Question

Rani, a UK resident, has salary income from a UK Company. For the tax year 2020/21, she used her motor car for business purpose. For

Rani, a UK resident, has salary income from a UK Company. For the tax year 2020/21, she used her motor car for business purpose. For that, she received a mileage allowance from her employer. She also received House rent Allowances from her employer. For the tax year 2020/21, she has calculated her employment income as follows:

She had no other income during the tax year 2020/21. The employer has given options to Rani to go for Car benefit instead of Mileage Allowance and Accommodation benefit instead of House Rent Allowance for the tax year 2021/22 onwards. She is eligible to go for a Petrol Car with CO2 emission of 110 g/per km. The cost of the car will be 30,000, even though the list price will be 35,000. If she opts for the company accommodation, she will get accommodation which costs the company 125,000. The annual Value of the accommodation will be 8,000.

You are required to advise Rani whether to accept Car and Accommodation from the employer. Substantiate your answer with supporting calculations of tax savings. Ignore the actual cost of fuel spent by the employee and Fuel benefit. To answer this question, assume the tax rate and allowances of 2020/21 will be applicable for 2021/22. (300-400 words)

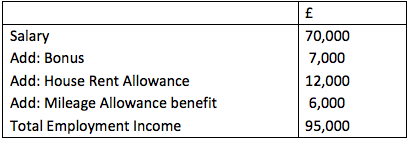

Salary Add: Bonus Add: House Rent Allowance Add: Mileage Allowance benefit Total Employment Income 70,000 7,000 12,000 6,000 95,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started