Question

Ratio Analysis - Use the 2019 numbers This assignment includes calculating the 10 ratios for two different companies (Lockheed and Boeing) in the industry which

Ratio Analysis - Use the 2019 numbers

This assignment includes calculating the 10 ratios for two different companies (Lockheed and Boeing) in the industry which can be found attached to this assignment. Then, tell me which company you would invest in and why. Ratios (10 x 10 x 2 = 200) + 40 (explanation) = 240 points

The 10 ratios to be calculated are the

Current Ratio, Quick Ratio, Debt Ratio, Debt to Net Worth Ratio, Net Sales to Total Assets Ratio, Net Profit on Sales Ratio, Net Profit on Assets, Net Profit on Equity, Average Inventory Turnover Ratio, Accounts Receivables Ratio.

Use the materials from the Instructional Materials Area for Tesla and Toyota.

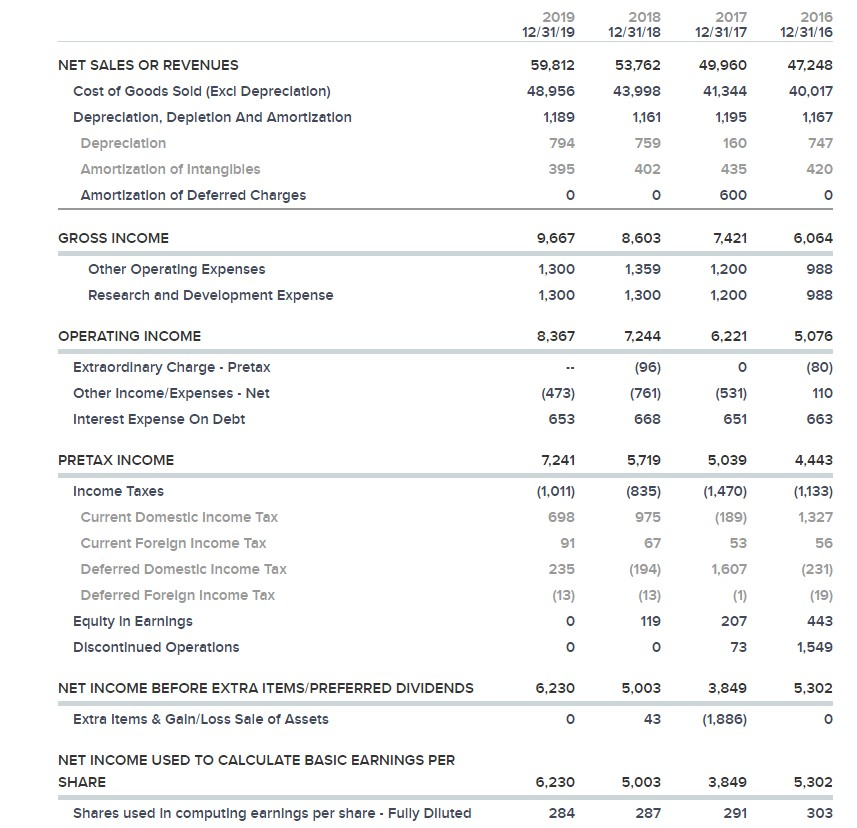

Lockheed Martin Income Statement June 1, 2020 - $388.95 share

(down .01/ -.0026%)

