Answered step by step

Verified Expert Solution

Question

1 Approved Answer

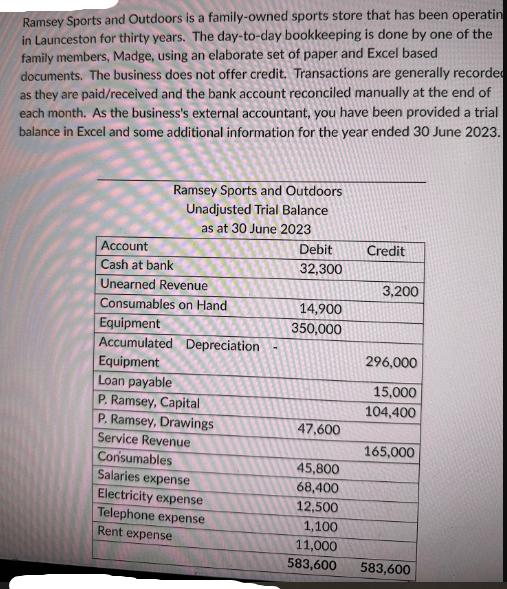

Ramsey Sports and Outdoors is a family-owned sports store that has been operatin in Launceston for thirty years. The day-to-day bookkeeping is done by

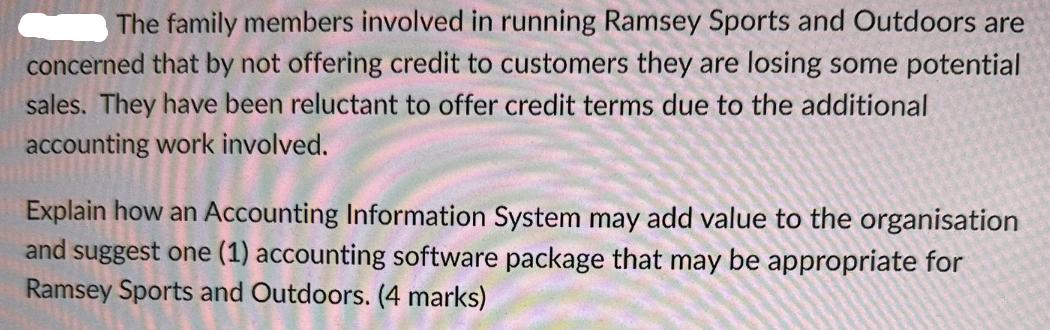

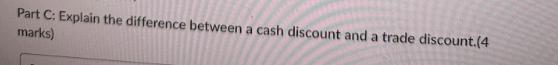

Ramsey Sports and Outdoors is a family-owned sports store that has been operatin in Launceston for thirty years. The day-to-day bookkeeping is done by one of the family members, Madge, using an elaborate set of paper and Excel based documents. The business does not offer credit. Transactions are generally recorded as they are paid/received and the bank account reconciled manually at the end of each month. As the business's external accountant, you have been provided a trial balance in Excel and some additional information for the year ended 30 June 2023. Ramsey Sports and Outdoors Unadjusted Trial Balance as at 30 June 2023 Account Cash at bank Debit Credit 32,300 Unearned Revenue 3,200 Consumables on Hand 14,900 Equipment 350,000 Accumulated Depreciation 296,000 Equipment Loan payable 15,000 P. Ramsey, Capital 104,400 P. Ramsey, Drawings 47,600 Service Revenue 165,000 Consumables 45,800 Salaries expense 68,400 Electricity expense 12,500 Telephone expense 1,100 Rent expense 11,000 583,600 583,600 The family members involved in running Ramsey Sports and Outdoors are concerned that by not offering credit to customers they are losing some potential sales. They have been reluctant to offer credit terms due to the additional accounting work involved. Explain how an Accounting Information System may add value to the organisation and suggest one (1) accounting software package that may be appropriate for Ramsey Sports and Outdoors. (4 marks) Part C: Explain the difference between a cash discount and a trade discount.(4 marks) Consumables 45,800 Salaries expense 68,400 Electricity expense 12,500 Telephone expense 1,100 Rent expense 11,000 583,600 583,600 i. The unearned revenue account includes $850 for sporting goods paid for in advance that have been used in June 2023. ii. Interest expense of $520 has accrued on the loan payable but has not been recorded. iii. Depreciation of the equipment for the year of $8,000 has not yet been recorded. iv. Salaries for the last week of June totalling $3,200 have not yet been paid or recorded. Required: Part A: Prepare general journal entries to record the above transactions. You are not required to complete narrations or posting references. (8 marks) B I UA Paragraph Lato (Recom... V 19px V + Fa + General Journal of Ramsey Sports and Outdoors Date Particulars Debit Credit B

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started