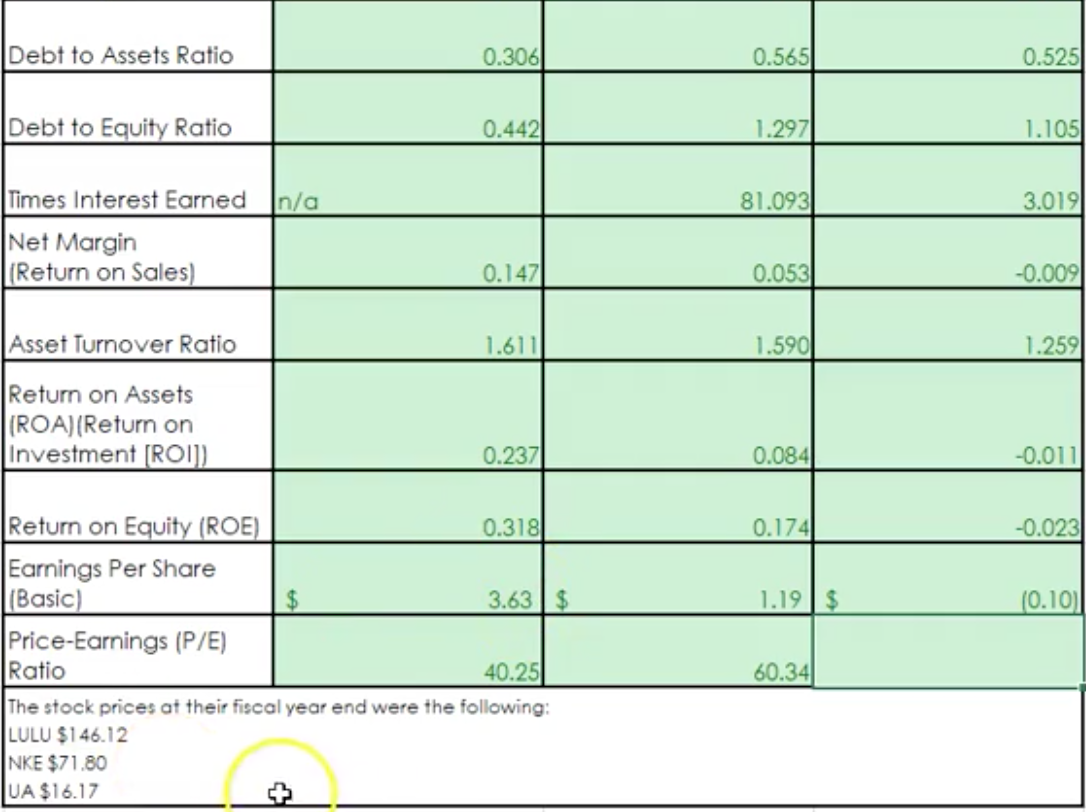

