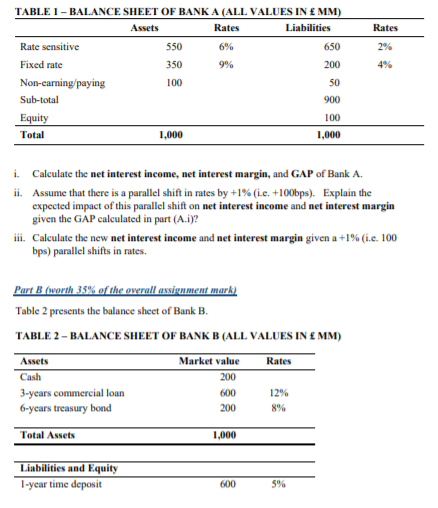

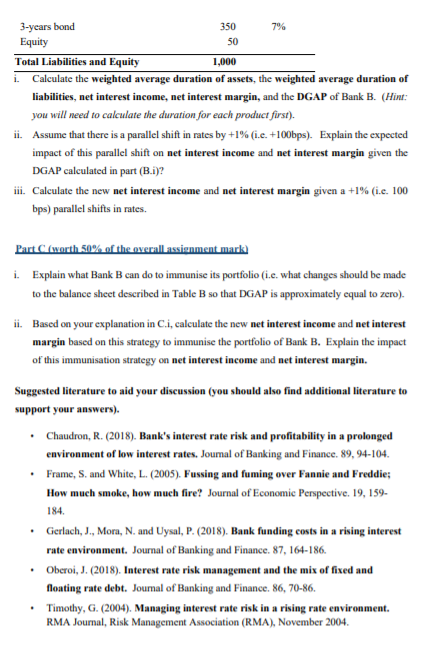

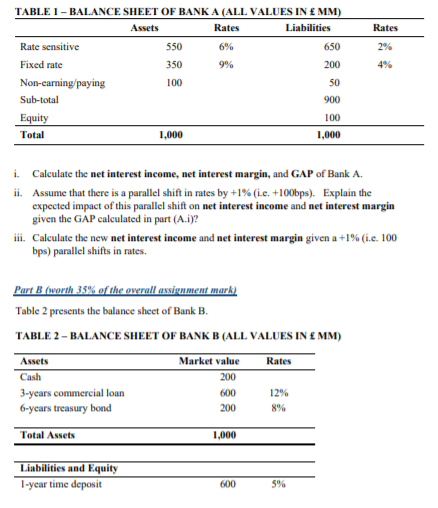

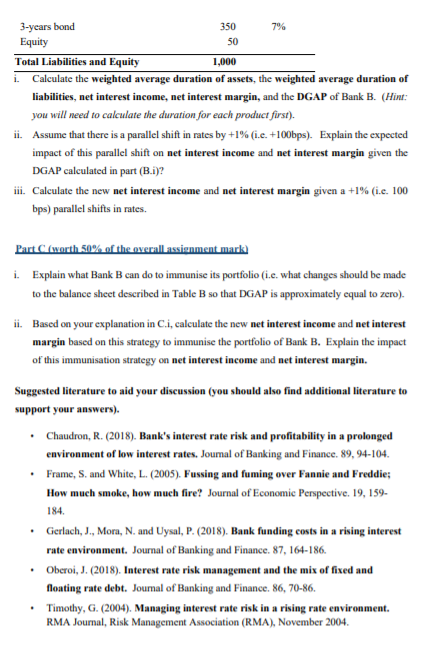

Rates 2% 4% TABLE 1 - BALANCE SHEET OF BANK A (ALL VALUES IN MM) Assets Rates Liabilities Rate sensitive 550 6% 650 Fixed rate 350 9% 200 Non-carning paying 100 50 Sub-total 900 Equity 100 Total 1,000 1,000 i. Calculate the net interest income, net interest margin, and GAP of Bank A. ii. Assume that there is a parallel shift in rates by +1% (1.e. +100bps). Explain the expected impact of this parallel shift on net interest income and net interest margin given the GAP calculated in part (A.1)? iii. Calculate the new net interest income and net interest margin given a +1% (i.e. 100 bps) parallel shifts in rates. Part B (worth 35% of the overall assignment mark) Table 2 presents the balance sheet of Bank B. TABLE 2 - BALANCE SHEET OF BANK B (ALL VALUES IN MM) Market value Rates Cash 3-years commercial loan 600 12% 6-years treasury bond 200 8% Total Assets 1,000 Assets 200 Liabilities and Equity 1-year time deposit 600 5% 7% 350 50 3-years bond Equity Total Liabilities and Equity 1,000 i. Calculate the weighted average duration of assets, the weighted average duration of liabilities, net interest income, net interest margin, and the DGAP of Bank B. (Hint: you will need to calculate the duration for each product first). ii. Assume that there is a parallel shift in rates by +1% (i.c. +100bps). Explain the expected impact of this parallel shift on net interest income and net interest margin given the DGAP calculated in part (B.1)? iii. Calculate the new net interest income and net interest margin given a +1% (.e. 100 bps) parallel shifts in rates. Part C (worth 50% of the overall assionment mark) i. Explain what Bank B can do to immunise its portfolio (i.e. what changes should be made to the balance sheet described in Table B so that DGAP is approximately equal to zero). ii. Based on your explanation in Ci, calculate the new net interest income and net interest margin based on this strategy to immunise the portfolio of Bank B. Explain the impact of this immunisation strategy on net interest income and net interest margin. Suggested literature to aid your discussion (you should also find additional literature to support your answers). Chaudron, R. (2018). Bank's interest rate risk and profitability in a prolonged environment of low interest rates. Joumal of Banking and Finance. 89, 94-104. Frame, S. and White, L. (2005). Fussing and fuming over Fannie and Freddie; How much smoke, how much fire? Journal of Economic Perspective. 19, 159- 184 Gerlach, J., Mora, N. and Uysal, P. (2018). Bank funding costs in a rising interest rate environment. Journal of Banking and Finance. 87, 164-186. Oberoi, J. (2018). Interest rate risk management and the mix of fixed and floating rate debt. Joumal of Banking and Finance. 