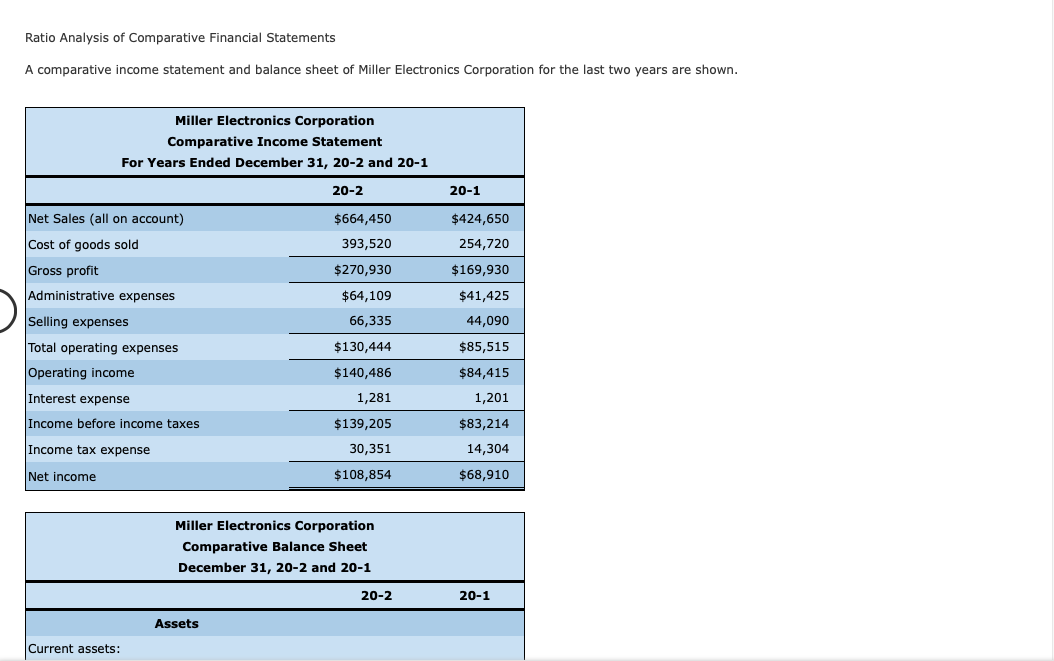

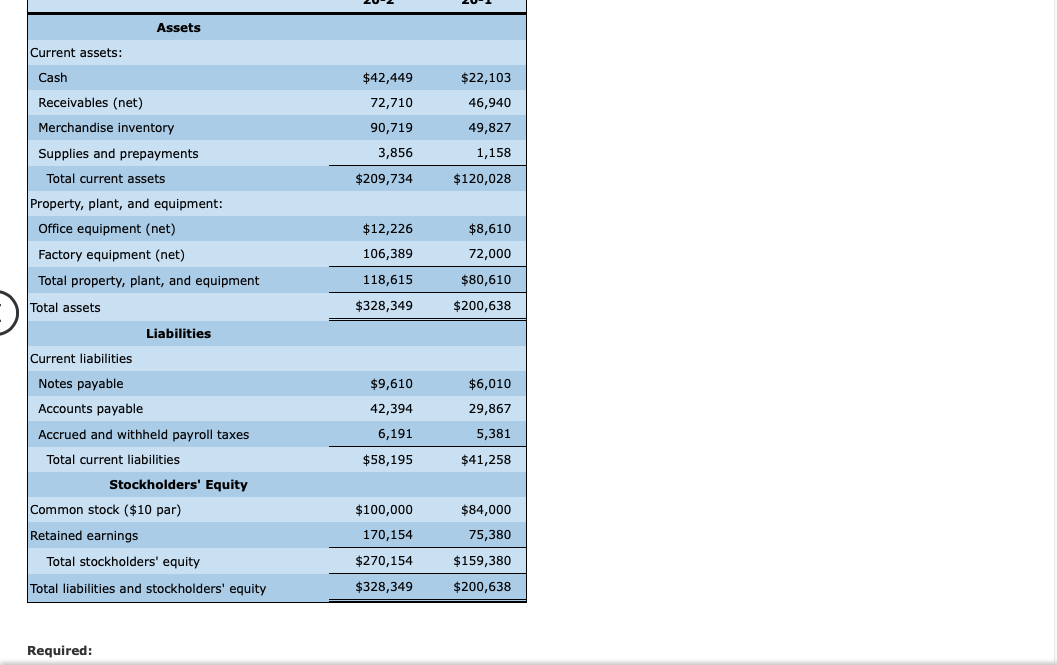

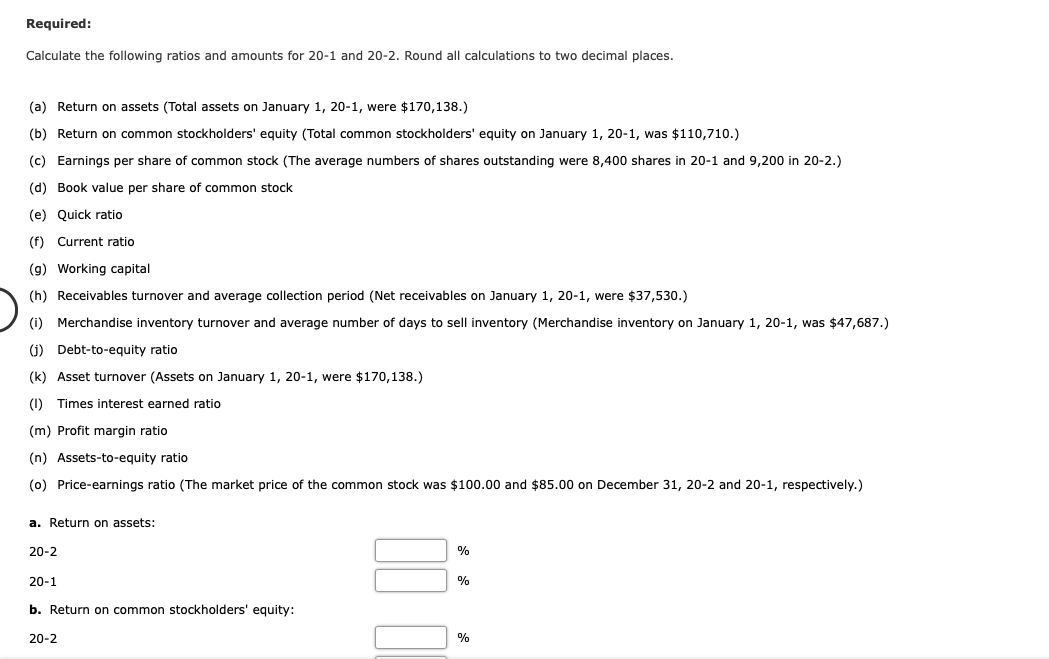

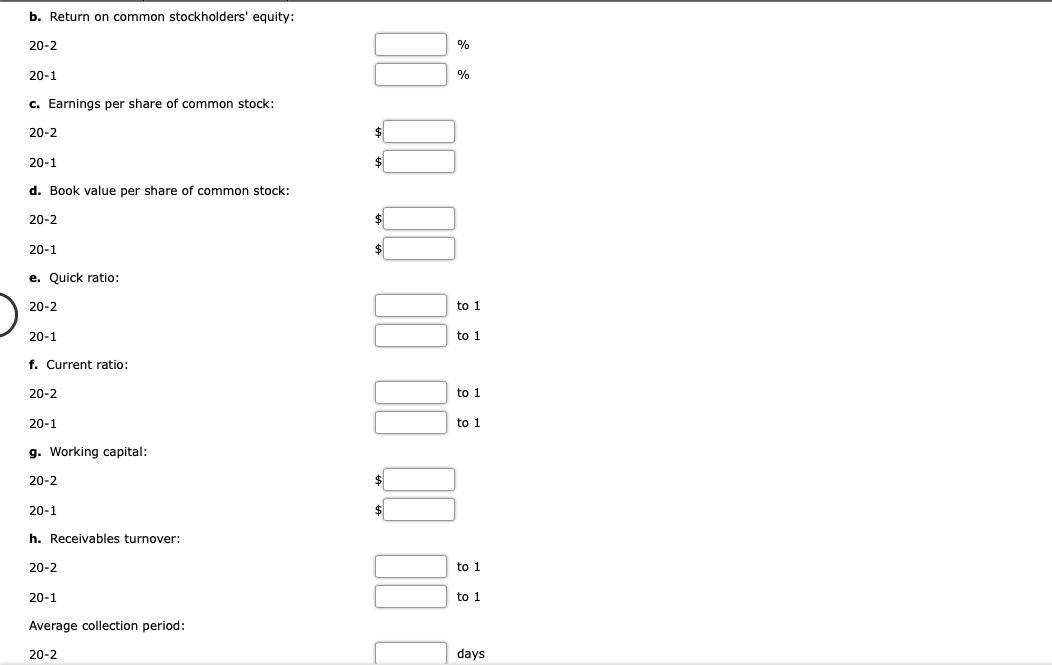

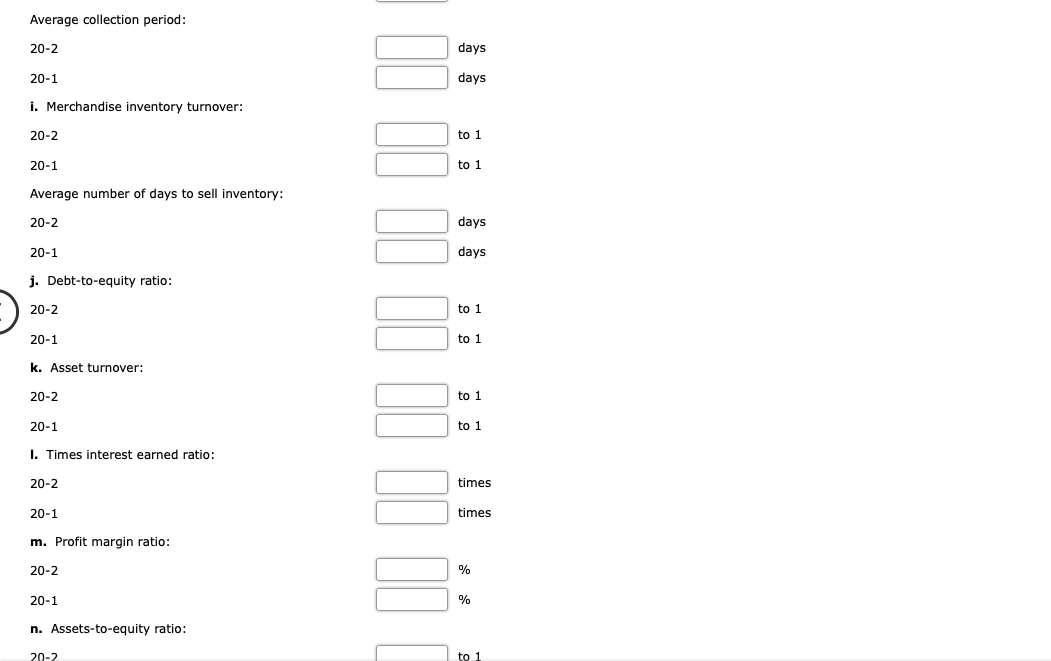

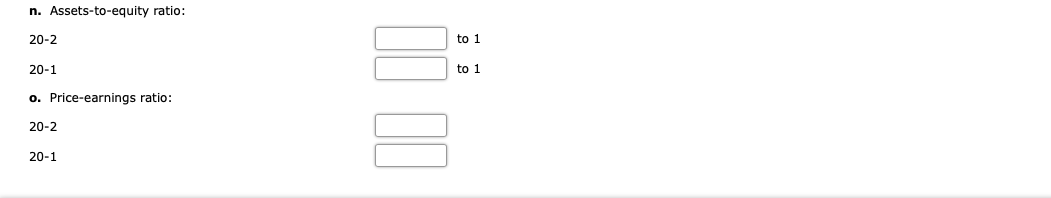

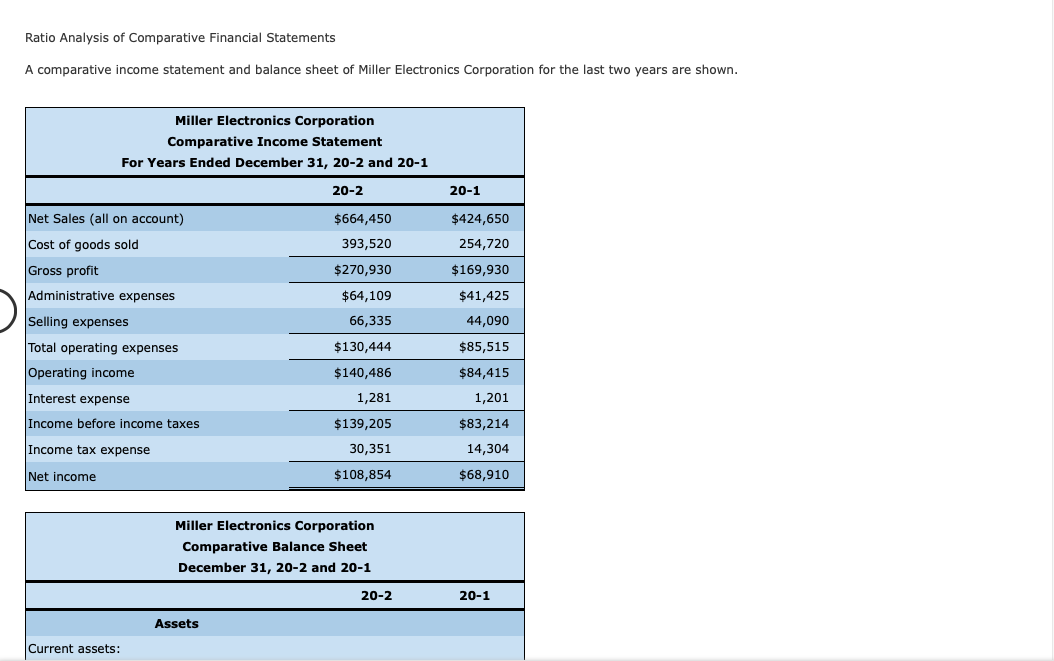

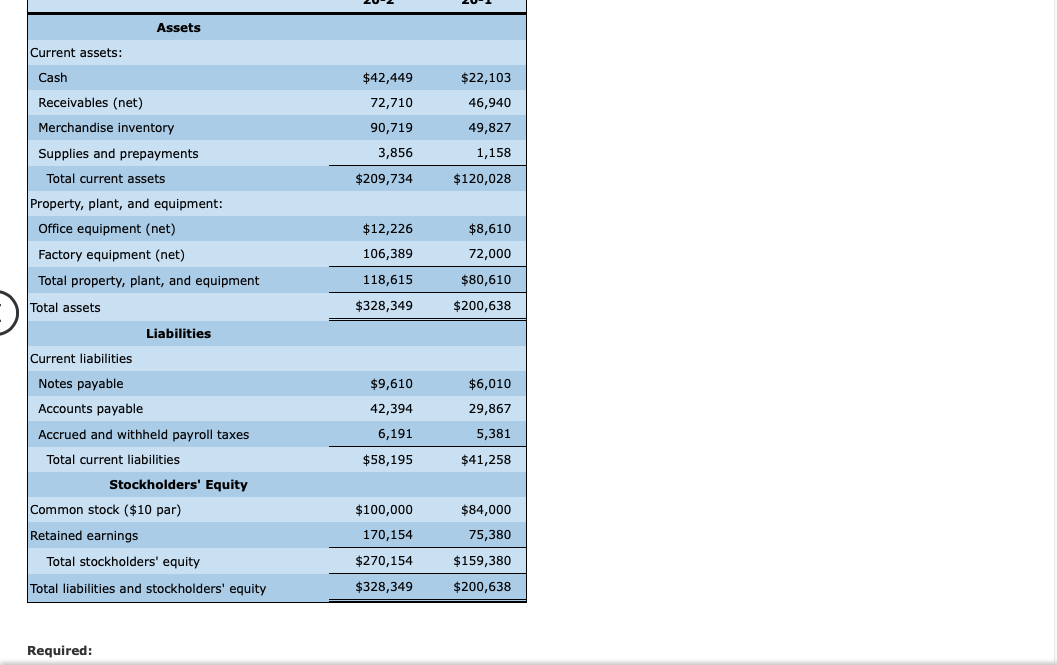

Ratio Analysis of Comparative Financial Statements A comparative income statement and balance sheet of Miller Electronics Corporation for the last two years are shown. Miller Electronics Corporation Comparative Income Statement For Years Ended December 31, 20-2 and 20-1 20-2 20-1 $424,650 $664,450 393,520 254,720 $270,930 Net Sales (all on account) Cost of goods sold Gross profit Administrative expenses Selling expenses Total operating