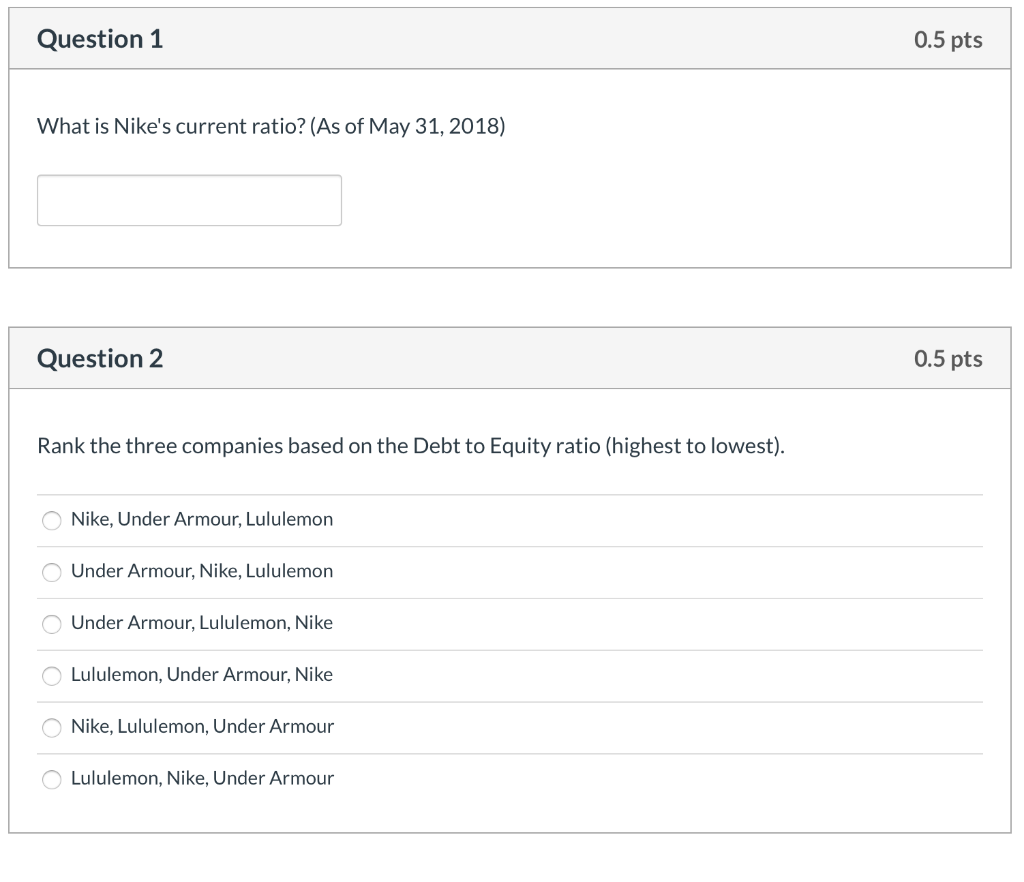

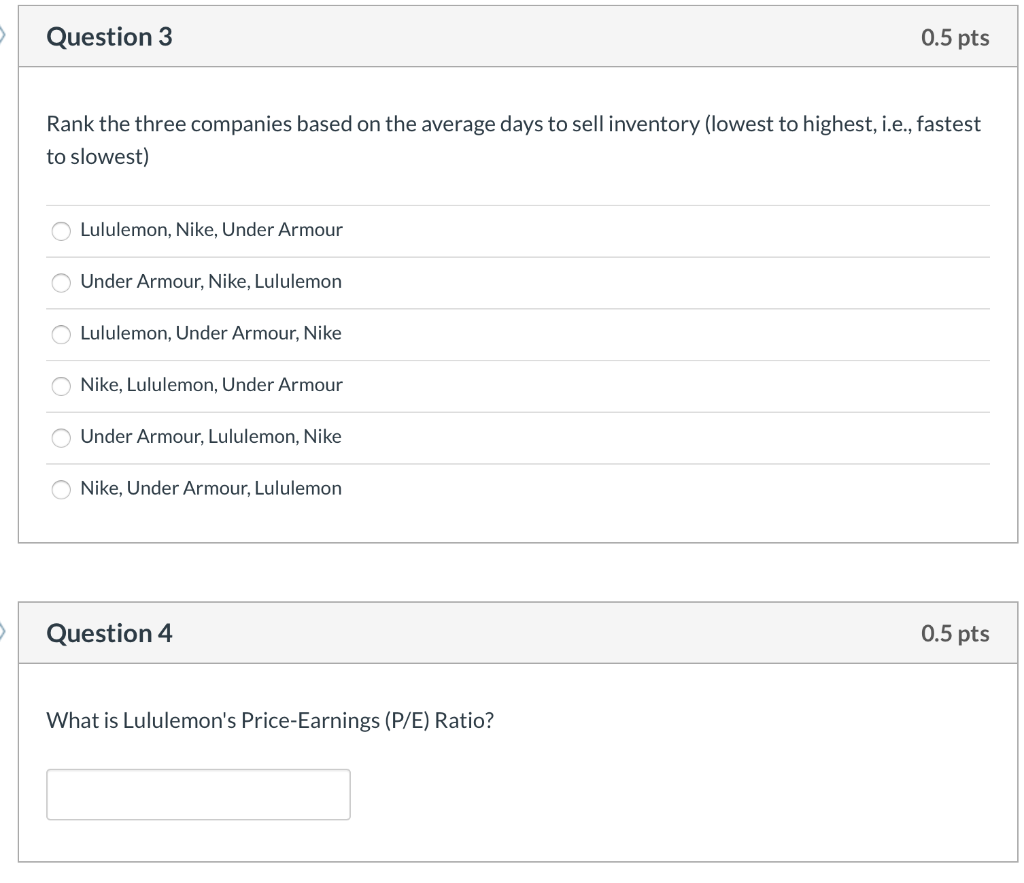