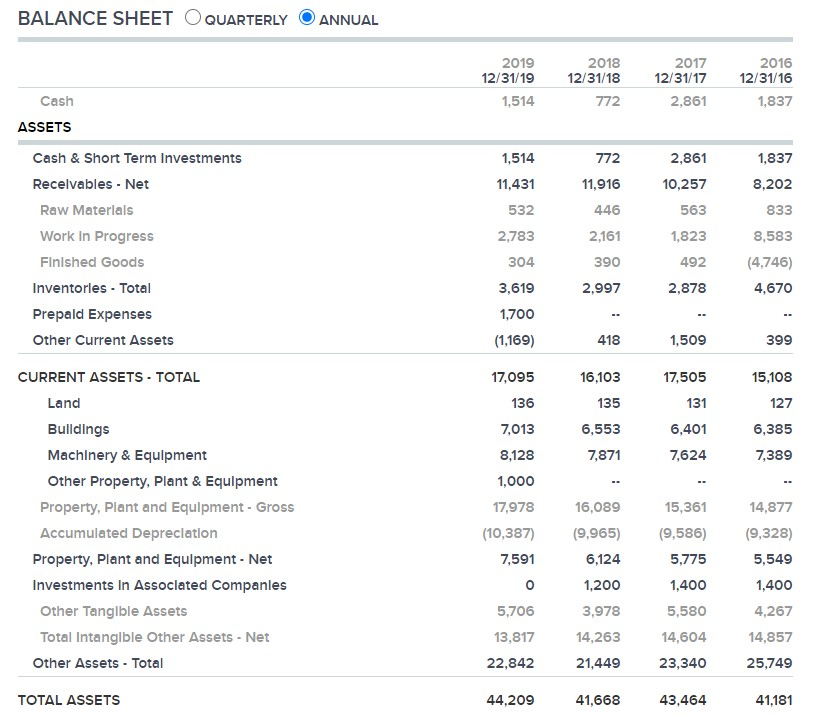

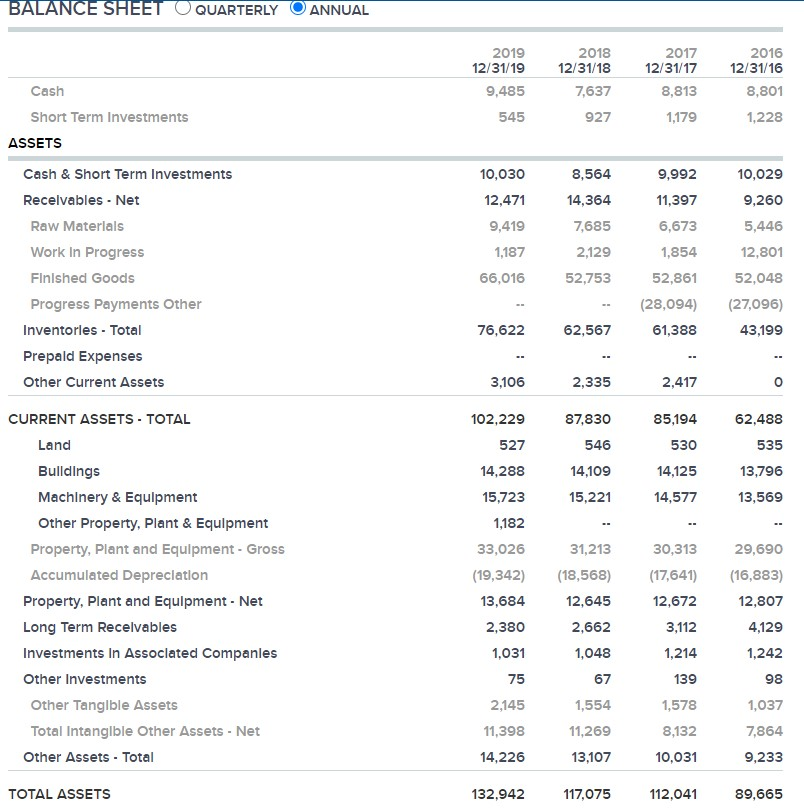

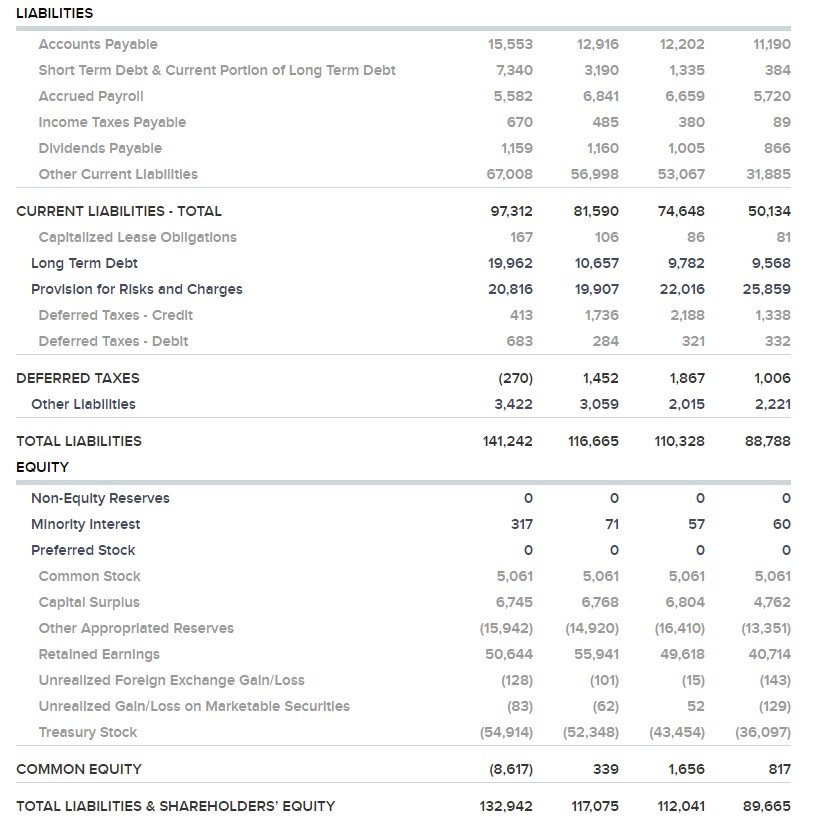

