Answered step by step

Verified Expert Solution

Question

1 Approved Answer

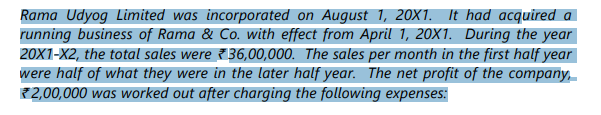

Rama Udyog Limited was incorporated on August 1, 20X1. It had acquired a running business of Rama & Co. with effect from April 1, 20X1.

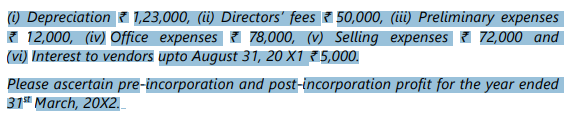

Rama Udyog Limited was incorporated on August 1, 20X1. It had acquired a running business of Rama \\& Co. with effect from April 1, 20X1. During the year 20X1-X2, the total sales were \\( 36,00,000 \\). The sales per month in the first half year were half of what they were in the later half year. The net profit of the company, \\( 2,00,000 \\) was worked out after charging the following expenses: (i) Depreciation \\( 1,23,000 \\), (ii) Directors' fees \\( 50,000 \\), (iii) Preliminary expenses F 12,000, (iv) Office expenses 78,000, (v) Selling expenses \\( \\) (vi) Interest to vendors upto August 31, 20X1 5,000. Please ascertain pre-incorporation and post-incorporation profit for the year ended \\( 31^{\\text {st }} \\) March, 20X2

Rama Udyog Limited was incorporated on August 1, 20X1. It had acquired a running business of Rama \\& Co. with effect from April 1, 20X1. During the year 20X1-X2, the total sales were \\( 36,00,000 \\). The sales per month in the first half year were half of what they were in the later half year. The net profit of the company, \\( 2,00,000 \\) was worked out after charging the following expenses: (i) Depreciation \\( 1,23,000 \\), (ii) Directors' fees \\( 50,000 \\), (iii) Preliminary expenses F 12,000, (iv) Office expenses 78,000, (v) Selling expenses \\( \\) (vi) Interest to vendors upto August 31, 20X1 5,000. Please ascertain pre-incorporation and post-incorporation profit for the year ended \\( 31^{\\text {st }} \\) March, 20X2 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started