Answered step by step

Verified Expert Solution

Question

1 Approved Answer

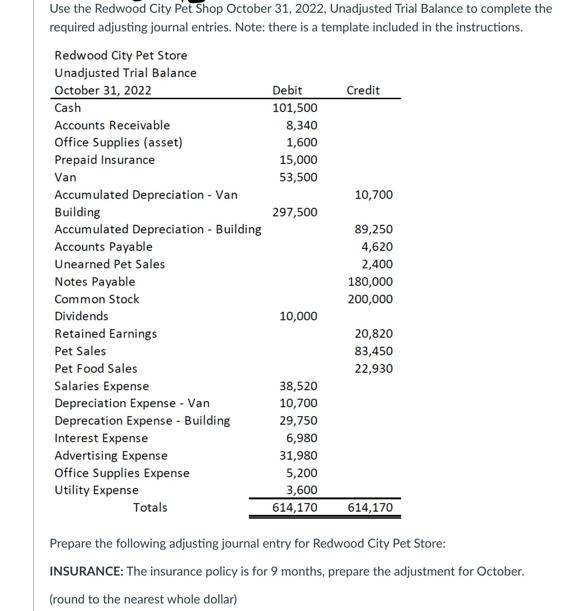

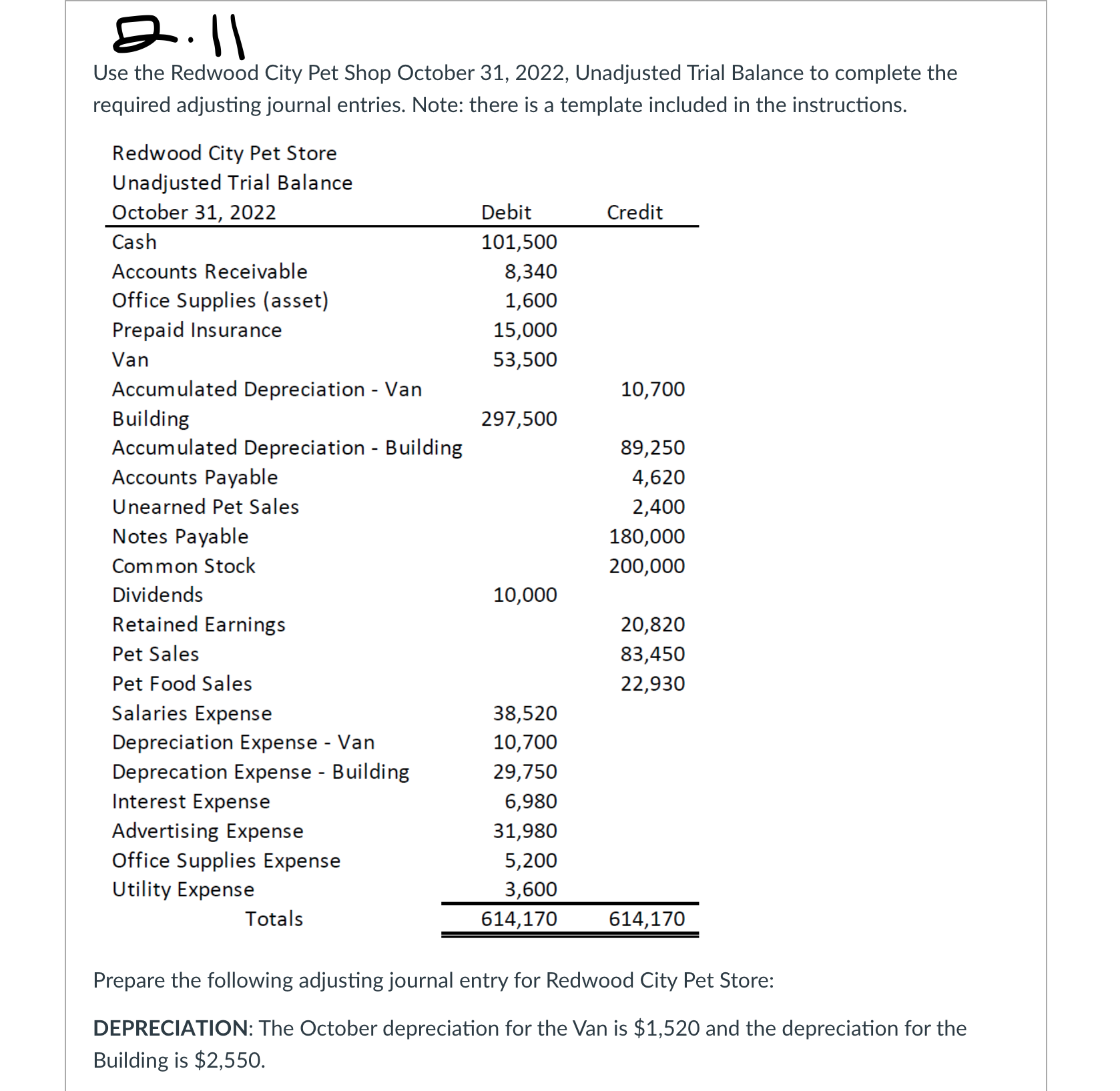

Use the Redwood City Pet Shop October 31, 2022, Unadjusted Trial Balance to complete the required adjusting journal entries. Note: there is a template

Use the Redwood City Pet Shop October 31, 2022, Unadjusted Trial Balance to complete the required adjusting journal entries. Note: there is a template included in the instructions. Redwood City Pet Store Unadjusted Trial Balance October 31, 2022 Debit Credit Cash 101,500 Accounts Receivable 8,340 Office Supplies (asset) 1,600 Prepaid Insurance 15,000 Van 53,500 Accumulated Depreciation - Van 10,700 Building 297,500 Accumulated Depreciation - Building 89,250 Accounts Payable 4,620 Unearned Pet Sales 2,400 Notes Payable 180,000 Common Stock 200,000 Dividends Retained Earnings Pet Sales 10,000 20,820 83,450 Pet Food Sales 22,930 Salaries Expense 38,520 Depreciation Expense - Van 10,700 Deprecation Expense - Building 29,750 Interest Expense 6,980 Advertising Expense 31,980 Office Supplies Expense 5,200 Utility Expense 3,600 Totals 614,170 614,170 Prepare the following adjusting journal entry for Redwood City Pet Store: INSURANCE: The insurance policy is for 9 months, prepare the adjustment for October. (round to the nearest whole dollar) Question 7 5 pts Prepare the following journal entry: Baily decided to pay 6 months of insurance in advance by check, the total amount of the policy was $26,000. Edit View Insert Format Tools Table 12pt v Paragraph B I U > ID > T B Question 8 Prepare the following journal entry: Baily paid their employees for the