Lockheed Martin Balance Sheet

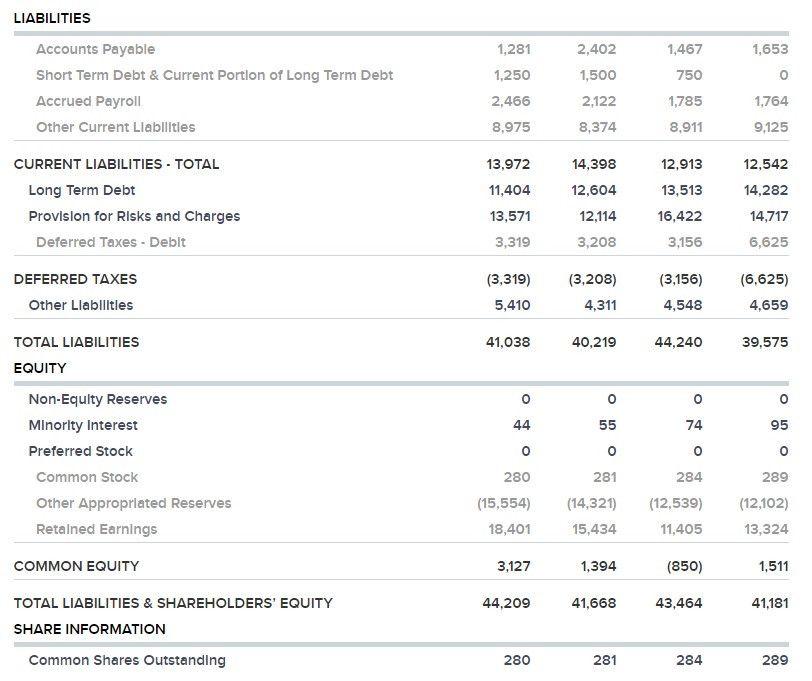

Boeing Income Statement June 1, 2020 $149.55 share (-1.84/ -1.22%)