expenses $64,109 66,335 $130,444 $140,486 1,281 $169,930 $41,425 44,090 $85,515 Operating income $84,415 Interest expense 1,201 Income before income taxes $139,205 30,351 Income tax expense $83,214 14,304 $68,910 Net income $108,854 Miller Electronics Corporation Comparative Balance Sheet December 31, 20-2 and 20-1 20-2 20-1 Assets Current assets: Assets Current assets: Cash $42,449 72,710 Receivables (net) Merchandise inventory $22,103 46,940 49,827 1,158 90,719 3,856 Supplies and prepayments Total current assets $209,734 $120,028 $12,226 Property, plant, and equipment: Office equipment (net) Factory equipment (net) Total property, plant, and equipment 106,389 $8,610 72,000 $80,610 118,615 Total assets $328,349 $200,638 Liabilities $9,610 $6,010 42,394 Current liabilities Notes payable Accounts payable Accrued and withheld payroll taxes Total current liabilities Stockholders' Equity Common stock ($10 par) 29,867 5,381 6,191 $58,195 $41,258 $100,000 $84,000 75,380 Retained earnings 170,154 Total stockholders' equity $270,154 $159,380 Total liabilities and stockholders' equity $328,349 $200,638 Required: Required: Calculate the following ratios and amounts for 20-1 and 20-2. Round all calculations to two decimal places. (a) Return on assets (Total assets on January 1, 20-1, were $170,138.) (b) Return on common stockholders' equity (Total common stockholders' equity on January 1, 20-1, was $110,710.) (c) Earnings per share of common stock (The average numbers of shares outstanding were 8,400 shares in 20-1 and 9,200 in 