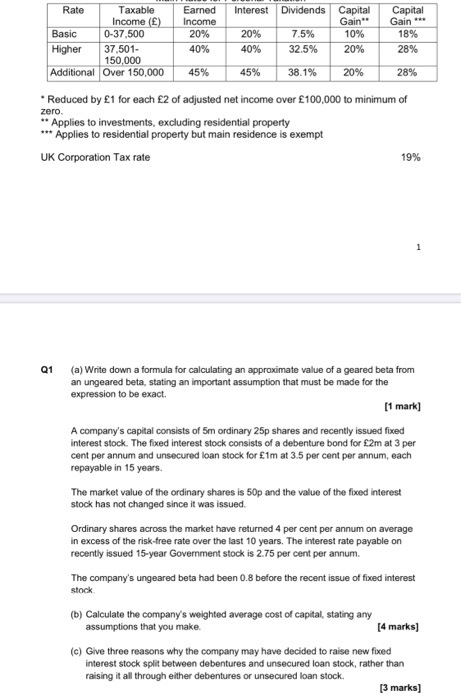

Rate Interest Dividends Taxable Income () Basic 0-37,500 Higher 37,501- 150,000 Additional Over 150,000 Earned Income 20% 40% 20% 40% 7.5% 32.5% Capital Gain 10% 20% Capital Gain 18% 28% 45% 45% 38.1% 20% 28% Reduced by 1 for each 2 of adjusted net income over 100,000 to minimum of zero. ** Applies to investments, excluding residential property *** Applies to residential property but main residence is exempt UK Corporation Tax rate 19% Q1 (a) Write down a formula for calculating an approximate value of a geared beta from an ungeared beta, stating an important assumption that must be made for the expression to be exact. [1 mark] A company's capital consists of 5m ordinary 25p shares and recently issued fixed interest stock. The fixed interest stock consists of a debenture bond for 2m at 3 per cent per annum and unsecured loan stock for 1m at 3.5 per cent per annum, each repayable in 15 years. The market value of the ordinary shares is 50p and the value of the fixed interest stock has not changed since it was issued. Ordinary shares across the market have returned 4 per cent per annum on average in excess of the risk-free rate over the last 10 years. The interest rate payable on recently issued 15-year Government stock is 2.75 per cent per annum. The company's ungeared beta had been 0.8 before the recent issue of fixed interest stock (b) Calculate the company's weighted average cost of capital, stating any assumptions that you make. [4 marks) (c) Give three reasons why the company may have decided to raise new fixed interest stock split between debentures and unsecured loan stock, rather than raising it all through either debentures or unsecured loan stock [3 marks] Rate Interest Dividends Taxable Income () Basic 0-37,500 Higher 37,501- 150,000 Additional Over 150,000 Earned Income 20% 40% 20% 40% 7.5% 32.5% Capital Gain 10% 20% Capital Gain 18% 28% 45% 45% 38.1% 20% 28% Reduced by 1 for each 2 of adjusted net income over 100,000 to minimum of zero. ** Applies to investments, excluding residential property *** Applies to residential property but main residence is exempt UK Corporation Tax rate 19% Q1 (a) Write down a formula for calculating an approximate value of a geared beta from an ungeared beta, stating an important assumption that must be made for the expression to be exact. [1 mark] A company's capital consists of 5m ordinary 25p shares and recently issued fixed interest stock. The fixed interest stock consists of a debenture bond for 2m at 3 per cent per annum and unsecured loan stock for 1m at 3.5 per cent per annum, each repayable in 15 years. The market value of the ordinary shares is 50p and the value of the fixed interest stock has not changed since it was issued. Ordinary shares across the market have returned 4 per cent per annum on average in excess of the risk-free rate over the last 10 years. The interest rate payable on recently issued 15-year Government stock is 2.75 per cent per annum. The company's ungeared beta had been 0.8 before the recent issue of fixed interest stock (b) Calculate the company's weighted average cost of capital, stating any assumptions that you make. [4 marks) (c) Give three reasons why the company may have decided to raise new fixed interest stock split between debentures and unsecured loan stock, rather than raising it all through either debentures or unsecured loan stock [3 marks]