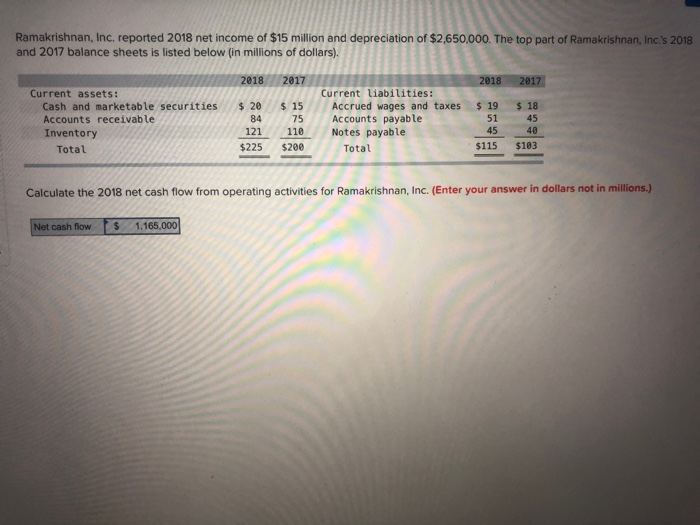

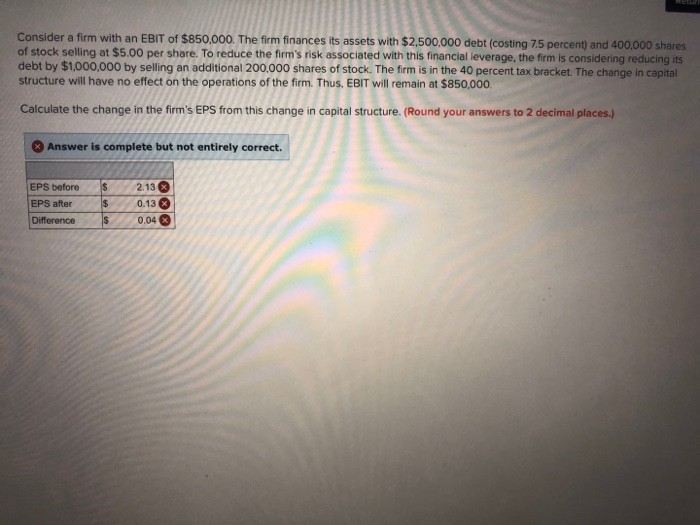

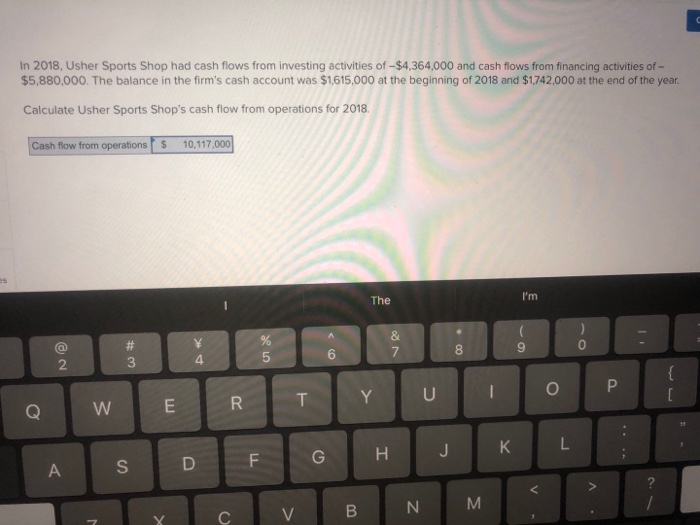

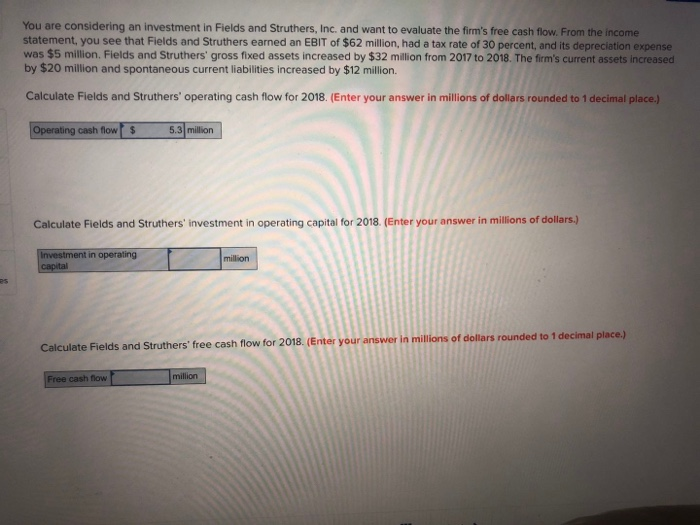

Ramakrishnan, Inc. reported 2018 net income of $15 million and depreciation of $2,650,000. The top part of Ramakrishnan, Inc.'s 2018 and 2017 balance sheets is listed below (in millions of dollars). 2018 2017 2018 2017 Current assets: Cash and marketable securities Accounts receivable Inventory Total $ 20 84 $ 15 75 Current liabilities: Accrued wages and taxes Accounts payable Notes payable Total $ 19 51 1 8 45 $225 $200 $115 $103 Calculate the 2018 net cash flow from operating activities for Ramakrishnan, Inc. (Enter your answer in dollars not in millions.) Net cash flow $ 1.165,000 Consider a firm with an EBIT of $850,000. The firm finances its assets with $2,500,000 debt (costing 7.5 percent) and 400,000 shares of stock selling at $5.00 per share. To reduce the firm's risk associated with this financial leverage, the firm is considering reducing its debt by $1,000,000 by selling an additional 200,000 shares of stock. The firm is in the 40 percent tax bracket. The change in capital structure will have no effect on the operations of the firm. Thus. EBIT will remain at $850.000 Calculate the change in the firm's EPS from this change in capital structure. (Round your answers to 2 decimal places.) Answer is complete but not entirely correct. EPS before EPS after Difference $ $ $ 2.13 0.13 0.04 In 2018, Usher Sports Shop had cash flows from investing activities of -$4,364,000 and cash flows from financing activities of $5,880,000. The balance in the firm's cash account was $1,615,000 at the beginning of 2018 and $1.742,000 at the end of the year. Calculate Usher Sports Shop's cash flow from operations for 2018. Cash flow from operations $ 10,117,000 The I'm C 10 WERT ruoli VBNM ? ? You are considering an investment in Fields and Struthers, Inc. and want to evaluate the firm's free cash flow. From the income statement, you see that Fields and Struthers earned an EBIT of $62 million, had a tax rate of 30 percent, and its depreciation expense was $5 million, Fields and Struthers' gross fixed assets increased by $32 million from 2017 to 2018. The firm's current assets increased by $20 million and spontaneous current liabilities increased by $12 million Calculate Fields and Struthers' operating cash flow for 2018. (Enter your answer in millions of dollars rounded to 1 decimal place. Operating cash flow $ 5.3 million Calculate Fields and Struthers' investment in operating capital for 2018. (Enter your answer in millions of dollars.) Investment in operating million capital Calculate Fields and Struthers' free cash flow for 2018. (Enter your answer in millions of dollars rounded to 1 decimal place.) Free cash flow million