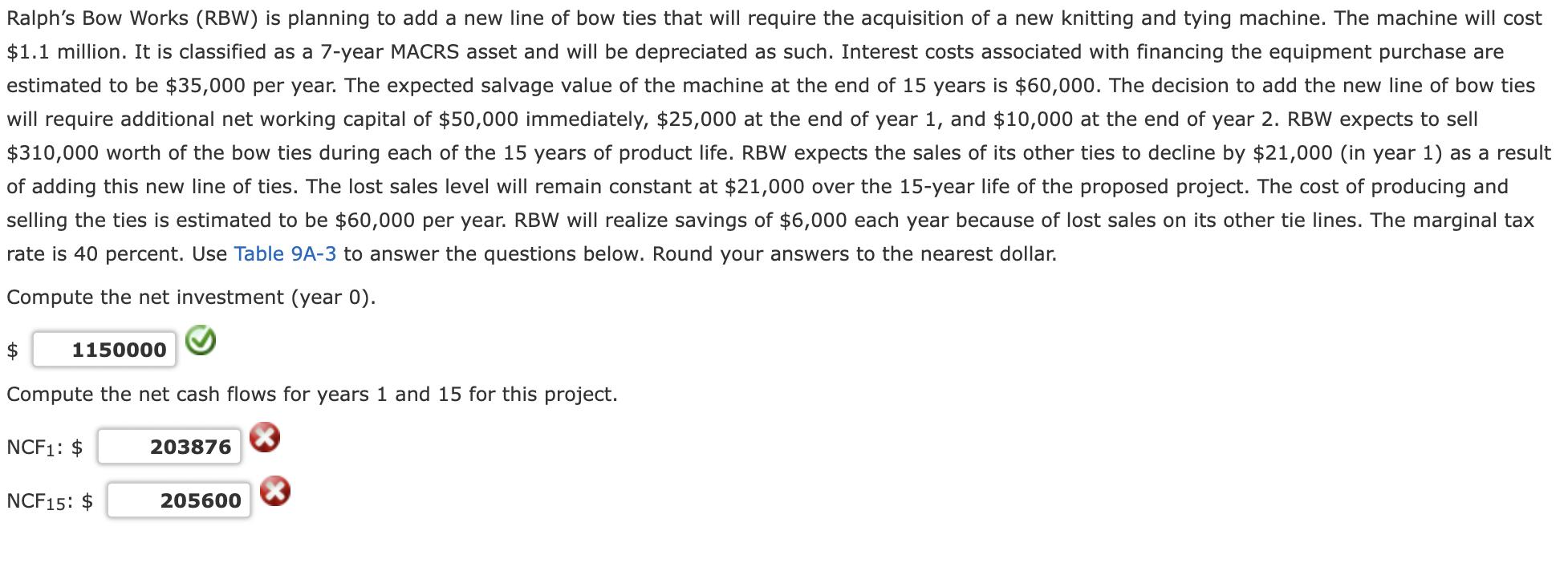

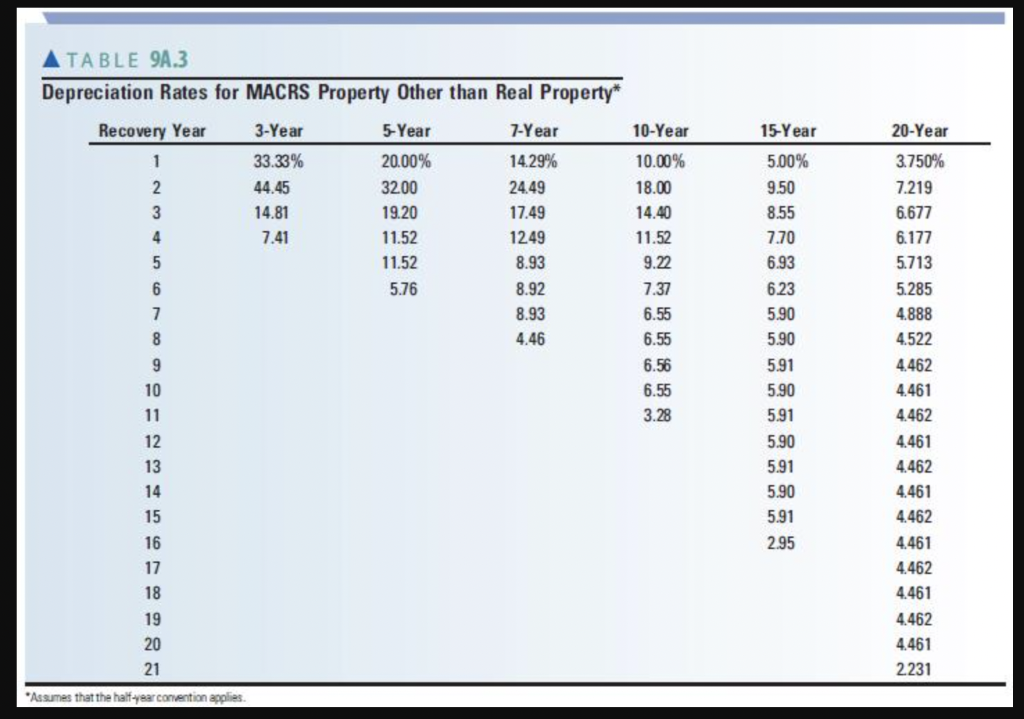

Ralph's Bow Works (RBW) is planning to add a new line of bow ties that will require the acquisition of a new knitting and tying machine. The machine will cost $1.1 million. It is classified as a 7-year MACRS asset and will be depreciated as such. Interest costs associated with financing the equipment purchase are estimated to be $35,000 per year. The expected salvage value of the machine at the end of 15 years is $60,000. The decision to add the new line of bow ties will require additional net working capital of $50,000 immediately, $25,000 at the end of year 1, and $10,000 at the end of year 2. RBW expects to sell $310,000 worth of the bow ties during each of the 15 years of product life. RBW expects the sales of its other ties to decline by $21,000 (in year 1) as a result of adding this new line of ties. The lost sales level will remain constant at $21,000 over the 15-year life of the proposed project. The cost of producing and selling the ties is estimated to be $60,000 per year. RBW will realize savings of $6,000 each year because of lost sales on its other tie lines. The marginal tax rate is 40 percent. Use Table 9A-3 to answer the questions below. Round your answers to the nearest dollar. Compute the net investment (year 0). $ 1150000 Compute the net cash flows for years 1 and 15 for this project. X NCF1: $ NCF15: $ 203876 205600 ATABLE 9A.3 Depreciation Rates for MACRS Property Other than Real Property* Recovery Year 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 "Assumes that the half-year convention applies. 3-Year 33.33% 44.45 14.81 7.41 5-Year 20.00% 32.00 19.20 11.52 11.52 5.76 7-Year 14.29% 24.49 17.49 1249 8.93 8.92 8.93 4.46 10-Year 10.00% 18.00 14.40 11.52 9.22 7.37 6.55 6.55 6.56 6.55 3.28 15-Year 5.00% 9.50 8.55 7.70 6.93 6.23 5.90 5.90 5.91 5.90 5.91 5.90 5.91 5.90 5.91 2.95 20-Year 3.750% 7.219 6.677 6.177 5.713 5.285 4.888 4.522 4.462 4.461 4.462 4.461 4.462 4.461 4.462 4.461 4.462 4.461 4.462 4.461 2231

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Compute the Net Investment Year 0 The net investment in year O is the initial investment in the mach...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started