month of March by check, the total is $35,700. Edit View Insert Format Tools Table 12pt v Paragraph BIUA > T 5 pts Question 9 5 pts Prepare the following journal entry: Dividends were paid to investors in the amount of $15,000; these dividends were paid by check. Edit View Insert Format Tools Table 12pt v Paragraph B I > Question 10 20 pts Using the monthly business transactions (above) for Baily Corporation; prepare an Unadjusted Trial Balance for the Baily Corporation for the month of March 2022. Edit View Insert Format Tools Table 12pt Paragraph B I I U A T v ... 2.11 Use the Redwood City Pet Shop October 31, 2022, Unadjusted Trial Balance to complete the required adjusting journal entries. Note: there is a template included in the instructions. Redwood City Pet Store Unadjusted Trial Balance October 31, 2022 Debit Credit Cash 101,500 Accounts Receivable 8,340 Office Supplies (asset) 1,600 Prepaid Insurance 15,000 Van 53,500 Accumulated Depreciation - Van 10,700 Building 297,500 Accumulated Depreciation - Building 89,250 Accounts Payable 4,620 Unearned Pet Sales 2,400 Notes Payable 180,000 Common Stock 200,000 Dividends Retained Earnings Pet Sales 10,000 20,820 83,450 Pet Food Sales 22,930 Salaries Expense 38,520 Depreciation Expense - Van 10,700 Deprecation Expense - Building 29,750 Interest Expense 6,980 Advertising Expense 31,980 Office Supplies Expense 5,200 Utility Expense 3,600 Totals 614,170 614,170 Prepare the following adjusting journal entry for Redwood City Pet Store: DEPRECIATION: The October depreciation for the Van is $1,520 and the depreciation for the Building is $2,550.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started