Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Rather than let the vacation home sit unused during Tim's last illness, Tim and Clara rented it to vacationers for 180 days in the year

Rather than let the vacation home sit unused during Tim's last illness, Tim and Clara rented it to vacationers for 180 days in the year of Tim's death. However, Clara used her vacation home for the last 40 days of the year after Tim's death. The only expenses for the home were utilities, taxes, and maintenance. What guidance do you give her regarding these expenses?

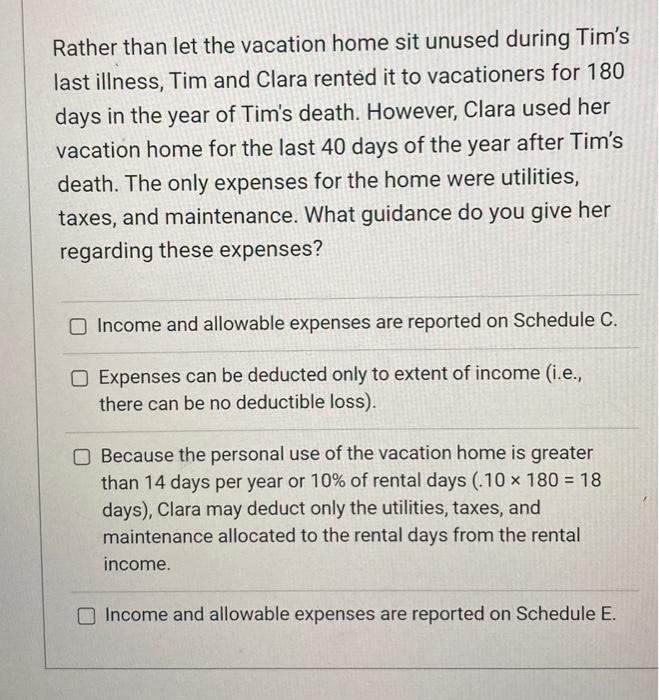

Rather than let the vacation home sit unused during Tim's last illness, Tim and Clara rented it to vacationers for 180 days in the year of Tim's death. However, Clara used her vacation home for the last 40 days of the year after Tim's death. The only expenses for the home were utilities, taxes, and maintenance. What guidance do you give her regarding these expenses? Income and allowable expenses are reported on Schedule C. Expenses can be deducted only to extent of income (i.e., there can be no deductible loss). Because the personal use of the vacation home is greater than 14 days per year or 10% of rental days (.10180=18 days), Clara may deduct only the utilities, taxes, and maintenance allocated to the rental days from the rental income. Income and allowable expenses are reported on Schedule E

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started