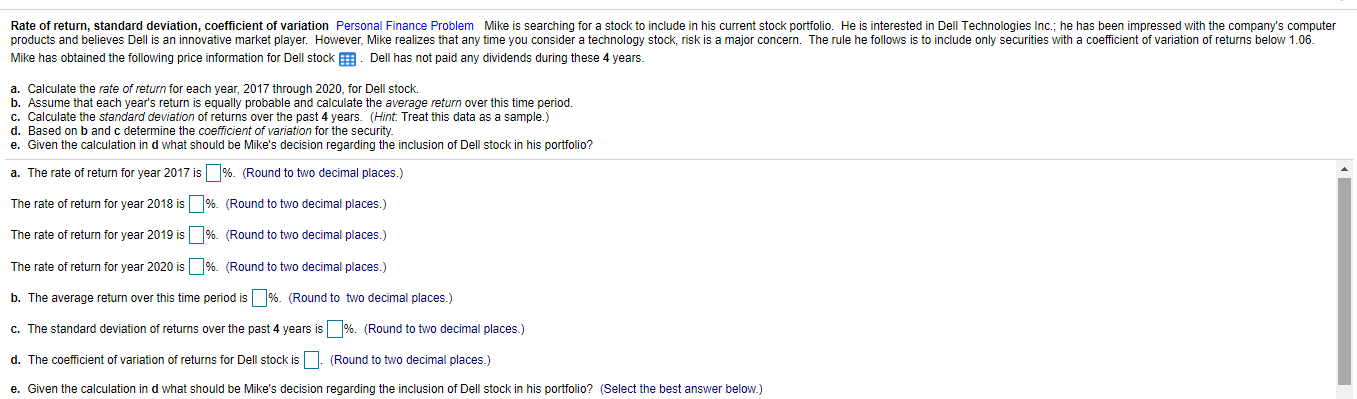

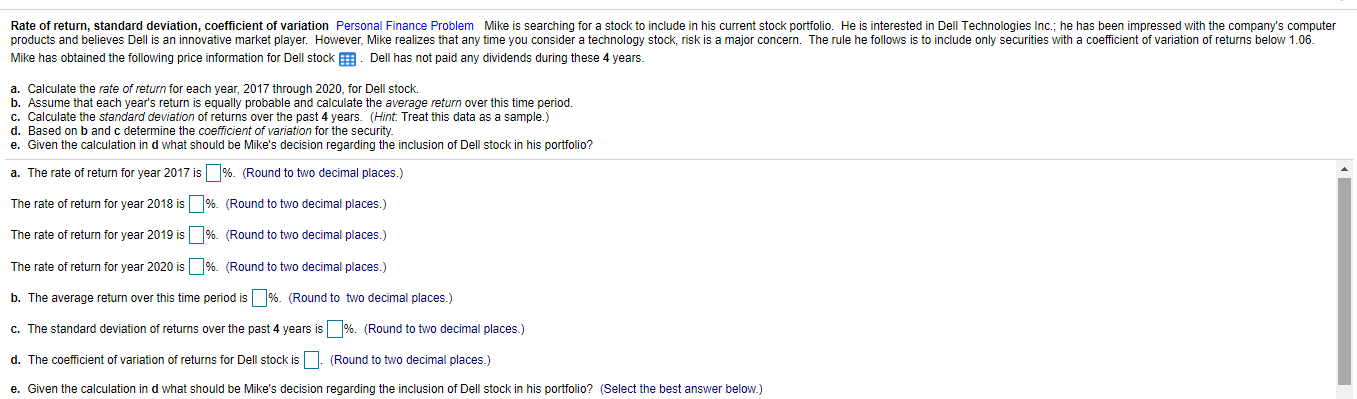

Rate of return, standard deviation, coefficient of variation Personal Finance Problem Mike is searching for a stock to include in his current stock portfolio. He is interested in Dell Technologies Inc.; he has been impressed with the company's computer products and believes Dell is an innovative market player. However, Mike realizes that any time you consider a technology stock, risk is a major concern. The rule he follows is to include only securities with a coefficient of variation of returns below 1.06. Mike has obtained the following price information for Dell stock E. Dell has not paid any dividends during these 4 years. a. Calculate the rate of return for each year, 2017 through 2020, for Dell stock. b. Assume that each year's return is equally probable and calculate the average return over this time period. C. Calculate the standard deviation of returns over the past 4 years. (Hint: Treat this data as a sample.) d. Based on b and c determine the coefficient of variation for the security. e. Given the calculation in d what should be Mike's decision regarding the inclusion of Dell stock in his portfolio? a. The rate of return for year 2017 is%. (Round to two decimal places.) The rate of return for year 2018 is %. (Round to two decimal places.) The rate of return for year 2019 is %. (Round to two decimal places.) The rate of return for year 2020 is %. (Round to two decimal places.) b. The average return over this time period is %. (Round to two decimal places.) C. The standard deviation of returns over the past 4 years is %. (Round to two decimal places.) d. The coefficient of variation of returns for Dell stock is (Round to two decimal places.) e. Given the calculation in d what should be Mike's decision regarding the inclusion of Dell stock in his portfolio? (Select the best answer below.) Rate of return, standard deviation, coefficient of variation Personal Finance Problem Mike is searching for a stock to include in his current stock portfolio. He is interested in Dell Technologies Inc.; he has been impressed with the company's computer products and believes Dell is an innovative market player. However, Mike realizes that any time you consider a technology stock, risk is a major concern. The rule he follows is to include only securities with a coefficient of variation of returns below 1.06. Mike has obtained the following price information for Dell stock E. Dell has not paid any dividends during these 4 years. a. Calculate the rate of return for each year, 2017 through 2020, for Dell stock. b. Assume that each year's return is equally probable and calculate the average return over this time period. C. Calculate the standard deviation of returns over the past 4 years. (Hint: Treat this data as a sample.) d. Based on b and c determine the coefficient of variation for the security. e. Given the calculation in d what should be Mike's decision regarding the inclusion of Dell stock in his portfolio? a. The rate of return for year 2017 is%. (Round to two decimal places.) The rate of return for year 2018 is %. (Round to two decimal places.) The rate of return for year 2019 is %. (Round to two decimal places.) The rate of return for year 2020 is %. (Round to two decimal places.) b. The average return over this time period is %. (Round to two decimal places.) C. The standard deviation of returns over the past 4 years is %. (Round to two decimal places.) d. The coefficient of variation of returns for Dell stock is (Round to two decimal places.) e. Given the calculation in d what should be Mike's decision regarding the inclusion of Dell stock in his portfolio? (Select the best answer below.)