20-2.) (d) Book value per share of common stock (e) Quick ratio (f) Current ratio (9) Working capital (h) Receivables turnover and average collection period (Net receivables on January 1, 20-1, were $37,530.) (i) Merchandise inventory turnover and average number of days to sell inventory (Merchandise inventory on January 1, 20-1, was $47,687.) (1) Debt-to-equity ratio (k) Asset turnover (Assets on January 1, 20-1, were $170,138.) (1) Times interest earned ratio (m) Profit margin ratio (n) Assets-to-equity ratio (0) Price-earnings ratio (The market price of the common stock was $100.00 and $85.00 on December 31, 20-2 and 20-1, respectively.) a. Return on assets: 20-2 % 20-1 % b. Return on common stockholders' equity: 20-2 % b. Return on common stockholders' equity: 20-2 % 20-1 % c. Earnings per share of common stock: 20-2 $ 20-1 $ d. Book value per share of common stock: 20-2 $ 20-1 $ e. Quick ratio: 20-2 to 1 20-1 to 1 f. Current ratio: 20-2 to 1 20-1 to 1 g. Working capital: 20-2 $ 20-1 $ h. Receivables turnover: 20-2 to 1 20-1 to 1 Average collection period: 20-2 days Average collection period: 20-2 days 20-1 days i. Merchandise inventory turnover: 20-2 to 1 20-1 to 1 Average number of days to sell inventory: 20-2 days 20-1 days j. Debt-to-equity ratio: 20-2 to 1 20-1 to 1 k. Asset turnover: 20-2 to 1 20-1 to 1 1. Times interest earned ratio: 20-2 times 20-1 times m. Profit margin ratio: 20-2 % 20-1 % n. Assets-to-equity ratio: 20-2 to 1 n. Assets-to-equity ratio: 20-2 to 1 20-1 to 1 o. Price-earnings ratio: 20-2 II 20-1