Question

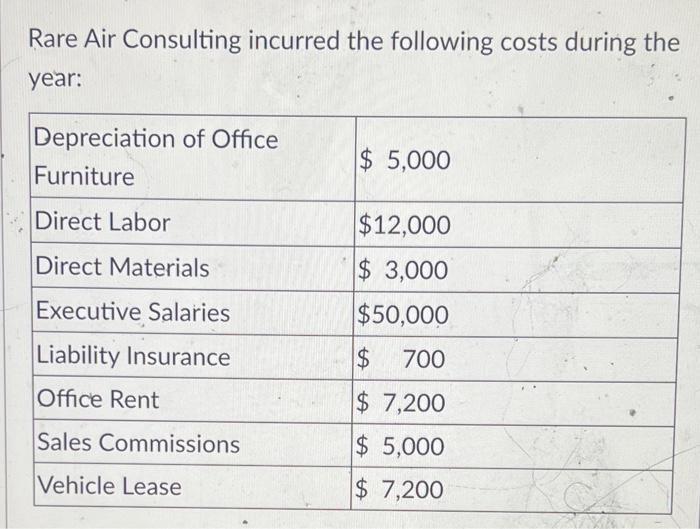

Rare Air Consulting incurred the following costs during the year: Depreciation of Office Furniture Direct Labor Direct Materials $ 5,000 $12,000 $ 3,000 $50,000

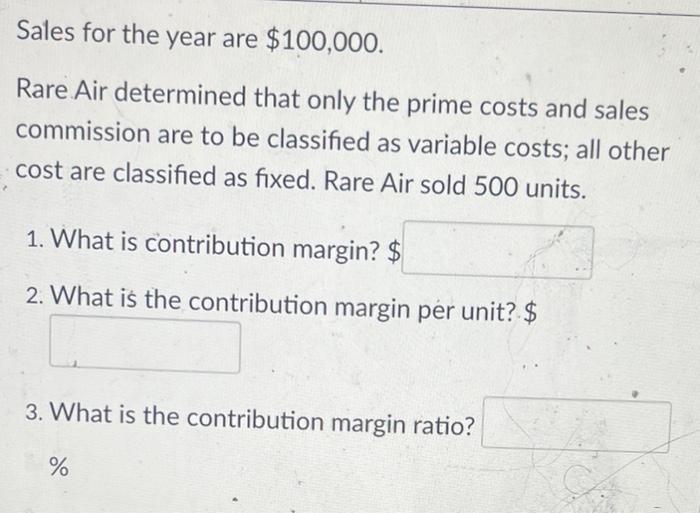

Rare Air Consulting incurred the following costs during the year: Depreciation of Office Furniture Direct Labor Direct Materials $ 5,000 $12,000 $ 3,000 $50,000 Executive Salaries Liability Insurance $ 700 Office Rent $ 7,200 Sales Commissions $5,000 Vehicle Lease $ 7,200 Sales for the year are $100,000. Rare Air determined that only the prime costs and sales commission are to be classified as variable costs; all other cost are classified as fixed. Rare Air sold 500 units. 1. What is contribution margin? $ 2. What is the contribution margin per unit? $ 3. What is the contribution margin ratio? %

Step by Step Solution

3.38 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the contribution margin and related metrics we first need to identify the variable cost...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Accounting

Authors: Donald Kieso, Jerry Weygandt, Terry Warfield, Nicola Young,

10th Canadian Edition, Volume 1

978-1118735329, 9781118726327, 1118735323, 1118726324, 978-0176509736

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App