Ramona and Hermione formed Wiley Corporation on January 2. Ramona contributed cash of $295,000 in return for 50 percent of the corporation's stock. Hermione

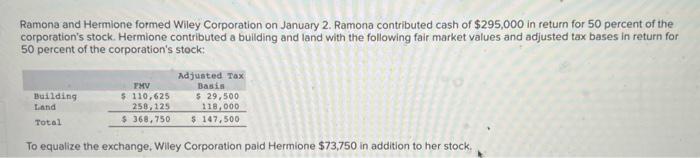

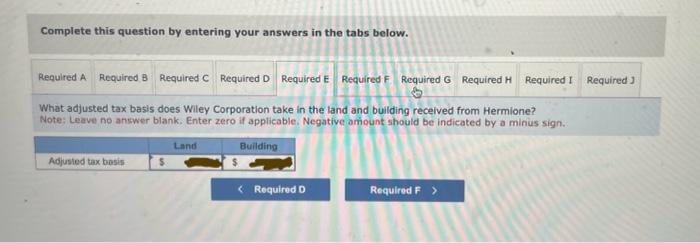

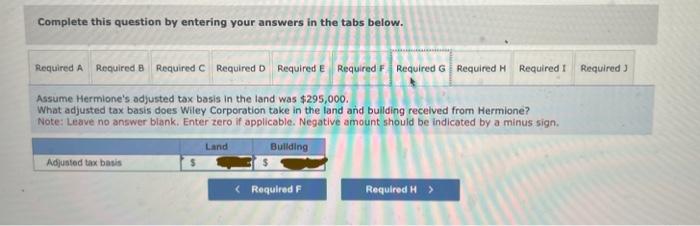

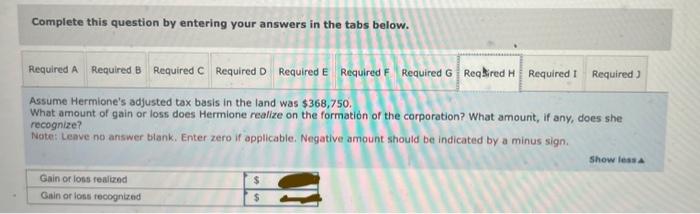

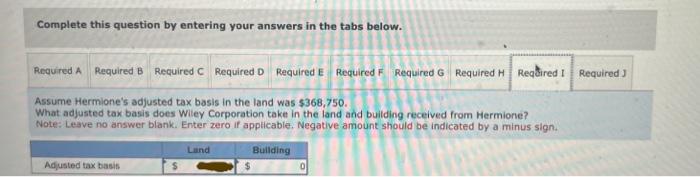

Ramona and Hermione formed Wiley Corporation on January 2. Ramona contributed cash of $295,000 in return for 50 percent of the corporation's stock. Hermione contributed a building and land with the following fair market values and adjusted tax bases in return for 50 percent of the corporation's stock: Building Land Total FMV $ 110,625 258,125 $368,750 Adjusted Tax Basis $ 29,500 118,000 $ 147,500 To equalize the exchange, Wiley Corporation paid Hermione $73,750 in addition to her stock. Complete this question by entering your answers in the tabs below. Required A Required B Required C Required D Required E Required F Required G Required H Required I What adjusted tax basis does Wiley Corporation take in the land and building received from Hermione? Note: Leave no answer blank. Enter zero if applicable. Negative amount should be indicated by a minus sign. Building Adjusted tax basis S Land < Required D Required F > Required J Complete this question by entering your answers in the tabs below. Required A Required 8 Required C Required D Required E Required F Required G Required H Required I Required J Assume Hermione's adjusted tax basis in the land was $295,000. What adjusted tax basis does Wiley Corporation take in the land and building received from Hermione? Note: Leave no answer blank. Enter zero if applicable. Negative amount should be indicated by a minus sign. Land Adjusted tax basis Building < Required F Required H > Complete this question by entering your answers in the tabs below. Required A Required B Required C Required D Required E Required F Required G Reqhired H Required I Assume Hermione's adjusted tax basis in the land was $368,750. What amount of gain or loss does Hermione realize on the formation of the corporation? What amount, if any, does she recognize? Note: Leave no answer blank. Enter zero if applicable. Negative amount should be indicated by a minus sign. Gain or loss realized Gain or loss recognized $ $ Required J Show less A Complete this question by entering your answers in the tabs below. Required A Required B Required C Required D Required E Required F Required G Required H Assume Hermione's adjusted tax basis in the land was $368,750. What adjusted tax basis does Wiley Corporation take in the land and building received from Hermione? Note: Leave no answer blank. Enter zero if applicable. Negative amount should be indicated by a minus sign. Building Adjusted tax basis Land Required I Required J

Step by Step Solution

3.35 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

The adjusted tax basis that Wiley Corporation takes in the land and building received from Hermione ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started