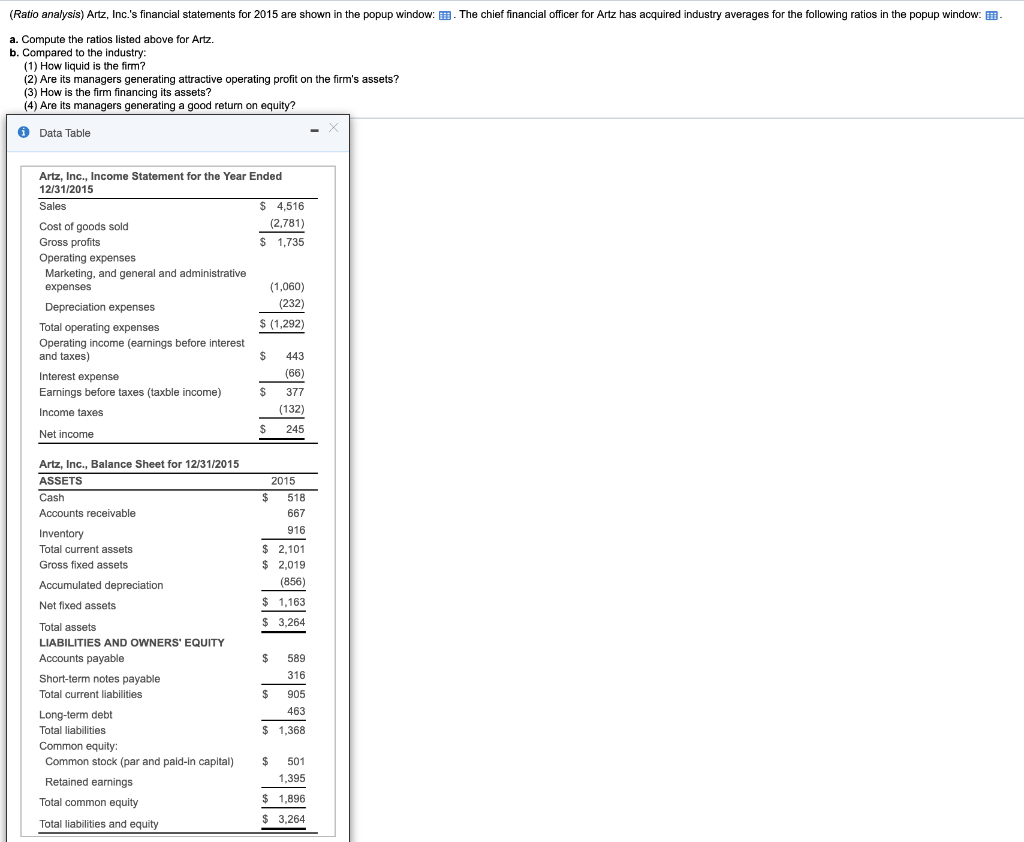

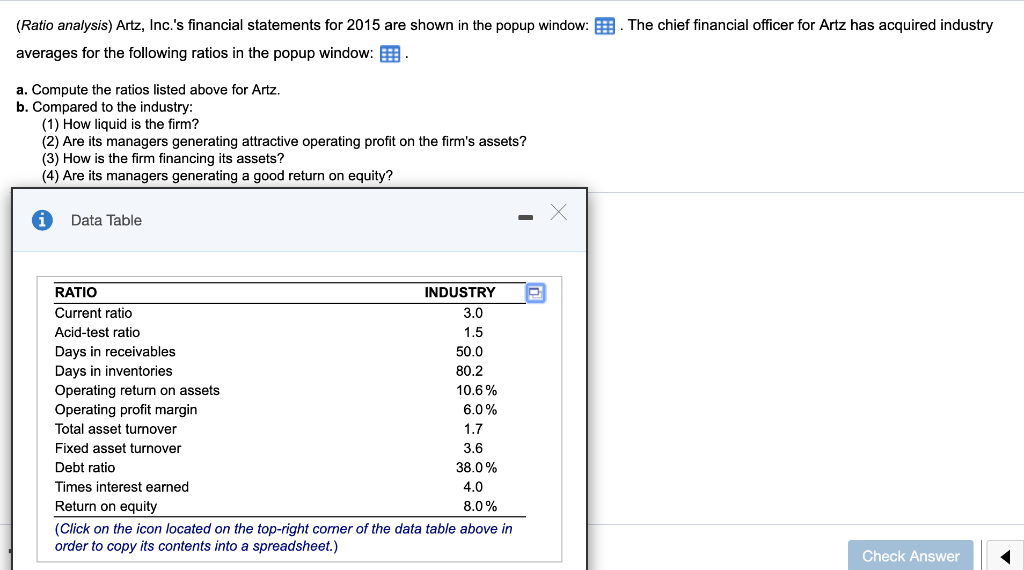

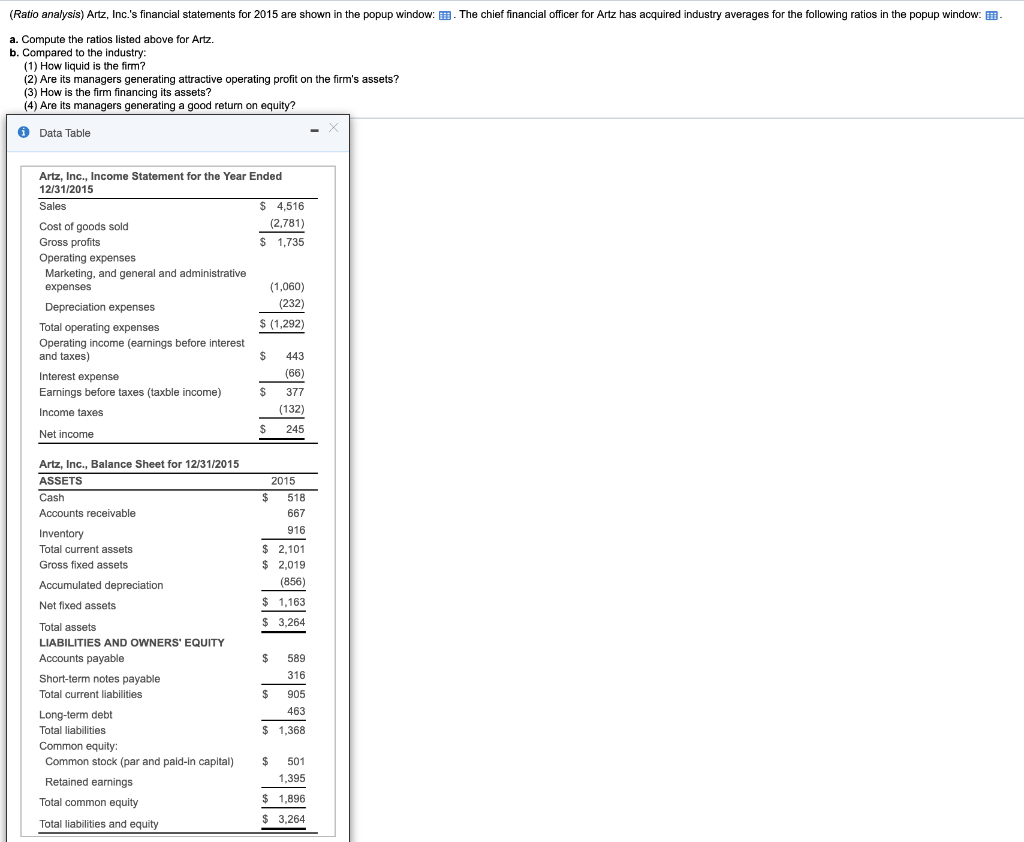

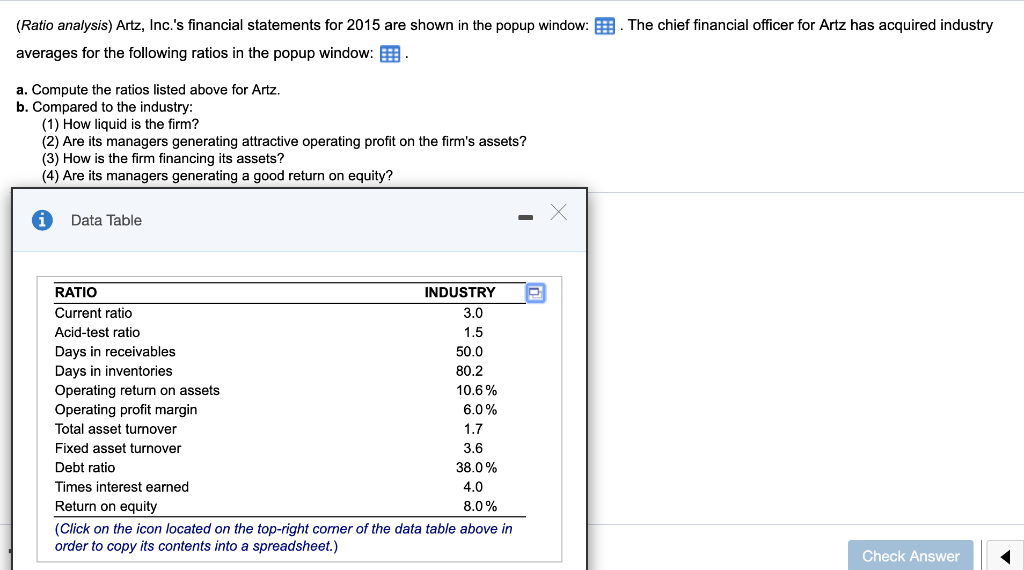

(Ratio analysis) Artz, Inc.'s financial statements for 2015 are shown in the popup window: The chief financial officer for Artz has acquired industry averages for the following ratios in the popup window: a. Compute the ratios listed above for Artz. b. Compared to the industry: (2)A d is the erating attractive operating profit on the firm's assets? (3) How is the firm financing its assets? (4) Are its managers generating a good return on equity? Data Table Artz, Inc., Income Statement for the Year Ended 12/31/2015 $ 4,516 Sales (2,781) Cost of goods sold $ 1,735 Gross profits Operating expenses and general and administrative exnenses (1,060) (232) Depreciation