Answered step by step

Verified Expert Solution

Question

1 Approved Answer

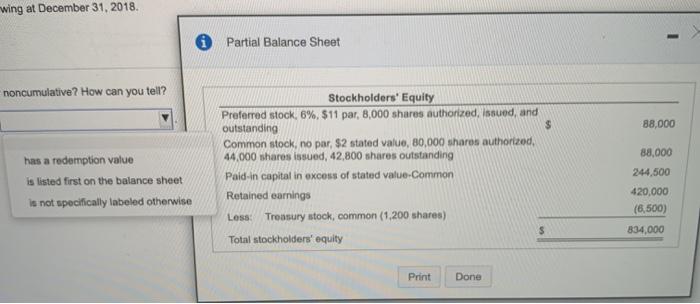

The balance sheet of Hamilton Corp. reported the following at December 31, 2018. (Click the icon to view the partial balance sheet.) Read the

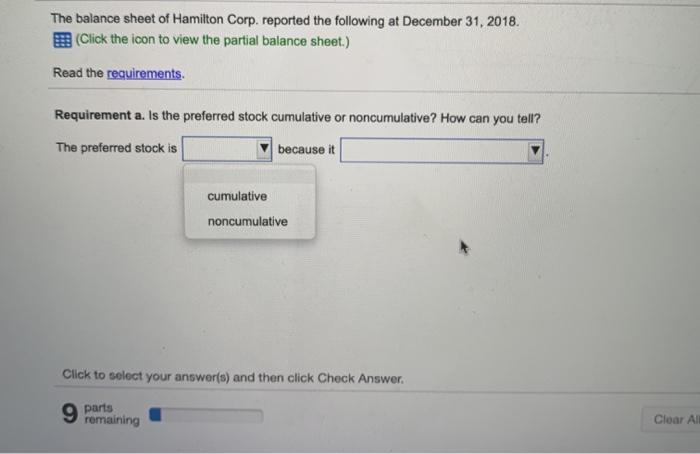

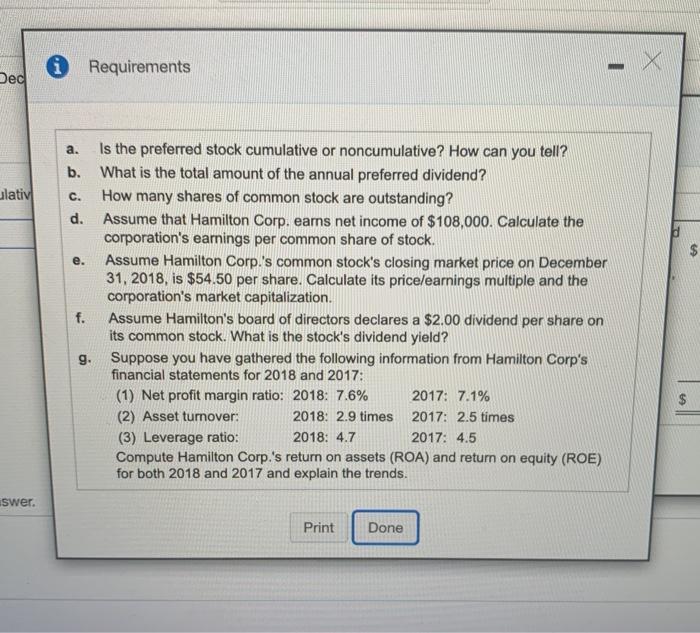

The balance sheet of Hamilton Corp. reported the following at December 31, 2018. (Click the icon to view the partial balance sheet.) Read the requirements. Requirement a. Is the preferred stock cumulative or noncumulative? How can you tell? The preferred stock is because it remaining cumulative noncumulative Click to select your answer(s) and then click Check Answer. 9 parts Clear All wing at December 31, 2018. noncumulative? How can you tell? has a redemption value is listed first on the balance sheet is not specifically labeled otherwise Partial Balance Sheet Stockholders' Equity Preferred stock, 6%, $11 par, 8,000 shares authorized, issued, and outstanding $ Common stock, no par, $2 stated value, 80,000 shares authorized, 44,000 shares issued, 42,800 shares outstanding Paid-in capital in excess of stated value-Common Retained earnings Less: Treasury stock, common (1,200 shares) Total stockholders' equity Print Done 88,000 88,000 244,500 420,000 (6,500) 834,000 Dec ulativ iswer. a. b. C. d. e. f. Requirements 9. Is the preferred stock cumulative or noncumulative? How can you tell? What is the total amount of the annual preferred dividend? How many shares of common stock are outstanding? Assume that Hamilton Corp. earns net income of $108,000. Calculate the corporation's earnings per common share of stock. Assume Hamilton Corp.'s common stock's closing market price on December 31, 2018, is $54.50 per share. Calculate its price/earnings multiple and the corporation's market capitalization. Assume Hamilton's board of directors declares a $2.00 dividend per share on its common stock. What is the stock's dividend yield? Suppose you have gathered the following information from Hamilton Corp's financial statements for 2018 and 2017: (1) Net profit margin ratio: 2018: 7.6% (2) Asset turnover: (3) Leverage ratio: 2018: 2.9 times 2018: 4.7 Compute Hamilton Corp.'s return on assets (ROA) and return on equity (ROE) for both 2018 and 2017 and explain the trends. Print 2017: 7.1% 2017: 2.5 times 2017: 4.5. Done - - X 69

Step by Step Solution

★★★★★

3.50 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

According to chegg QA guidlines only four parts can be answerd Requirementa The preferred stock ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started