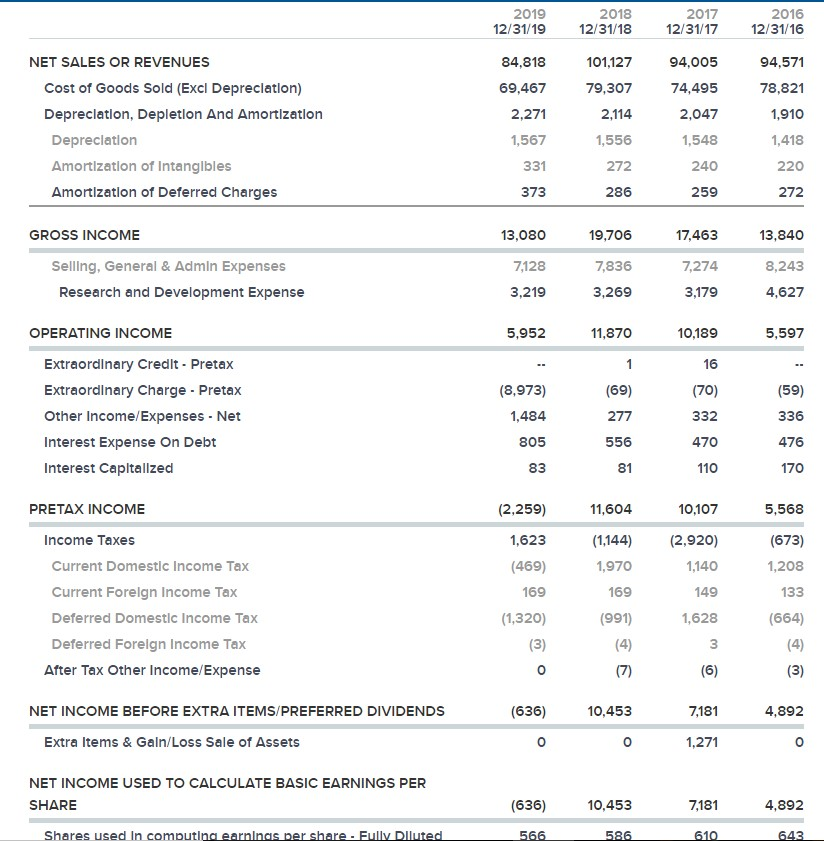

Boeing Balance Sheet

2019 12/31/19 2018 12/31/18 2017 12/31/17 2016 12/31/16 59,812 47,248 49,960 41,344 1,195 48,956 1,189 40,017 1,167 NET SALES OR REVENUES Cost of Goods Sold (Excl Depreciation) Depreciation, Depletion And Amortization Depreciation Amortization of Intangibles Amortization of Deferred Charges 53,762 43,998 1,161 759 402 o 794 747 160 435 600 395 o 420 0 9,667 8,603 7,421 6,064 GROSS INCOME Other Operating Expenses Research and Development Expense 1,300 1,359 1,200 988 1,300 1,300 1,200 988 8,367 7,244 6,221 5,076 (80) OPERATING INCOME Extraordinary Charge - Pretax Other Income/Expenses - Net Interest Expense On Debt (96) (761) 668 o (531) (473) 653 110 651 663 7,241 5,719 5,039 4,443 (1,133) 1,327 PRETAX INCOME Income Taxes Current Domestic Income Tax Current Forelgn Income Tax Deferred Domestic Income Tax Deferred Forelgn Income Tax Equity In Earnings Discontinued Operations (1,011) 698 91 235 (13) 56 (835) 975 67 (194) (13) 119 (1,470) (189) 53 1,607 (1) 207 (231) (19) 0 443 73 1,549 6,230 5,003 3,849 5,302 NET INCOME BEFORE EXTRA ITEMS/PREFERRED DIVIDENDS Extra Items & Gain/Loss Sale of Assets 0 43 (1,886) NET INCOME USED TO CALCULATE BASIC EARNINGS PER SHARE Shares used in computing earnings per share - Fully Dlluted 6,230 5,003 3,849 5,302 284 287 291 303 BALANCE SHEET O QUARTERLY ANNUAL 2019 12/31/19 1,514 2018 12/31/18 772 2017 12/31/17 2,861 2016 12/31/16 1,837 Cash ASSETS 1,837 1,514 11,431 532 8,202 833 Cash & Short Term Investments Recelvables - Net Raw Materials Work In Progress Finished Goods Inventories - Total Prepald Expenses Other Current Assets 772 11,916 446 2,161 390 2,997 2,861 10,257 563 1,823 492 2,878 8,583 (4,746) 2,783 304 3,619 1,700 (1,169) 4,670 418 1,509 399 16,103 17,505 15,108 131 127 135 6,553 7,871 6,401 6,385 7,624 7,389 CURRENT ASSETS - TOTAL Land Bulldings Machinery & Equipment Other Property, Plant & Equipment Property, Plant and Equipment - Gross Accumulated Depreciation Property, Plant and Equipment - Net Investments in Associated Companies Other Tangible Assets Total Intangible Other Assets - Net Other Assets - Total 17,095 136 7,013 8,128 1,000 17,978 (10,387) 7,591 0 5,706 13,817 16,089 (9,965) 6,124 1,200 3,978 14,263 15,361 (9,586) 5,775 1,400 14,877 (9,328) 5,549 1,400 5,580 14,604 4,267 14,857 25,749 22,842 21,449 23,340 TOTAL ASSETS 44,209 41,668 43,464 41,181 1,281 1,467 1,653 LIABILITIES