expenses $ (1,292) Total operating expenses Operating income (earnings before interest and taxes) 443 (66) Interest expense S Earnings before taxes (taxble income) 377 (132) Income taxes 245 Net income Artz, Inc., Balance Sheet for 12/31/2015 ASSETS 2015 Cash 518 Accounts receivable 667 916 Inventory Total current assets 2,101 $ 2,019 Gross fixed assets (856) Accumulated depreciation $ 1,163 Net fixed assets S 3.264 Total assets LIABILITIES AND OWNERS EQUITY Accounts payable 589 316 Short-term notes payable Total current liabilities S 905 163 Long-term debt. $ 1.368 Total liabilities Common equity: Common stock (par and paid-in capital) 501 1,395 Retained earnings $ 1.896 Total common equity $ 3.264 Total liabilities and equity (Ratio analysis) Artz, Inc.'s financial statements for 2015 are shown in the popup window: . The chief financial officer for Artz has acquired industry averages for the following ratios in the popup window: a. Compute the ratios listed above for Artz. b. Compared to the industry: (1) How liquid is the firm? (2) Are its managers generating attractive operating profit on the firm's assets? (3) How is the firm financing its assets? (4) Are its managers generating a good return on equity? Data Table INDUSTRY RATIO Current ratio 3.0 Acid-test ratio 1.5 Days in receivables Days in inventories 50.0 80.2 Operating return on assets Operating profit margin 10.6% 6.0% Total asset turnover 1.7 3.6 Fixed asset turnover Debt ratio 38.0% Times interest earned 4.0 Return on equity 8.0% (Click on the icon located on the top-right corner of the data table above in order to copy its contents into a spreadsheet.) Check