Answered step by step

Verified Expert Solution

Question

1 Approved Answer

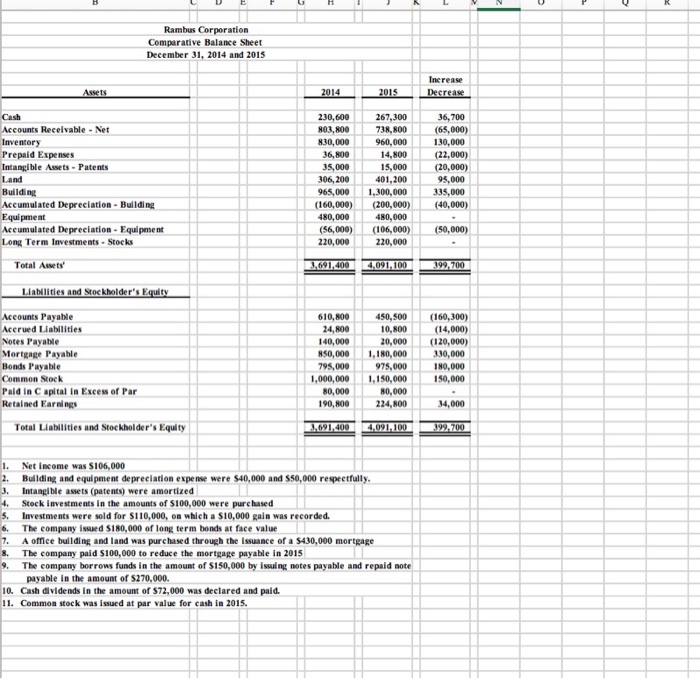

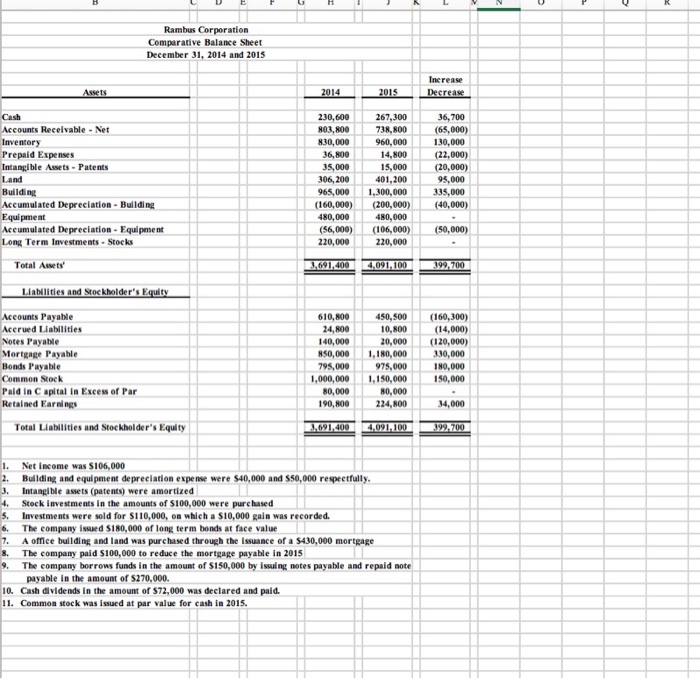

Rambus Corporation Comparative Balance Sheet December 31, 2014 and 2015 Increase 267,300(65,000) 738,800 Cash Accounts Recelvable Net Inventory Prepaid Expenses Intangible Assets-Patents Land Building Accumulated

Rambus Corporation Comparative Balance Sheet December 31, 2014 and 2015 Increase 267,300(65,000) 738,800 Cash Accounts Recelvable Net Inventory Prepaid Expenses Intangible Assets-Patents Land Building Accumulated Depreciation-Building Equipment Accumulated Depreciation Equipment Long Term Investments Stocks 230,600 803,800 830,000 36,700 36,800960,000(65,000 14,800 130,000 (22,000) (20,000) 95,000 35,000 306,200401,200 15,000 965,0001,300,000 335,000 160,000)(200,000) 40,000) 480,000 480,000 (56,000)(106,000) 220,000220,000 (50,000) Total Assets 691.400 iabilities and Stockholder's Accounts Payable Accrued Liabilities Notes Payable Mortgage Payable Bonds Payable Common Stock Pald in C apital in Excess of Par Retained Earning 10,800450,500 (160,300) (14,000) 0,000(120,000) 330,000 1N0,000 1,000,000 1,150,000150,000 10,800 24,800 140,000 50,000 1,180,000 95,000975,000 80,000 190,800 80,000 224,800 4,000 Total Liabilities and Stockholder's Equity . Net income was $106,000 2. Building and equipment depreciation expense were $40,000 and S50,000 respectfully 3. Intangible assets (patents) were amortized 4. Stock investments in the amounts of $100,000 were purc . Investments were sold for $110,000, on which a $10,000 gain was recorded 6. The company issued S180,000 of long term bonds at face value 7. A office building and land was purehased through the issuance of a $430,000 mortgage 8. The company paid $100,000 to reduce the mortgage payable in 2015 . The company borrows funds in the amount of S150,000 by issuing notes payable and repaid note payable in the amount of $270,000 10. Cash dividends in the amount of $72,000 was declared and paid. 11 Common stock was issued at par value for cash in 2015

Rambus Corporation Comparative Balance Sheet December 31, 2014 and 2015 Increase 267,300(65,000) 738,800 Cash Accounts Recelvable Net Inventory Prepaid Expenses Intangible Assets-Patents Land Building Accumulated Depreciation-Building Equipment Accumulated Depreciation Equipment Long Term Investments Stocks 230,600 803,800 830,000 36,700 36,800960,000(65,000 14,800 130,000 (22,000) (20,000) 95,000 35,000 306,200401,200 15,000 965,0001,300,000 335,000 160,000)(200,000) 40,000) 480,000 480,000 (56,000)(106,000) 220,000220,000 (50,000) Total Assets 691.400 iabilities and Stockholder's Accounts Payable Accrued Liabilities Notes Payable Mortgage Payable Bonds Payable Common Stock Pald in C apital in Excess of Par Retained Earning 10,800450,500 (160,300) (14,000) 0,000(120,000) 330,000 1N0,000 1,000,000 1,150,000150,000 10,800 24,800 140,000 50,000 1,180,000 95,000975,000 80,000 190,800 80,000 224,800 4,000 Total Liabilities and Stockholder's Equity . Net income was $106,000 2. Building and equipment depreciation expense were $40,000 and S50,000 respectfully 3. Intangible assets (patents) were amortized 4. Stock investments in the amounts of $100,000 were purc . Investments were sold for $110,000, on which a $10,000 gain was recorded 6. The company issued S180,000 of long term bonds at face value 7. A office building and land was purehased through the issuance of a $430,000 mortgage 8. The company paid $100,000 to reduce the mortgage payable in 2015 . The company borrows funds in the amount of S150,000 by issuing notes payable and repaid note payable in the amount of $270,000 10. Cash dividends in the amount of $72,000 was declared and paid. 11 Common stock was issued at par value for cash in 2015

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access with AI-Powered Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started