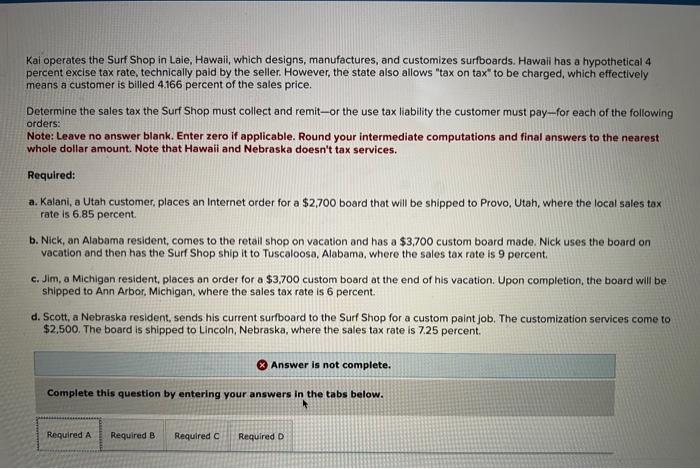

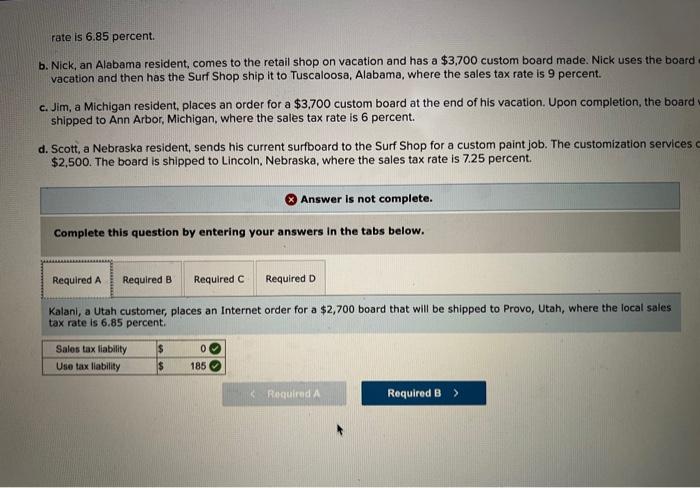

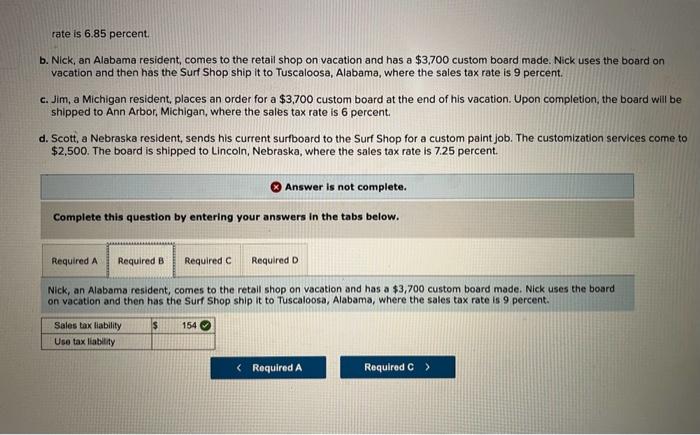

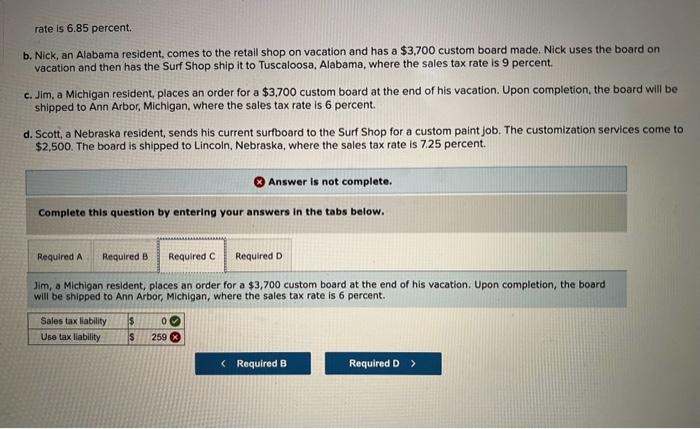

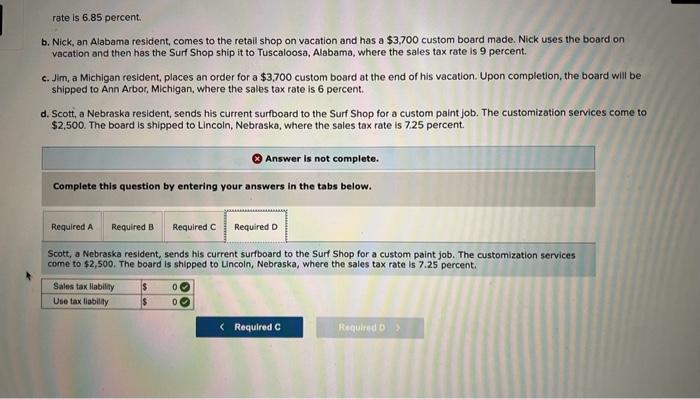

rate is 6.85 percent. b. Nick, an Alabama resident, comes to the retail shop on vacation and has a $3,700 custom board made. Nick uses the board on vacation and then has the Surf Shop ship it to Tuscaloosa, Alabama, where the sales tax rate is 9 percent. c. Jim, a Michigan resident, places an order for a $3,700 custom board at the end of his vacation. Upon completion, the board will be shipped to Ann Arbor, Michigan, where the sales tax rate is 6 percent. d. Scott, a Nebraska resident, sends his current surfboard to the Surf Shop for a custom paint job. The customization services come to $2,500. The board is shipped to Lincoln, Nebraska, where the sales tax rate is 7.25 percent. Answer is not complete. Complete this question by entering your answers in the tabs below. Nick, an Alabama resident, comes to the retall shop on vacation and has a $3,700 custom board made. Nick uses the board on vacation and then has the Surf Shop ship it to Tuscaloosa, Alabama, where the sales tax rate is 9 percent. Kai operates the Surf Shop in Laie, Hawaii, which designs, manufactures, and customizes surfboards. Hawail has a hypothetical 4 percent excise tax rate, technically paid by the seller. However, the state also allows "tax on tax" to be charged, which effectively means a customer is billed 4.166 percent of the sales price. Determine the sales tax the Surf Shop must collect and remit-or the use tax liability the customer must pay-for each of the following orders: Note: Leave no answer blank. Enter zero if applicable. Round your intermediate computations and final answers to the nearest whole dollar amount. Note that Hawail and Nebraska doesn't tax services. Required: a. Kalani, a Utah customer, places an Internet order for a $2,700 board that will be shipped to Provo, Utah, where the local sales tax rate is 6.85 percent. b. Nick, an Alabama resident, comes to the retail shop on vacation and has a $3,700 custom board made. Nick uses the board on vacation and then has the Surf Shop ship it to Tuscaloosa, Alabama, where the sales tax rate is 9 percent. c. Jim, a Michigan resident, places an order for a $3,700 custom board at the end of his vacation. Upon completion, the board will be shipped to Ann Arbor, Michigan, where the sales tax rate is 6 percent. d. Scott, a Nebraska resident, sends his current surfboard to the Surf Shop for a custom paint job. The customization services come to $2,500. The board is shipped to Lincoln, Nebraska, where the sales tax rate is 7.25 percent. () Answer is not complete. Complete this question by entering your answers in the tabs below. rate is 6.85 percent. b. Nick, an Alabama