Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Ratio analysis is often applied to test the reasonableness of the relationship among current financial data against those of prior years. Given prior year financial

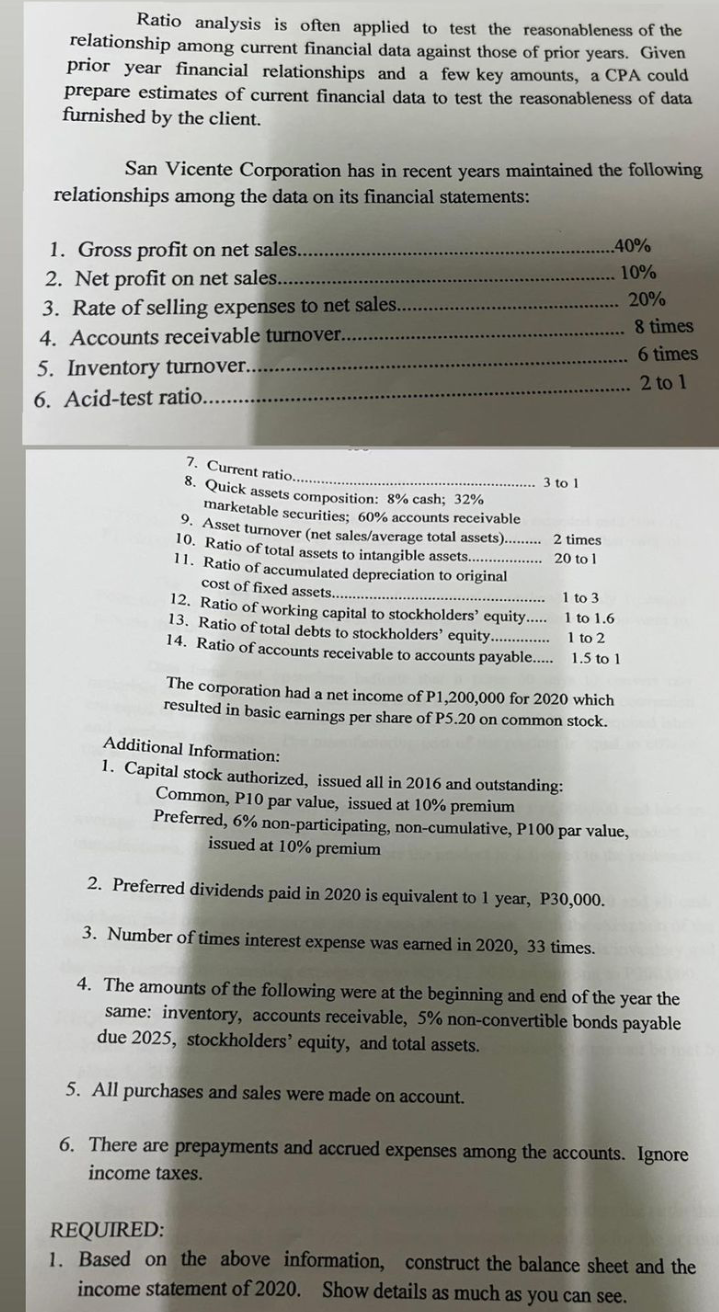

Ratio analysis is often applied to test the reasonableness of the relationship among current financial data against those of prior years. Given prior year financial relationships and a few key amounts, a CPA could prepare estimates of current financial data to test the reasonableness of data furnished by the client. San Vicente Corporation has in recent years maintained the following relationships among the data on its financial statements: 1. Gross profit on net sales. 40% 2. Net profit on net sales. 10% 3. Rate of selling expenses to net sales. 20% 4. Accounts receivable turnover. 8 times 6 times 5. Inventory turnover. 2 to 1 6. Acid-test ratio. 7. Current ratio 8. Quick assets composition: 8% cash; 32% marketable securities; 60% accounts receivable 9. Asset turnover (net sales/average total assets)........ 2 times 10. Ratio of total assets to intangible assets................ 20 to 1 11. Ratio of accumulated depreciation to original 12. Ratio of working capital to stockholders' equity................... 1 to 3 13. Ratio of total debts to stockholders' equity............. 1 to 2 14. Ratio of accounts receivable to accounts payable..... 1.5 to 1 The corporation had a net income of P1,200,000 for 2020 which resulted in basic earnings per share of P5.20 on common stock. Additional Information: 1. Capital stock authorized, issued all in 2016 and outstanding: Common, P10 par value, issued at 10% premium Preferred, 6\% non-participating, non-cumulative, P100 par value, issued at 10% premium 2. Preferred dividends paid in 2020 is equivalent to 1 year, P30,000. 3. Number of times interest expense was earned in 2020,33 times. 4. The amounts of the following were at the beginning and end of the year the same: inventory, accounts receivable, 5% non-convertible bonds payable due 2025, stockholders' equity, and total assets. 5. All purchases and sales were made on account. 6. There are prepayments and accrued expenses among the accounts. Ignore income taxes. REQUIRED: 1. Based on the above information, construct the balance sheet and the income statement of 2020 . Show details as much as you can see

Ratio analysis is often applied to test the reasonableness of the relationship among current financial data against those of prior years. Given prior year financial relationships and a few key amounts, a CPA could prepare estimates of current financial data to test the reasonableness of data furnished by the client. San Vicente Corporation has in recent years maintained the following relationships among the data on its financial statements: 1. Gross profit on net sales. 40% 2. Net profit on net sales. 10% 3. Rate of selling expenses to net sales. 20% 4. Accounts receivable turnover. 8 times 6 times 5. Inventory turnover. 2 to 1 6. Acid-test ratio. 7. Current ratio 8. Quick assets composition: 8% cash; 32% marketable securities; 60% accounts receivable 9. Asset turnover (net sales/average total assets)........ 2 times 10. Ratio of total assets to intangible assets................ 20 to 1 11. Ratio of accumulated depreciation to original 12. Ratio of working capital to stockholders' equity................... 1 to 3 13. Ratio of total debts to stockholders' equity............. 1 to 2 14. Ratio of accounts receivable to accounts payable..... 1.5 to 1 The corporation had a net income of P1,200,000 for 2020 which resulted in basic earnings per share of P5.20 on common stock. Additional Information: 1. Capital stock authorized, issued all in 2016 and outstanding: Common, P10 par value, issued at 10% premium Preferred, 6\% non-participating, non-cumulative, P100 par value, issued at 10% premium 2. Preferred dividends paid in 2020 is equivalent to 1 year, P30,000. 3. Number of times interest expense was earned in 2020,33 times. 4. The amounts of the following were at the beginning and end of the year the same: inventory, accounts receivable, 5% non-convertible bonds payable due 2025, stockholders' equity, and total assets. 5. All purchases and sales were made on account. 6. There are prepayments and accrued expenses among the accounts. Ignore income taxes. REQUIRED: 1. Based on the above information, construct the balance sheet and the income statement of 2020 . Show details as much as you can see Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started