Answered step by step

Verified Expert Solution

Question

1 Approved Answer

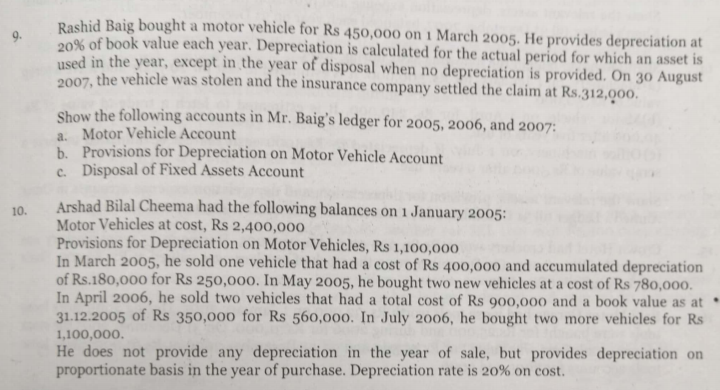

Rashid Baig bought a motor vehicle for Rs 450,000 on 1 March 2005. He provides depreciation at 20% of book value each year. Depreciation is

Rashid Baig bought a motor vehicle for Rs 450,000 on 1 March 2005. He provides depreciation at 20% of book value each year. Depreciation is calculated for the actual period for which an asset is used in the year, except in the year of disposal when no depreciation is provided. On 30 August 2007, the vehicle was stolen and the insurance company settled the claim at Rs.312,000. Show the following accounts in Mr. Baig's ledger for 2005, 2006, and 2007: a. Motor Vehicle Account b. Provisions for Depreciation on Motor Vehicle Account c. Disposal of Fixed Assets Account Arshad Bilal Cheema had the following balances on 1 January 2005: Motor Vehicles at cost, Rs 2,400,000 Provisions for Depreciation on Motor Vehicles, Rs 1,100,000 In March 2005, he sold one vehicle that had a cost of Rs 400,000 and accumulated depreciation of Rs.180,000 for Rs 250,000. In May 2005, he bought two new vehicles at a cost of Rs 780,000. In April 2006, he sold two vehicles that had a total cost of Rs 900,000 and a book value as at. 31.12.2005 of Rs 350,000 for Rs 560,000. In July 2006, he bought two more vehicles for Rs 1,100,000 He does not provide any depreciation in the year of sale, but provides depreciation on proportionate basis in the year of purchase. Depreciation rate is 20% on cost. 10

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started