resident, comes to the retall shop on vacation and has a $3,700 custom board made. Nick uses the board on vacation and then has the Surf Shop ship it to Tuscaloosa, Alabama, where the sales tax rate is 9 percent. c. Jim, a Michigan resident, places an order for a $3,700 custom board at the end of his vacation. Upon completion, the board will be shipped to Ann Arbor, Michigan, where the sales tax rate is 6 percent. d. Scott, a Nebraska resident, sends his current surfboard to the Surf Shop for a custom paint job. The customization services come to $2,500. The board is shipped to Lincoln, Nebraska, where the sales tax rate is 7.25 percent. Answer is not complete. Complete this question by entering your answers in the tabs below. Scott, a Nebraska resident, sends his current surfboard to the Surt Shop for a custom paint job. The customization services come to $2,500. The board is shipped to Uncoln, Nebraska, where the sales tax rate is 7.25 percent: rate is 6.85 percent. b. Nick, an Alabama resident, comes to the retail shop on vacation and has a $3,700 custom board made. Nick uses the boaro vacation and then has the Surf Shop ship it to Tuscaloosa, Alabama, where the sales tax rate is 9 percent. c. Jim, a Michigan resident, places an order for a $3,700 custom board at the end of his vacation. Upon completion, the board shipped to Ann Arbor, Michigan, where the sales tax rate is 6 percent. d. Scott, a Nebraska resident, sends his current surfboard to the Surf Shop for a custom paint job. The customization services $2,500. The board is shipped to Lincoln. Nebraska, where the sales tax rate is 7.25 percent. Answer is not complete. Complete this question by entering your answers in the tabs below. Kalani, a Utah customer, places an Internet order for a $2,700 board that will be shipped to Provo, Utah, where the local sales tax rate is 6.85 percent. rate is 6.85 percent. b. Nick, an Alabama resident, comes to the retail shop on vacation and has a $3,700 custom board made. Nick uses the board on vacation and then has the Surf Shop ship it to Tuscaloosa, Alabama, where the sales tax rate is 9 percent. c. Jim, a Michigan resident, places an order for a $3,700 custom board at the end of his vacation. Upon completion, the board will be shipped to Ann Arbor, Michigan, where the sales tax rate is 6 percent. d. Scott, a Nebraska resident, sends his current surfboard to the Surf Shop for a custom paint job. The customization services come to $2,500. The board is shipped to Lincoln, Nebraska, where the sales tax rate is 7.25 percent. Answer is not complete. Complete this question by entering your answers in the tabs below. Jim, a Michigan resident, places an order for a $3,700 custom board at the end of his vacation. Upon completion, the board will be shipped to Ann Arbor, Michigan, where the sales tax rate is 6 percent