Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Rambo presently owns the Marine Tower office building, which is 20 years old, and is considering renovating it. He purchased the property 2 years ago

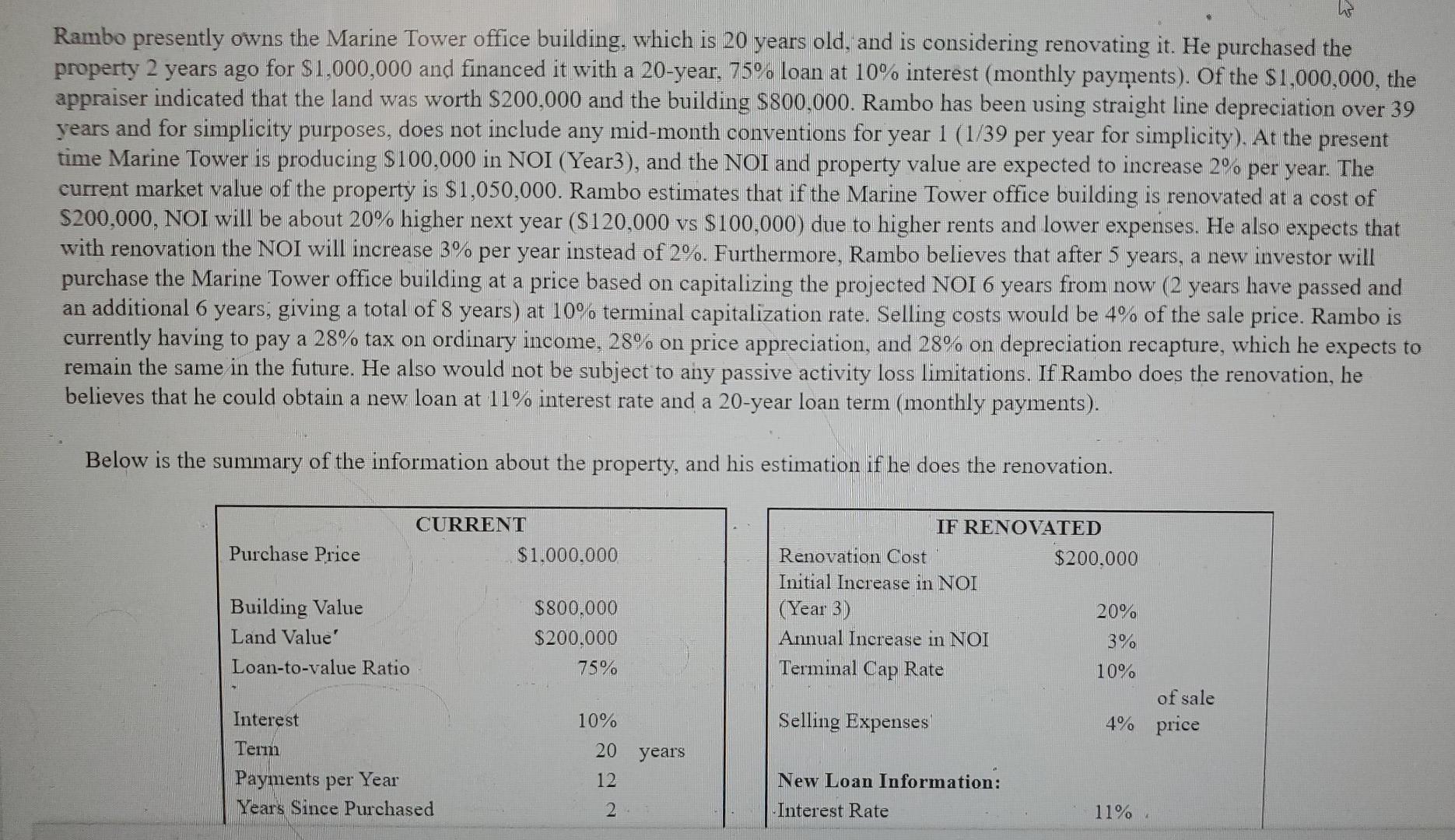

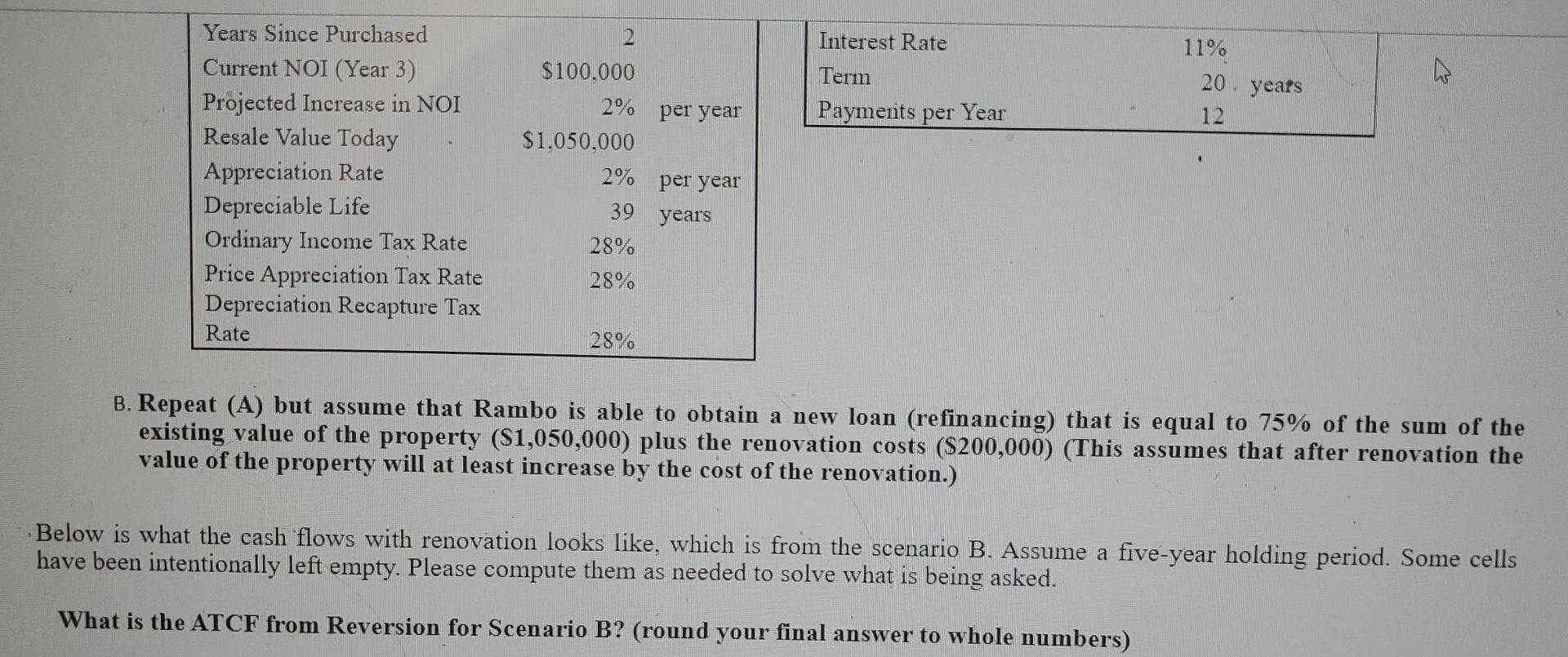

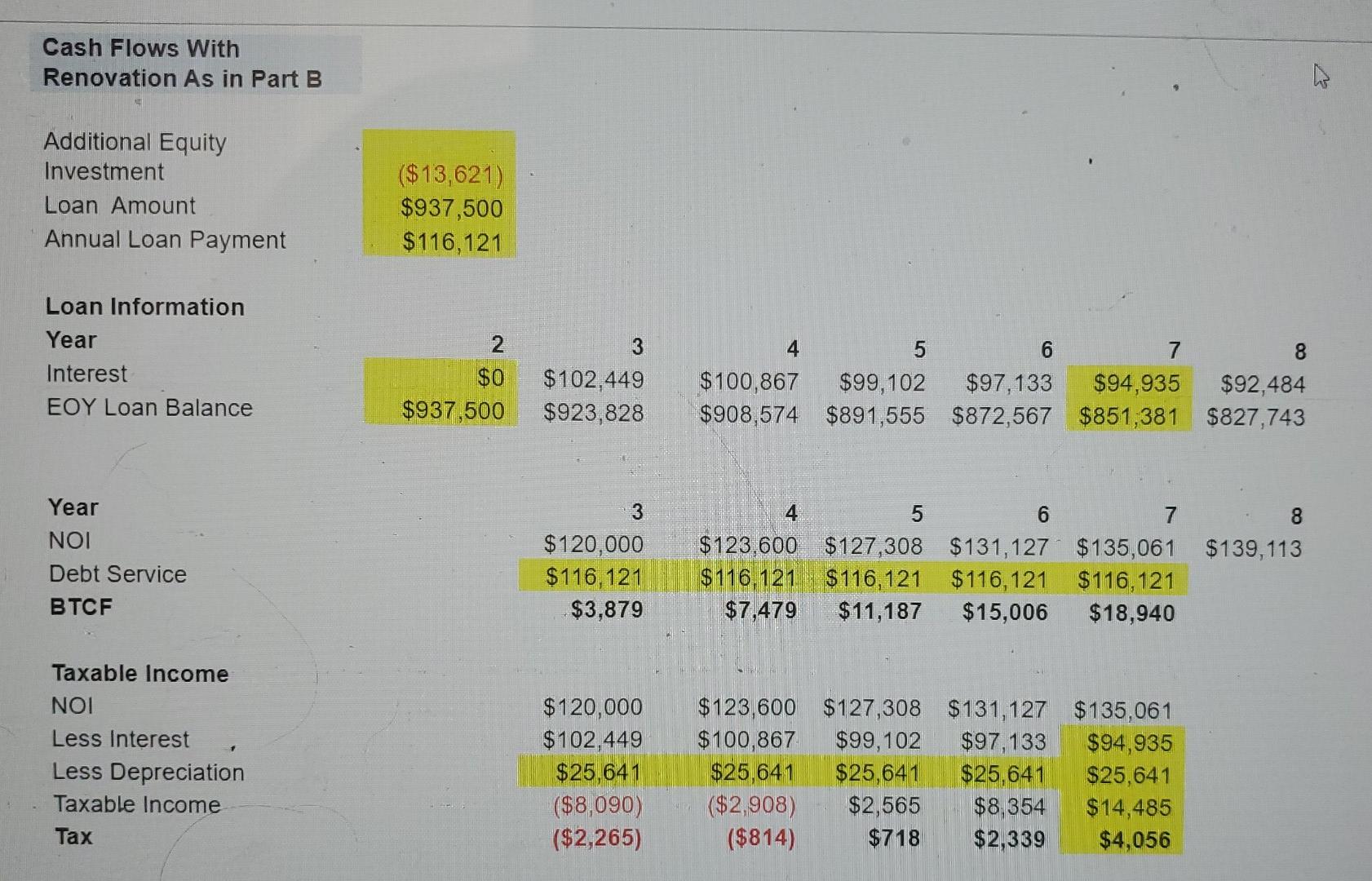

Rambo presently owns the Marine Tower office building, which is 20 years old, and is considering renovating it. He purchased the property 2 years ago for $1,000,000 and financed it with a 20-year, 75% loan at 10% interest (monthly payments). Of the $1,000,000, the appraiser indicated that the land was worth $200,000 and the building $800.000. Rambo has been using straight line depreciation over 39 years and for simplicity purposes, does not include any mid-month conventions for year 1 (1/39 per year for simplicity). At the present time Marine Tower is producing $100,000 in NOI (Year3), and the NOI and property value are expected to increase 2% per year. The current market value of the property is $1,050,000. Rambo estimates that if the Marine Tower office building is renovated at a cost of $200,000, NOI will be about 20% higher next year ($120,000 vs $100,000) due to higher rents and lower expenses. He also expects that with renovation the NOI will increase 3% per year instead of 2%. Furthermore, Rambo believes that after 5 years, a new investor will purchase the Marine Tower office building at a price based on capitalizing the projected NOI 6 years from now (2 years have passed and an additional 6 years, giving a total of 8 years) at 10% terminal capitalization rate. Selling costs would be 4% of the sale price. Rambo is currently having to pay a 28% tax on ordinary income, 28% on price appreciation, and 28% on depreciation recapture, which he expects to remain the