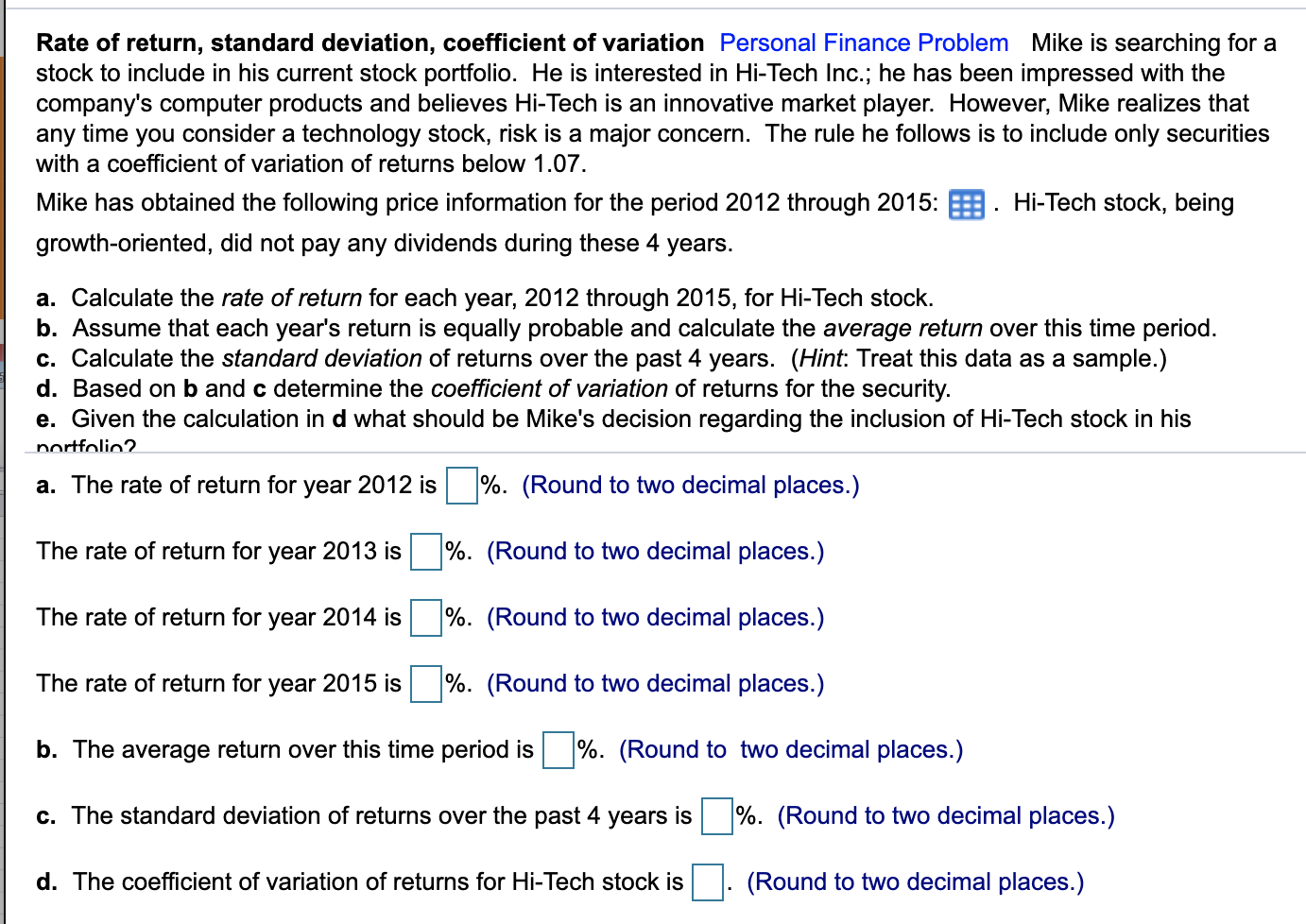

Rate of return, standard deviation, coefficient of variation Personal Finance Problem Mike is searching for a stock to include in his current stock portfolio. He is interested in Hi-Tech Inc.; he has been impressed with the company's computer products and believes Hi-Tech is an innovative market player. However, Mike realizes that any time you consider a technology stock, risk is a major concern. The rule he follows is to include only securities with a coefficient of variation of returns below 1.07. Mike has obtained the following price information for the period 2012 through 2015: Hi-Tech stock, being growth-oriented, did not pay any dividends during these 4 years. a. Calculate the rate of return for each year, 2012 through 2015, for Hi-Tech stock. b. Assume that each year's return is equally probable and calculate the average return over this time period. c. Calculate the standard deviation of returns over the past 4 years. (Hint: Treat this data as a sample.) d. Based on b and c determine the coefficient of variation of returns for the security. e. Given the calculation in d what should be Mike's decision regarding the inclusion of Hi-Tech stock in his nortfolio 2 a. The rate of return for year 2012 is %. (Round to two decimal places.) The rate of return for year 2013 is l%. (Round to two decimal places.) The rate of return for year 2014 is %. (Round to two decimal places.) The rate of return for year 2015 is %. (Round to two decimal places.) b. The average return over this time period is \%. (Round to two decimal places.) c. The standard deviation of returns over the past 4 years is %. (Round to two decimal places.) d. The coefficient of variation of returns for Hi-Tech stock is . (Round to two decimal places.) Rate of return, standard deviation, coefficient of variation Personal Finance Problem Mike is searching for a stock to include in his current stock portfolio. He is interested in Hi-Tech Inc.; he has been impressed with the company's computer products and believes Hi-Tech is an innovative market player. However, Mike realizes that any time you consider a technology stock, risk is a major concern. The rule he follows is to include only securities with a coefficient of variation of returns below 1.07. Mike has obtained the following price information for the period 2012 through 2015: Hi-Tech stock, being growth-oriented, did not pay any dividends during these 4 years. a. Calculate the rate of return for each year, 2012 through 2015, for Hi-Tech stock. b. Assume that each year's return is equally probable and calculate the average return over this time period. c. Calculate the standard deviation of returns over the past 4 years. (Hint: Treat this data as a sample.) d. Based on b and c determine the coefficient of variation of returns for the security. e. Given the calculation in d what should be Mike's decision regarding the inclusion of Hi-Tech stock in his nortfolio 2 a. The rate of return for year 2012 is %. (Round to two decimal places.) The rate of return for year 2013 is l%. (Round to two decimal places.) The rate of return for year 2014 is %. (Round to two decimal places.) The rate of return for year 2015 is %. (Round to two decimal places.) b. The average return over this time period is \%. (Round to two decimal places.) c. The standard deviation of returns over the past 4 years is %. (Round to two decimal places.) d. The coefficient of variation of returns for Hi-Tech stock is . (Round to two decimal places.)