Answered step by step

Verified Expert Solution

Question

1 Approved Answer

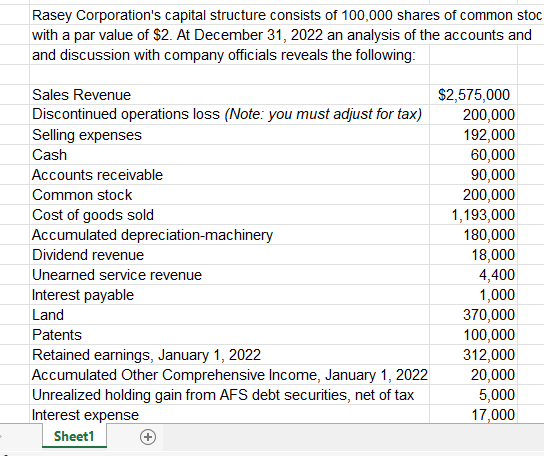

Rasey Corporation's capital structure consists of 100,000 shares of common stoc with a par value of $2. At December 31, 2022 an analysis of

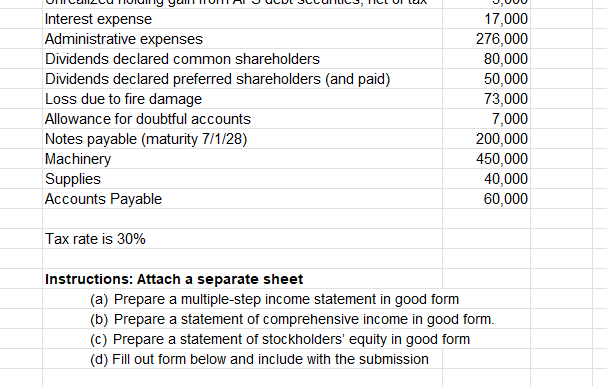

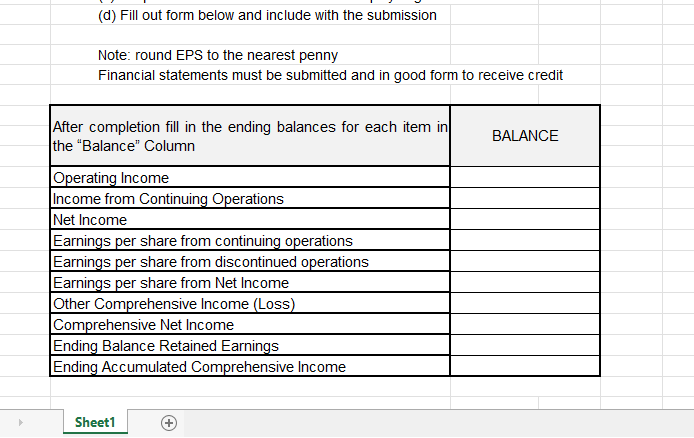

Rasey Corporation's capital structure consists of 100,000 shares of common stoc with a par value of $2. At December 31, 2022 an analysis of the accounts and and discussion with company officials reveals the following: Sales Revenue Discontinued operations loss (Note: you must adjust for tax) Selling expenses Cash Accounts receivable Common stock Cost of goods sold Accumulated depreciation-machinery Dividend revenue $2,575,000 200,000 192,000 60,000 90,000 200,000 1,193,000 180,000 18,000 Unearned service revenue 4,400 Interest payable 1,000 Land 370,000 Patents 100,000 Retained earnings, January 1, 2022 312,000 Accumulated Other Comprehensive Income, January 1, 2022 20,000 Unrealized holding gain from AFS debt securities, net of tax Interest expense 5,000 17,000 Sheet1 Interest expense 17,000 Administrative expenses 276,000 Dividends declared common shareholders 80,000 Dividends declared preferred shareholders (and paid) 50,000 Loss due to fire damage 73,000 Allowance for doubtful accounts 7,000 Notes payable (maturity 7/1/28) 200,000 Machinery Supplies 450,000 Accounts Payable Tax rate is 30% 40,000 60,000 Instructions: Attach a separate sheet (a) Prepare a multiple-step income statement in good form (b) Prepare a statement of comprehensive income in good form. (c) Prepare a statement of stockholders' equity in good form (d) Fill out form below and include with the submission (d) Fill out form below and include with the submission Note: round EPS to the nearest penny Financial statements must be submitted and in good form to receive credit After completion fill in the ending balances for each item in BALANCE the "Balance" Column Operating Income Income from Continuing Operations Net Income Earnings per share from continuing operations Earnings per share from discontinued operations Earnings per share from Net Income Other Comprehensive Income (Loss) Comprehensive Net Income Ending Balance Retained Earnings Ending Accumulated Comprehensive Income Sheet1

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started