same in the future. He also would not be subject to any passive activity loss limitations. If Rambo does the renovation, he believes that he could obtain a new loan at 11% interest rate and a 20-year loan term (monthly payments). Below is the summary of the information about the property, and his estimation if he does the renovation. CURRENT $1.000.000 Purchase Price Building Value Land Value' $800,000 $200.000 75% IF RENOVATED Renovation Cost $200.000 Initial Increase in NOI (Year 3) 20% Annual Increase in NOI 3% Terminal Cap Rate 10% of sale Selling Expenses 4% price Loan-to-value Ratio Interest 10% 20 years Term Payments per Year Years Since Purchased 12 2 New Loan Information: Interest Rate 11% 2 11% Interest Rate Term Payments per Year 20. years 12 Years Since Purchased Current NOI (Year 3) Projected Increase in NOI Resale Value Today Appreciation Rate Depreciable Life Ordinary Income Tax Rate Price Appreciation Tax Rate Depreciation Recapture Tax Rate $100.000 2% per year $1.050,000 2% per year 39 years 28% 28% 28% B. Repeat (A) but assume that Rambo is able to obtain a new loan (refinancing) that is equal to 75% of the sum of the existing value of the property (S1,050,000) plus the renovation costs ($200,000) (This assumes that after renovation the value of the property will at least increase by the cost of the renovation.) Below is what the cash flows with renovation looks like, which is from the scenario B. Assume a five-year holding period. Some cells have been intentionally left empty. Please compute them as needed to solve what is being asked. What is the ATCF from Reversion for Scenario B? (round your final answer to whole numbers) Cash Flows With Renovation As in Part B Additional Equity Investment Loan Amount Annual Loan Payment ($13,621) $937,500 $116,121 Loan Information Year Interest EOY Loan Balance 2 $0 $937,500 $102,449 $923,828 4 6 7 8 $100,867 $99,102 $97,133 $94,935 $92,484 $908,574 $891,555 $872,567 $851,381 $827,743 Year NOI Debt Service BTCF 3 $120,000 $116,121 $3,879 4. 