Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Randy just won the Powerball Jackpot for $5,000,000 Randy has the option to take a lump sum payment of $3 million now or receive payments

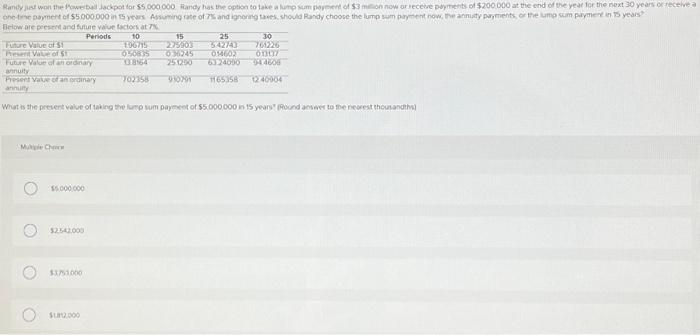

Randy just won the Powerball Jackpot for $5,000,000 Randy has the option to take a lump sum payment of $3 million now or receive payments of $200,000 at the end of the year for the next 30 years or receive a one-time payment of $5,000,000 in 15 years. Assuming rate of 7% and ignoring taxes, should Randy choose the lump sum payment now, the annuity payments, or the lump sum payment in 15 years? Below are present and future value factors at 7%. Periods Future Value of $1 Present Value of $1 Future Value of an ordinary annuity Present Value of an ordinary annuity Multiple Choice $5,000,000 $2,542,000 $3,753,000 10 1.96715 0.50835 13.8164 $1,812,000 702358 What is the present value of taking the lump sum payment of $5,000,000 in 15 years? (Round answer to the nearest thousandths) 15 25 2.75903 5.42743 0.36245 014602 25.1290 63.24090 9.10791 11.65358 30 7.61226 0.13137 94.4608 12.40904

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started