Question

Randall manufacturing company. EIN (46-7299870) Was organized on February 1, 1998. Randolph manufactures electronic components. Its business activity code is 3670 the offices of the

Randall manufacturing company. EIN (46-7299870) Was organized on February

1, 1998. Randolph manufactures electronic components. Its business activity code is 3670

the offices of the company are located at 350 Mission Street, San Jose, CA 951074311

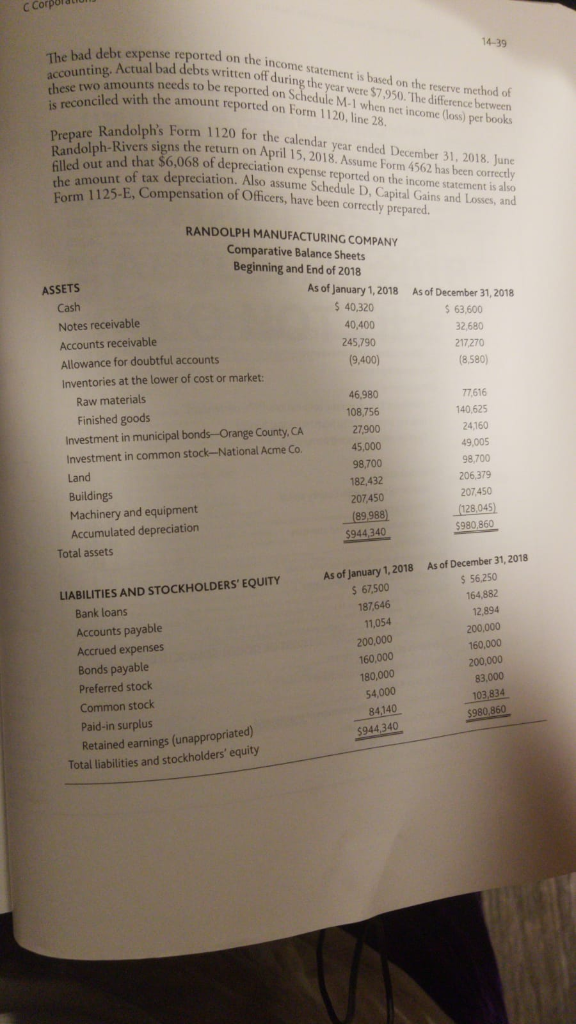

Randolphs financial statements are reproduced on the pages that follow

During the year Randolph made estimated federal income tax payments totaling $15,800

If there is any overpayment of taxes, the accounting department has requested that it be

applied towards next year's estimated tax. Randolph paid a total of $46.600 of dividends to

shareholders during the year. Randolph preferred stock is held by 17 different shareholders

none of whom own more than 10% of the stock in the company. Randolph's two officers

each own 50% of the company's common stock. June Randolph-Rivers is President of the

company. Her compensation is $75,000. June's husband, Travis Rivers is Vice-President. His

compensation is $66,350

During the year Randolph sold two investments. Orange County bonds purchased on July

6, 2004 were sold on November 16, 2018 for $3,215. Randolph's adjusted basis in the bonds

was $3,740. Randolph sold 100 shares of National Acme common stock on March 14, 2018

for $26,300. The stock was purchased for $18,200 on May 9, 2000.

The bad debt expense reported on the income statement is based on the reserve method of

accounting. Actual bad debts written off during the year were $7.950. The difference between is needs to be reported on Schedule M-1 when net income (loss) per books

is reconciled with the amount reported on Form 1120.14

Prepare Randolph's Form 1120 for the calendar

Randolph-Rivers signs the return on April 15, 2018. Assume Form 4562 has been correctly

filled out and that $6,068 of depreciation expense reported on the income statement is also

the amount of tax depreciation. Also assume Schedule D, Capital Gains and Losses, and Form 1125-E, Compensation of Officers, have been correctly prepared.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started