5 6 7 8 $123,600 $127,308 $131,127 $135,061 $139,113 $116,121 $116,121 $116,121 $116,121 $7,479 $11,187 $15,006 $18,940 $120,000 $102,449 Taxable income NOI Less Interest Less Depreciation Taxable income Tax $25,641 $25,641 $123,600 $127,308 $131,127 $135,061 $100,867 $99,102 $97,133 $94,935 $ $25,641 $25.641 $25,641 ($2,908) $2,565 $8,354 $14,485 ($814) $718 $2,339 $4,056 ($8,090) ($2,265) ATCF BTCF Tax ATCF $3,879 ($2,265) $6,144 $7,479 ($814) $8,293 $11,187 $718 $10,469 $15,006 $18,940 $2,339 $4,056 $12,667 $14,884 Cash Flows from Sale in Year 7 $1,391,129 Sales Price Sales Cost Mortgage Balance BTCF(sale) ? $1,391,129 ? Sales Price Sales Costs Original Cost basis Price Appreciation Accumulated Depreciation ? ? ? Capital Gain Tax from Price Appreciation Tax from Accumulated Depreciation Total Tax ATCF (Reversion) ? Rambo presently owns the Marine Tower office building, which is 20 years old, and is considering renovating it. He purchased the property 2 years ago for $1,000,000 and financed it with a 20-year, 75% loan at 10% interest (monthly payments). Of the $1,000,000, the appraiser indicated that the land was worth $200,000 and the building $800.000. Rambo has been using straight line depreciation over 39 years and for simplicity purposes, does not include any mid-month conventions for year 1 (1/39 per year for simplicity). At the present time Marine Tower is producing $100,000 in NOI (Year3), and the NOI and property value are expected to increase 2% per year. The current market value of the property is $1,050,000. Rambo estimates that if the Marine Tower office building