86, 70-86. Timothy, G. (2004). Managing interest rate risk in a rising rate environment. RMA Journal, Risk Management Association (RMA), November 2004 Rates 2% 4% TABLE 1 - BALANCE SHEET OF BANK A (ALL VALUES IN MM) Assets Rates Liabilities Rate sensitive 550 6% 650 Fixed rate 350 9% 200 Non-carning paying 100 50 Sub-total 900 Equity 100 Total 1,000 1,000 i. Calculate the net interest income, net interest margin, and GAP of Bank A. ii. Assume that there is a parallel shift in rates by +1% (1.e. +100bps). Explain the expected impact of this parallel shift on net interest income and net interest margin given the GAP calculated in part (A.1)? iii. Calculate the new net interest income and net interest margin given a +1% (i.e. 100 bps) parallel shifts in rates. Part B (worth 35% of the overall assignment mark) Table 2 presents the balance sheet of Bank B. TABLE 2 - BALANCE SHEET OF BANK B (ALL VALUES IN MM) Market value Rates Cash 3-years commercial loan 600 12% 6-years treasury bond 200 8% Total Assets 1,000 Assets 200 Liabilities and Equity 1-year time deposit 600 5% 7% 350 50 3-years bond Equity Total Liabilities and Equity 1,000 i. Calculate the weighted average duration of assets, the weighted average duration of liabilities, net interest income, net interest margin, and the DGAP of Bank B. (Hint: you will need to calculate the duration for each product first). ii. Assume that there is a parallel shift in rates by +1% (i.c. +100bps). Explain the expected impact of this parallel shift on net interest income and net interest margin given the DGAP calculated in part (B.1)? iii. Calculate the new net interest income and net interest margin given a +1% (.e. 100 bps) parallel shifts in rates. Part C (worth 50% of the overall assionment mark) i. Explain what Bank B can do to immunise its portfolio (i.e. what changes should be made to the balance sheet described in Table B so that DGAP is approximately equal to zero). ii. Based on your explanation in Ci, calculate the new net interest income and net interest margin based on this strategy to immunise the portfolio of Bank B. Explain the impact of this immunisation strategy on net interest income and net interest margin. Suggested literature to aid your discussion (you should also find additional literature to support your answers). Chaudron, R. (2018). Bank's interest rate risk and profitability in a prolonged environment of low interest rates. Joumal of Banking and Finance. 89, 94-104. Frame, S. and White, L. (2005). Fussing and fuming over Fannie and Freddie; How much smoke, how much fire? Journal of Economic Perspective. 19, 159- 184 Gerlach, J., Mora, N. and Uysal, P. (2018). Bank funding costs in a rising interest rate environment. Journal of Banking and Finance. 87, 164-186. Oberoi, J. (2018). Interest rate risk management and the mix of fixed and floating rate debt. Joumal of Banking and Finance. 86, 70-86. Timothy, G. (2004). Managing interest rate risk in a rising rate environment. RMA Journal, Risk Management Association (RMA), November 2004