Accounts Payable Short Term Debt & Current Portion of Long Term Debt Accrued Payroll Other Current Llabilities 2,402 1,500 1,250 0 2,466 8,975 1,764 750 1,785 8,911 2,122 8,374 9,125 14,398 12,604 12,542 14,282 CURRENT LIABILITIES - TOTAL Long Term Debt Provision for Risks and Charges Deferred Taxes - Deblt 13,972 11,404 13,571 3,319 12,913 13,513 16,422 3,156 12,114 14,717 6,625 3,208 DEFERRED TAXES Other Llabilities (3,319) 5,410 (3,208) 4,311 (3,156) 4,548 (6,625) 4,659 41,038 40,219 44,240 39,575 TOTAL LIABILITIES EQUITY 0 0 44 55 74 95 o o o 0 Non-Equity Reserves Minority Interest Preferred Stock Common Stock Other Appropriated Reserves Retained Earnings 280 281 284 (15,554) 18,401 (14,321) 15,434 (12,539) 11,405 289 (12,102) 13,324 COMMON EQUITY 3,127 1,394 (850) 1,511 44,209 41,668 43,464 41,181 TOTAL LIABILITIES & SHAREHOLDERS' EQUITY SHARE INFORMATION Common Shares Outstanding 280 281 284 289 2019 12/31/19 2018 12/31/18 2017 12/31/17 2016 12/31/16 94,005 74,495 94,571 78,821 2,047 1,910 NET SALES OR REVENUES Cost of Goods Sold (Excl Depreciation) Depreciation, Depletion And Amortization Depreciation Amortization of Intangibles Amortization of Deferred Charges 84,818 69,467 2,271 1,567 331 373 101,127 79,307 2,114 1,556 272 286 1,548 1,418 240 220 259 272 13,080 19,706 17,463 13,840 GROSS INCOME Selling, General & Admin Expenses Research and Development Expense 8,243 7,128 3,219 7,836 3,269 7,274 3,179 4,627 5,952 11,870 10,189 5,597 16 (70) (59) OPERATING INCOME Extraordinary Credit - Pretax Extraordinary Charge - Pretax Other Income/Expenses - Net Interest Expense On Debt Interest Capitalized (8,973) 1,484 805 1 (69) 277 556 81 332 336 476 470 110 83 170 (2,259) 10,107 5,568 (2,920) 1,140 (673) 1,208 PRETAX INCOME Income Taxes Current Domestic Income Tax Current Forelgn Income Tax Deferred Domestic Income Tax Deferred Forelgn Income Tax After Tax Other Income/Expense 1,623 (469) 169 (1,320) (3) 11,604 (1,144) 1,970 169 (991) (4) (7) 149 133 1,628 3 (664) (4) (3) (6) (636) 10,453 7,181 4,892 NET INCOME BEFORE EXTRA ITEMS/PREFERRED DIVIDENDS Extra Items & Gain/Loss Sale of Assets o 1,271 NET INCOME USED TO CALCULATE BASIC EARNINGS PER SHARE (636) 10,453 7,181 4,892 Shares used in computing earnings per share. Fully Diluted 566 586 610 643 BALANCE SHEET O QUARTERLY ANNUAL 2019 12/31/19 9,485 545 Cash Short Term Investments ASSETS 2018 12/31/18 7,637 927 2017 12/31/17 8,813 1,179 2016 12/31/16 8,801 