is renovated at a cost of $200,000, NOI will be about 20% higher next year ($120,000 vs $100,000) due to higher rents and lower expenses. He also expects that with renovation the NOI will increase 3% per year instead of 2%. Furthermore, Rambo believes that after 5 years, a new investor will purchase the Marine Tower office building at a price based on capitalizing the projected NOI 6 years from now (2 years have passed and an additional 6 years, giving a total of 8 years) at 10% terminal capitalization rate. Selling costs would be 4% of the sale price. Rambo is currently having to pay a 28% tax on ordinary income, 28% on price appreciation, and 28% on depreciation recapture, which he expects to remain the same in the future. He also would not be subject to any passive activity loss limitations. If Rambo does the renovation, he believes that he could obtain a new loan at 11% interest rate and a 20-year loan term (monthly payments). Below is the summary of the information about the property, and his estimation if he does the renovation. CURRENT $1.000.000 Purchase Price Building Value Land Value' $800,000 $200.000 75% IF RENOVATED Renovation Cost $200.000 Initial Increase in NOI (Year 3) 20% Annual Increase in NOI 3% Terminal Cap Rate 10% of sale Selling Expenses 4% price Loan-to-value Ratio Interest 10% 20 years Term Payments per Year Years Since Purchased 12 2 New Loan Information: Interest Rate 11% 2 11% Interest Rate Term Payments per Year 20. years 12 Years Since Purchased Current NOI (Year 3) Projected Increase in NOI Resale Value Today Appreciation Rate Depreciable Life Ordinary Income Tax Rate Price Appreciation Tax Rate Depreciation Recapture Tax Rate $100.000 2% per year $1.050,000 2% per year 39 years 28% 28% 28% B. Repeat (A) but assume that Rambo is able to obtain a new loan (refinancing) that is equal to 75% of the sum of the existing value of the property (S1,050,000) plus the renovation costs ($200,000) (This assumes that after renovation the value of the property will at least increase by the cost of the renovation.) Below is what the cash flows with renovation looks like, which is from the scenario B. Assume a five-year holding period. Some cells have been intentionally left empty. Please compute them as needed to solve what is being asked. What is the ATCF from Reversion for Scenario B? (round your final answer to whole numbers) Cash Flows With Renovation As in Part B Additional Equity Investment Loan Amount Annual Loan Payment ($13,621) $937,500 $116,121 Loan Information Year Interest EOY Loan Balance 2 $0 $937,500 $102,449 $923,828 4 6 7 8 $100,867 $99,102 $97,133 $94,935 $92,484 $908,574 $891,555 $872,567 $851,381 $827,743 Year NOI Debt Service BTCF 3 $120,000 $116,121 $3,879 4. 5 6 7 8 $123,600 $127,308 $131,127 $135,061 $139,113 $116,121 $116,121 $116,121 $116,121 $7,479 $11,187 $15,006 $18,940 $120,000 $102,449 Taxable income NOI Less Interest Less Depreciation Taxable income Tax $25,641 $25,641 $123,600 $127,308 $131,127 $135,061 $100,867 $99,102 $97,133 $94,935 $ $25,641 $25.641 $25,641 ($2,908) $2,565 $8,354 $14,485 ($814) $718 $2,339 $4,056 ($8,090) ($2,265) ATCF BTCF Tax ATCF $3,879 ($2,265) $6,144 $7,479 ($814) $8,293 $11,187 $718 $10,469 $15,006 $18,940 $2,339 $4,056 $12,667 $14,884 Cash Flows from Sale in Year 7 $1,391,129 Sales Price Sales Cost Mortgage Balance BTCF(sale) ? $1,391,129 ? Sales Price Sales Costs Original Cost basis Price Appreciation Accumulated Depreciation ? ? ? Capital Gain Tax from Price Appreciation Tax from Accumulated Depreciation Total Tax ATCF (Reversion)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started