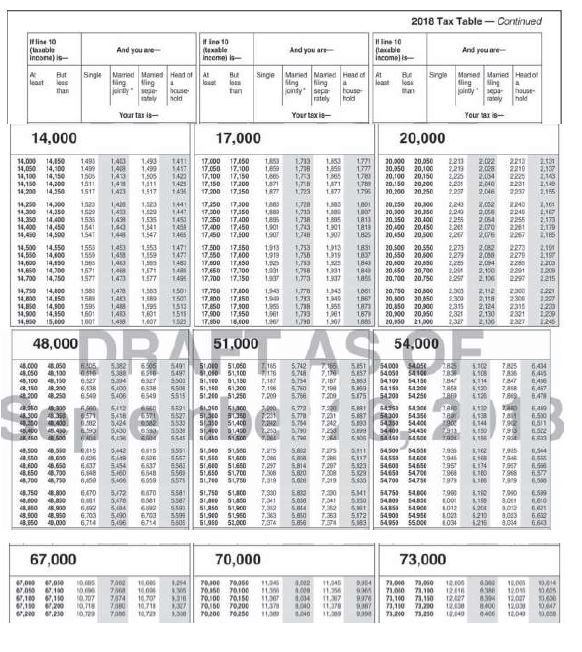

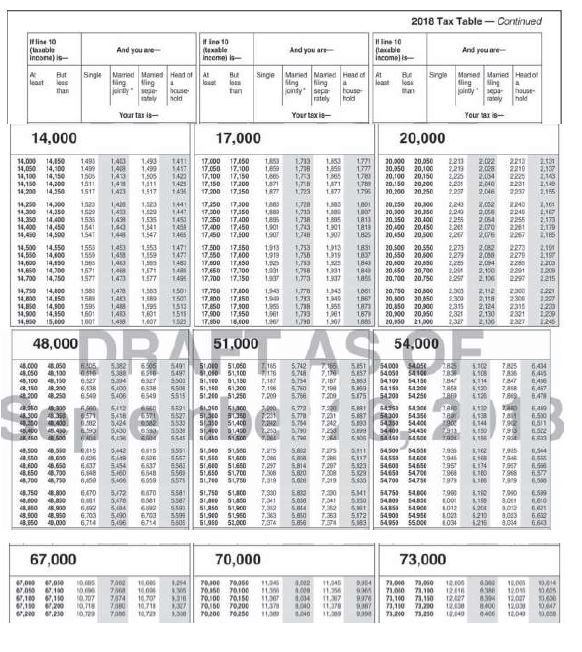

Raphael and Martina are engaged and are planning to travel to Las Vegas during the 2018 Christmas season and get married around the end of the year. In 2018, Raphael expects to earn $53,000 and Martina expects to earn $20,000. Their employers have deducted the appropriate amount of withholding from their paychecks throughout the year. Neither Raphael nor Martina has any itemized deductions. They are trying to decide whether they should get married on December 31, 2018, or on January 1, 2019. What do you recommend? Use the appropriate Tax Tables.

Collective tax liability in 2018 If Raphael and Martina get married in 2018 If Raphael and Martina get married in 2019 Recommendation 2018 Tax Table 0 Contued 000.. 14,000 But man 17,000 ,00 20,000 ,00 use 14.000 14,150 15 1.4 1.493 t41t,T7.co0 17450 tAS} 1.713 1.553 t771 | | 20.000 20.05 2.211 2.t22 2212 2t21 14,050 14,100 499 1.4 1.499 1.4||170 17.100 1 t7M Les 1r77 | | 20,050 20,100 1,213 2.cos 2210 1,100 14.5514 $50 100 130 200 //.. $50 562210 2.13 !! 1.8 1,7t3 1M 178) | | 20/00 20.150 uas 2.034 222 1,143 !!!! use 14.200 14,250 151T 1.423 1.517 1406 | |1730017.350 +R77 t723 t377 1796 | | 20.200 20.250 2257 2,046 2297 2,1 .. 000 181 20,350 20,400 2255 04 2255 2.73 14,500 14.550 1553 1.453 1,553 tATI||17500 17350 1313 1.7S3 tM3 1831 | 20.500 20.550 2273 2,082 227 2 1,458 1,559 147, | | 17.550 17.600 1.9 !.75 1J19 8420,0 20,500 224222 14.700 14,250 1ST 1.473 t177 149 | 17.700 17.750 1.9ar tJT3 Ua7 1.8||20700 20130 1207 2.100 2297 226 0.00205030 14,850 14,900 159s 1.488 1.595 1,513 17.50 17300 ' 73H tS63 1871 | | 20350 20.300 2315 2,724 2315 1,220 7.500 1750 1 48,000 4.200 250 es49 5406 6549 5515 | | 51.200 ,51,250 7200 5n6 7200 5.075 2 05433 5440 48,150 700 6 5+60 6548 55115%.650 S1.700 7.506 SRU 7309 5X29 | |5465354706 1966 K160 7988 577 70,000 73,000 67,000 1.010 7.30 67,100 67.110707 2.574 10,70, 9.3,fl ||TQ,0070150 s1.307 4,0 "'M7 9378 | | 73. 10073.110 12.127 8394 12,027 Collective tax liability in 2018 If Raphael and Martina get married in 2018 If Raphael and Martina get married in 2019 Recommendation 2018 Tax Table 0 Contued 000.. 14,000 But man 17,000 ,00 20,000 ,00 use 14.000 14,150 15 1.4 1.493 t41t,T7.co0 17450 tAS} 1.713 1.553 t771 | | 20.000 20.05 2.211 2.t22 2212 2t21 14,050 14,100 499 1.4 1.499 1.4||170 17.100 1 t7M Les 1r77 | | 20,050 20,100 1,213 2.cos 2210 1,100 14.5514 $50 100 130 200 //.. $50 562210 2.13 !! 1.8 1,7t3 1M 178) | | 20/00 20.150 uas 2.034 222 1,143 !!!! use 14.200 14,250 151T 1.423 1.517 1406 | |1730017.350 +R77 t723 t377 1796 | | 20.200 20.250 2257 2,046 2297 2,1 .. 000 181 20,350 20,400 2255 04 2255 2.73 14,500 14.550 1553 1.453 1,553 tATI||17500 17350 1313 1.7S3 tM3 1831 | 20.500 20.550 2273 2,082 227 2 1,458 1,559 147, | | 17.550 17.600 1.9 !.75 1J19 8420,0 20,500 224222 14.700 14,250 1ST 1.473 t177 149 | 17.700 17.750 1.9ar tJT3 Ua7 1.8||20700 20130 1207 2.100 2297 226 0.00205030 14,850 14,900 159s 1.488 1.595 1,513 17.50 17300 ' 73H tS63 1871 | | 20350 20.300 2315 2,724 2315 1,220 7.500 1750 1 48,000 4.200 250 es49 5406 6549 5515 | | 51.200 ,51,250 7200 5n6 7200 5.075 2 05433 5440 48,150 700 6 5+60 6548 55115%.650 S1.700 7.506 SRU 7309 5X29 | |5465354706 1966 K160 7988 577 70,000 73,000 67,000 1.010 7.30 67,100 67.110707 2.574 10,70, 9.3,fl ||TQ,0070150 s1.307 4,0 "'M7 9378 | | 73. 10073.110 12.127 8394 12,027