Answered step by step

Verified Expert Solution

Question

1 Approved Answer

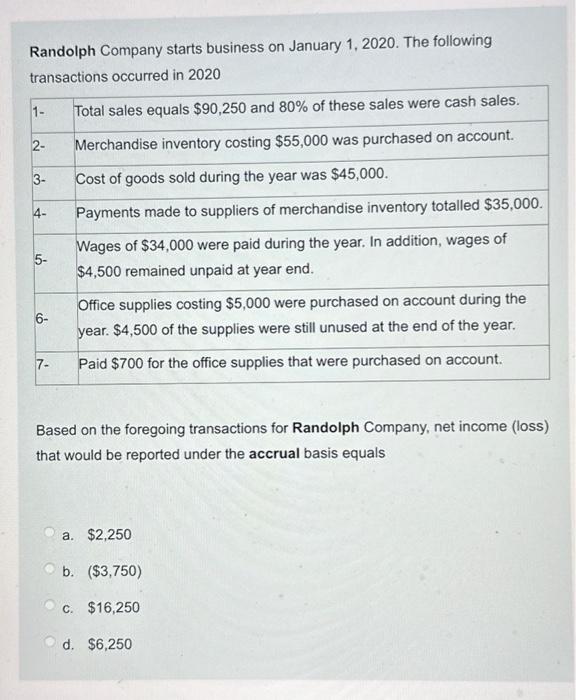

Randolph Company starts business on January 1, 2020. The following transactions occurred in 2020 1- 2- 3- 4- 5- 6- 7- Total sales equals $90,250

Randolph Company starts business on January 1, 2020. The following transactions occurred in 2020 1- 2- 3- 4- 5- 6- 7- Total sales equals $90,250 and 80% of these sales were cash sales. Merchandise inventory costing $55,000 was purchased on account. Cost of goods sold during the year was $45,000. Payments made to suppliers of merchandise inventory totalled $35,000. Wages of $34,000 were paid during the year. In addition, wages of $4,500 remained unpaid at year end. Office supplies costing $5,000 were purchased on account during the year. $4,500 of the supplies were still unused at the end of the year. Paid $700 for the office supplies that were purchased on account. Based on the foregoing transactions for Randolph Company, net income (loss) that would be reported under the accrual basis equals a. $2,250 b. ($3,750) c. $16,250 d. $6,250

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started