Question

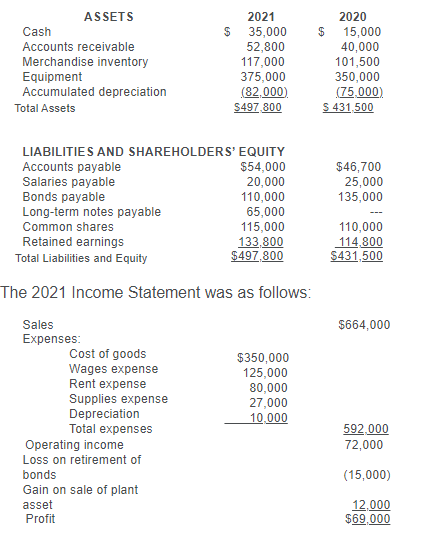

Ram Inc. December 31, 2021 and 2020 balance sheet and income statement is shown below: additional info: 1. Gain on sale of equipment was $12,000.

Ram Inc. December 31, 2021 and 2020 balance sheet and income statement is shown below:

additional info:

1. Gain on sale of equipment was $12,000. This resulted from a sale of equipment that had an original cost of $50,000 and accumulated depreciation of $3,000. The equipment was sold for $59,000 cash.

2. Equipment costing $75,000 was purchased using $10,000 in cash and the remainder was financed with a long-term note payable.

3. Loss on retirement of bonds was $15,000. This resulted from a retirement of bonds that had been originally sold for $25,000. The bonds were purchased back for $40,000 cash paid.

4. Increase in common shares accounts is due to the issuance of 2,000 common shares.

5. Paid cash dividends of $50,000.

REQUIRED:

Prepare Cash Flow Statement for Ram inc. for December 31, 2021

ASSETS Cash Accounts receivable Merchandise inventory Equipment Accumulated depreciation Total Assets 2021 $ 35,000 52,800 117,000 375,000 (82.000) $497.800 2020 $ 15,000 40,000 101,500 350,000 (75.000) S 431.500 $46,700 25,000 135,000 LIABILITIES AND SHAREHOLDERS' EQUITY Accounts payable $54,000 Salaries payable 20,000 Bonds payable 110,000 Long-term notes payable 65,000 Common shares 115,000 Retained earnings 133.800 Total Liabilities and Equity $497.800 110,000 114.800 $431,500 The 2021 Income Statement was as follows: $664,000 Sales Expenses: Cost of goods Wages expense Rent expense Supplies expense Depreciation Total expenses Operating income Loss on retirement of bonds Gain on sale of plant asset Profit $350,000 125,000 80,000 27,000 10.000 592.000 72,000 (15,000) 12.000 $69.000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started