Question: (Ratio analysis over time) The following information comes from the accounting records of Hercep Ltd. for the first three years of its existence: 2018

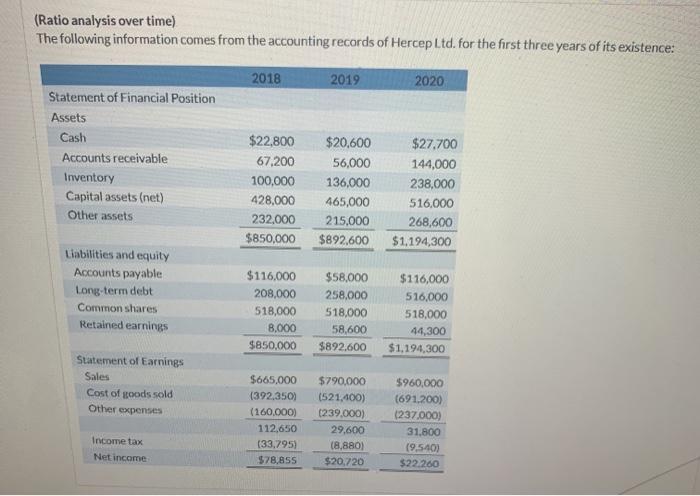

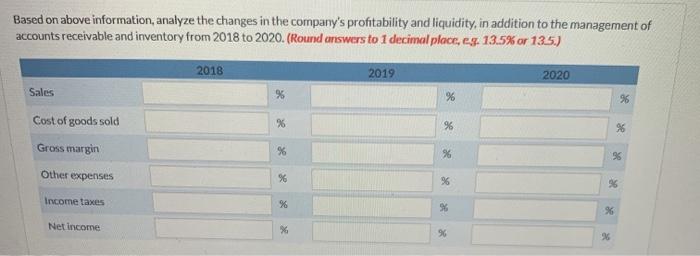

(Ratio analysis over time) The following information comes from the accounting records of Hercep Ltd. for the first three years of its existence: 2018 2019 2020 Statement of Financial Position Assets Cash $22,800 $20,600 $27,700 Accounts receivable 67,200 56,000 144,000 Inventory 100,000 136,000 238,000 Capital assets (net) 428,000 465,000 516,000 Other assets 232,000 215,000 268,600 $850,000 $892,600 $1,194,300 Liabilities and equity $116,000 $58,000 $116,000 Accounts payable Long-term debt 208,000 258,000 516,000 Common shares 518,000 518,000 518,000 Retained earnings 8,000 58,600 44,300 $850,000 $892,600 $1,194,300 Statement of Earnings Sales $665,000 $790,000 $960,000 Cost of goods sold (392,350) (521,400) (691,200) Other expenses (160,000) (239,000) (237,000) 112,650 29,600 31,800 Income tax (33,795) (8,880) (9,540) Net income $78,855 $20,720 $22.260 Based on above information, analyze the changes in the company's profitability and liquidity, in addition to the management of accounts receivable and inventory from 2018 to 2020. (Round answers to 1 decimal place, e.g. 13.5% or 13.5.) 2018 2019 2020 Sales % % Cost of goods sold % Gross margin % Other expenses % Income taxes Net income % % % % % % % R % %6 % %

Step by Step Solution

3.48 Rating (164 Votes )

There are 3 Steps involved in it

2018 2019 2020 Sales 1000 1000 1000 Cost of goods sold 590 660 720 Gross Margin 410 340 280 ... View full answer

Get step-by-step solutions from verified subject matter experts