Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(Rates of Returns on Portfolios) Stock A's expected return and standard deviation are E[RA]=5% and A=15%. Stock B's expected return and standard deviation are E[RB]=7%

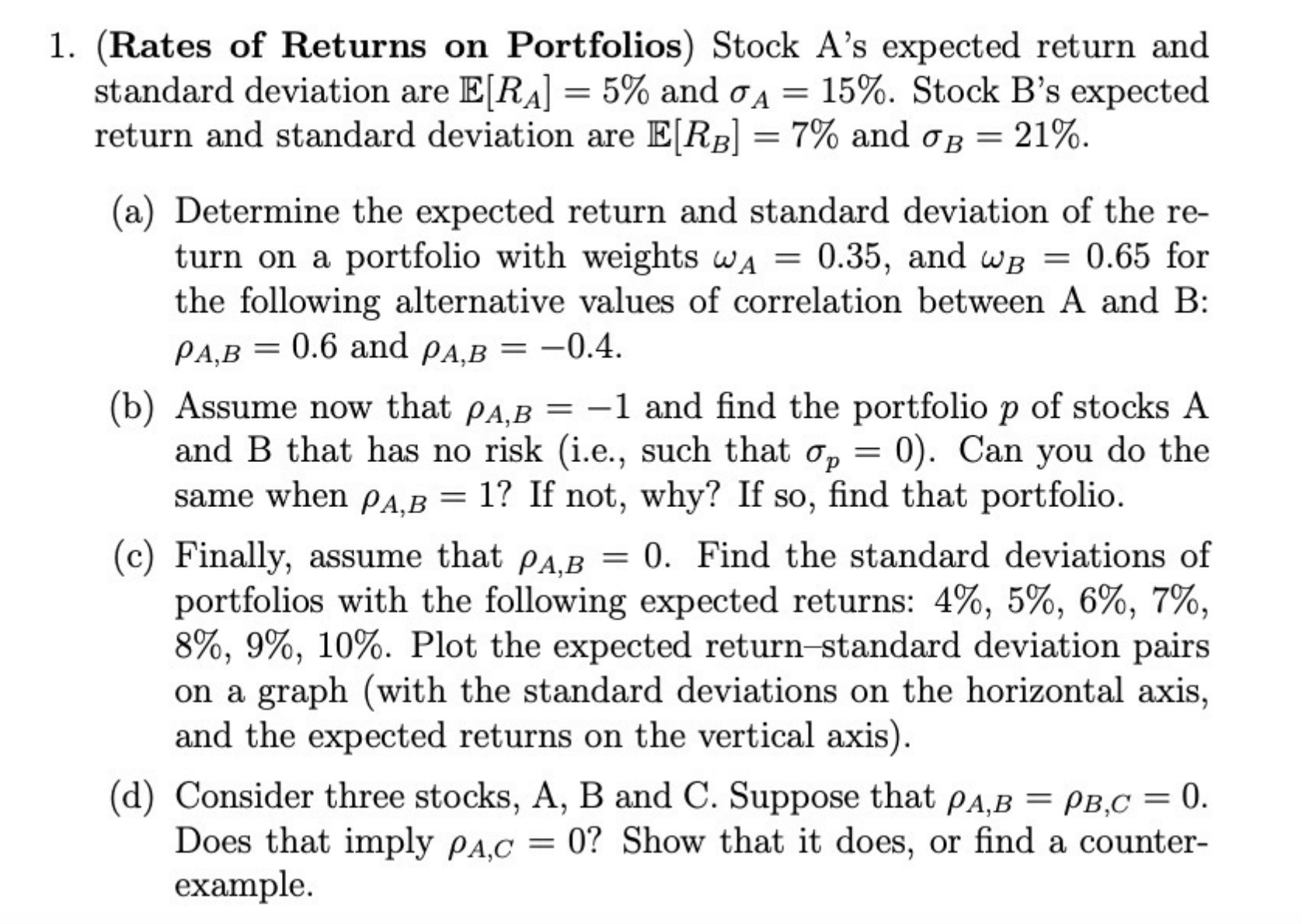

(Rates of Returns on Portfolios) Stock A's expected return and standard deviation are E[RA]=5% and A=15%. Stock B's expected return and standard deviation are E[RB]=7% and B=21%. (a) Determine the expected return and standard deviation of the return on a portfolio with weights A=0.35, and B=0.65 for the following alternative values of correlation between A and B : A,B=0.6 and A,B=0.4. (b) Assume now that A,B=1 and find the portfolio p of stocks A and B that has no risk (i.e., such that p=0 ). Can you do the same when A,B=1 ? If not, why? If so, find that portfolio. (c) Finally, assume that A,B=0. Find the standard deviations of portfolios with the following expected returns: 4%,5%,6%,7%, 8%,9%,10%. Plot the expected return-standard deviation pairs on a graph (with the standard deviations on the horizontal axis, and the expected returns on the vertical axis). (d) Consider three stocks, A, B and C. Suppose that A,B=B,C=0. Does that imply A,C=0 ? Show that it does, or find a counterexample

(Rates of Returns on Portfolios) Stock A's expected return and standard deviation are E[RA]=5% and A=15%. Stock B's expected return and standard deviation are E[RB]=7% and B=21%. (a) Determine the expected return and standard deviation of the return on a portfolio with weights A=0.35, and B=0.65 for the following alternative values of correlation between A and B : A,B=0.6 and A,B=0.4. (b) Assume now that A,B=1 and find the portfolio p of stocks A and B that has no risk (i.e., such that p=0 ). Can you do the same when A,B=1 ? If not, why? If so, find that portfolio. (c) Finally, assume that A,B=0. Find the standard deviations of portfolios with the following expected returns: 4%,5%,6%,7%, 8%,9%,10%. Plot the expected return-standard deviation pairs on a graph (with the standard deviations on the horizontal axis, and the expected returns on the vertical axis). (d) Consider three stocks, A, B and C. Suppose that A,B=B,C=0. Does that imply A,C=0 ? Show that it does, or find a counterexample Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started