Answered step by step

Verified Expert Solution

Question

1 Approved Answer

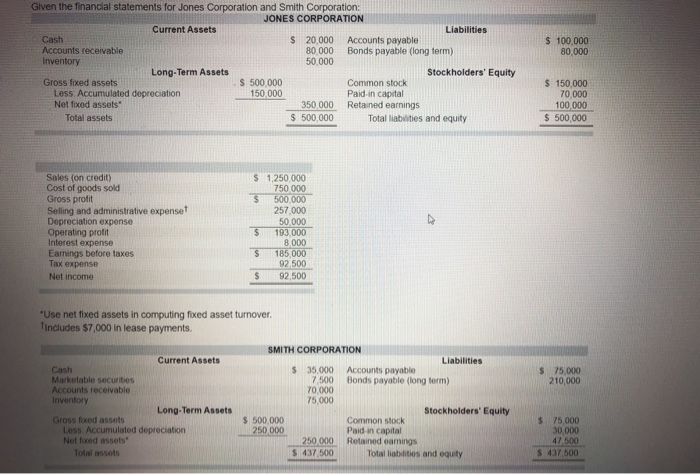

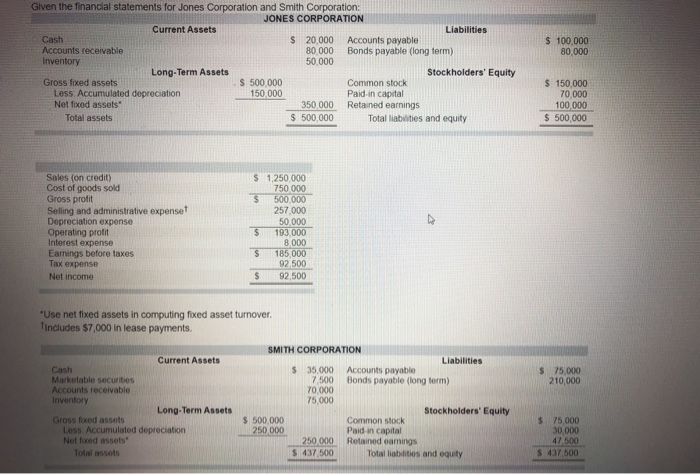

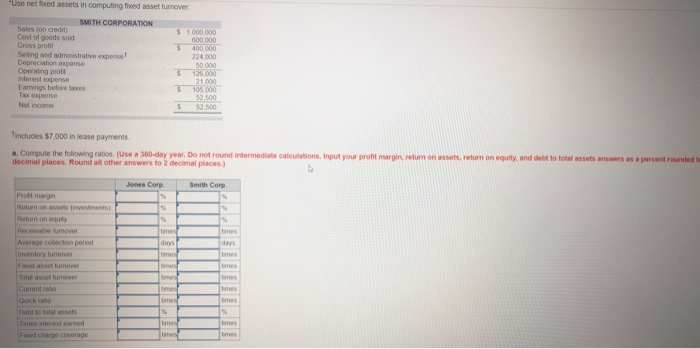

Ratio analysis $ 100,000 80 000 Given the financial statements for Jones Corporation and Smith Corporation: JONES CORPORATION Current Assets Liabilities Cash $ 20,000 Accounts

Ratio analysis

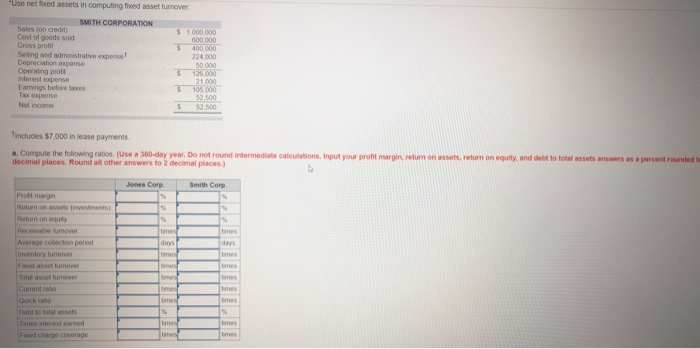

$ 100,000 80 000 Given the financial statements for Jones Corporation and Smith Corporation: JONES CORPORATION Current Assets Liabilities Cash $ 20,000 Accounts payable Accounts receivable 80 000 Bonds payable (long term) Inventory 50.000 Long-Term Assets Stockholders' Equity Gross fixed assets S 500 000 Common stock Less: Accumulated depreciation 150 000 Paid in capital Net fixed assets 350.000 Retained earnings Total assets $ 500,000 Total liabilities and equity $ 150,000 70,000 100,000 $ 500,000 $ Sales (on credit) Cost of goods sold Gross profit Selling and administrative expenset Depreciation expense Operating profit Interest expense Earnings before taxes Tax expense Net income 1,250 000 750 000 500000 257,000 50,000 193 000 8 000 185,000 92 500 92,500 $ "Use net fixed assets in computing fixed asset turnover. Tincludes $7,000 in lease payments. SMITH CORPORATION Current Assets Liabilities $ 35,000 Accounts payable Marketable securities 7,500 Bonds payable (long form) Accounts receivable 70 000 Inventory 75,000 Long-Term Assets Stockholders' Equity Gross foxed assets $ 500,000 Common stock Less Accumulated depreciation 250 000 Paid in capital Not foxed assets 250.000 Retained earings Total assets $ 437,500 Total liabilities and equity 75,000 210,000 $ 75,000 30,000 47.500 $ 437 500 Usenet foxed assets in computing fixed asset turnover SMITH CORPORATION Sales on credit Cost of goods sold 224 000 Selling administrative expenset Deprecation expense Operating profit S 3 Lamings before axes Tax expense Net income 125.000 21.000 105,000 5500 52.500 5 Tincludes $7.000 in lease payments a. Compute the following ratios (Use a 360-day year. Do not round intermediate decimal places. Round all other answers to 2 decimal places.) alculations, input your profit margin return on return on equity, and debt to total assets Jones Corp. Smith Corp con porod

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started