1,228 8,564 9,992 11,397 Cash & Short Term Investments Recelvables - Net Raw Materials Work In Progress Finished Goods Progress Payments Other Inventories - Total Prepald Expenses Other Current Assets 10,030 12,471 9,419 1,187 66,016 14,364 7,685 2,129 52,753 6,673 1,854 10,029 9,260 5,446 12,801 52,048 (27,096) 43,199 52,861 (28,094) 61,388 76,622 62,567 3,106 2,335 2,417 87,830 85,194 62,488 530 535 546 14,109 14,125 13,796 15,221 14,577 13,569 29,690 CURRENT ASSETS - TOTAL Land Bulldings Machinery & Equipment Other Property, Plant & Equipment Property, plant and Equipment - Gross Accumulated Depreciation Property, Plant and Equipment - Net Long Term Recelvables Investments In Associated Companles Other Investments Other Tangible Assets Total Intangible Other Assets - Net Other Assets - Total 102,229 527 14,288 15,723 1,182 33,026 (19,342) 13,684 2,380 1,031 75 2,145 (16,883) 12,807 31,213 (18,568) 12,645 2,662 1,048 67 1,554 11,269 13,107 30,313 (17,641) 12,672 3,112 1,214 139 1,578 8,132 10,031 4,129 1,242 98 1,037 7,864 11,398 14,226 9,233 TOTAL ASSETS 132,942 117,075 112,041 89,665 LIABILITIES 11,190 384 Accounts Payable Short Term Debt & Current Portion of Long Term Debt Accrued Payroll Income Taxes Payable Dividends Payable Other Current Liabilitles 5,720 15,553 7,340 5,582 670 1,159 67,008 12,916 3,190 6,841 485 1,160 56,998 12,202 1,335 6,659 380 89 1,005 53,067 866 31,885 50,134 97,312 167 74,648 86 81 9,782 CURRENT LIABILITIES - TOTAL Capitalized Lease Obligations Long Term Debt Provision for Risks and Charges Deferred Taxes - Credit Deferred Taxes. Deblt 81,590 106 10,657 19,907 1,736 9,568 19,962 20,816 22,016 25,859 1,338 413 683 2,188 321 284 332 1,867 1,006 DEFERRED TAXES Other Llabilities (270) 3,422 1,452 3,059 2,015 2,221 141,242 116,665 110,328 88,788 TOTAL LIABILITIES EQUITY o o 71 57 60 o 317 o 5,061 6,745 O 5,061 4,762 Non-Equity Reserves Minority Interest Preferred Stock Common Stock Capital Surplus Other Appropriated Reserves Retained Earnings Unrealized Foreign Exchange Gain/Loss Unrealized Galn/Loss on Marketable Securities Treasury Stock O 5,061 6,768 (14,920) 55,941 (101) o 5,061 6,804 (16,410) 49,618 (15) (15,942) 50,644 (128) (83) (54,914) (13,351) 40,714 (143) (129) (36,097) (62) 52 (52,348) (43,454) COMMON EQUITY (8,617) 339 1,656 817 TOTAL LIABILITIES & SHAREHOLDERS' EQUITY 132,942 117,075 112,041 89,665

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started