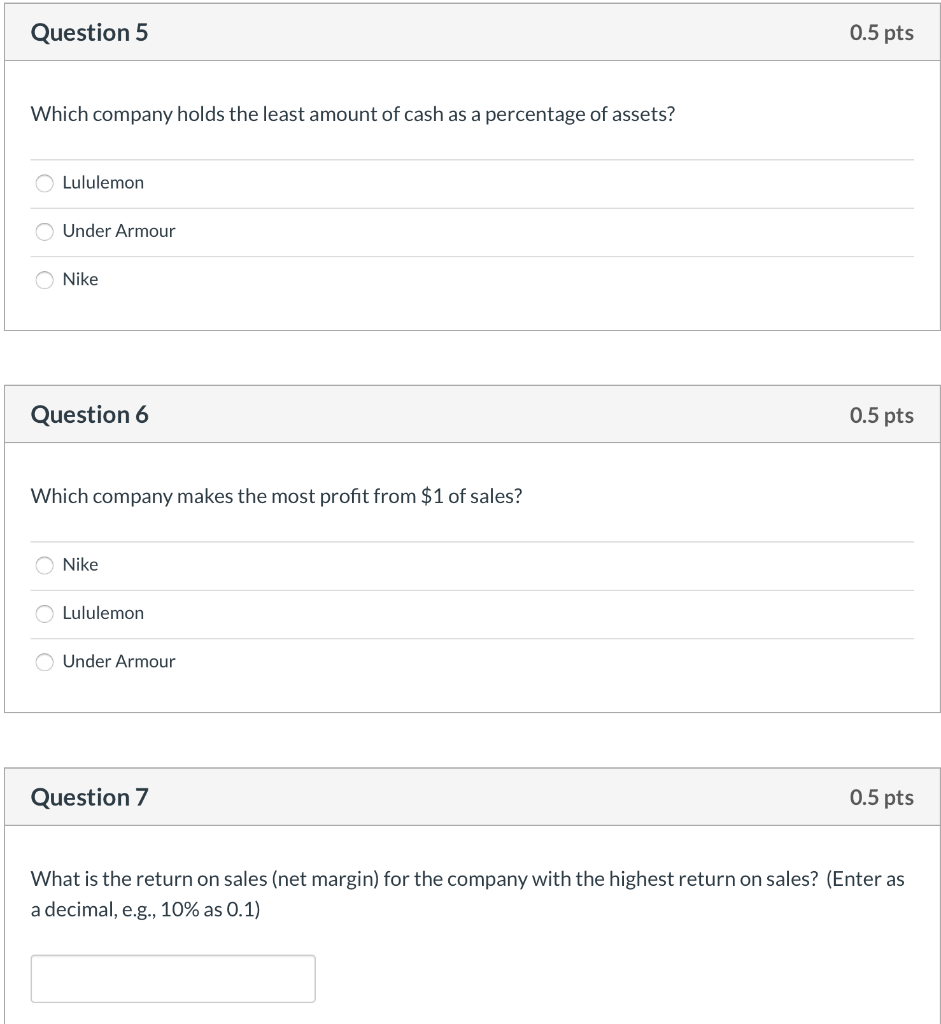

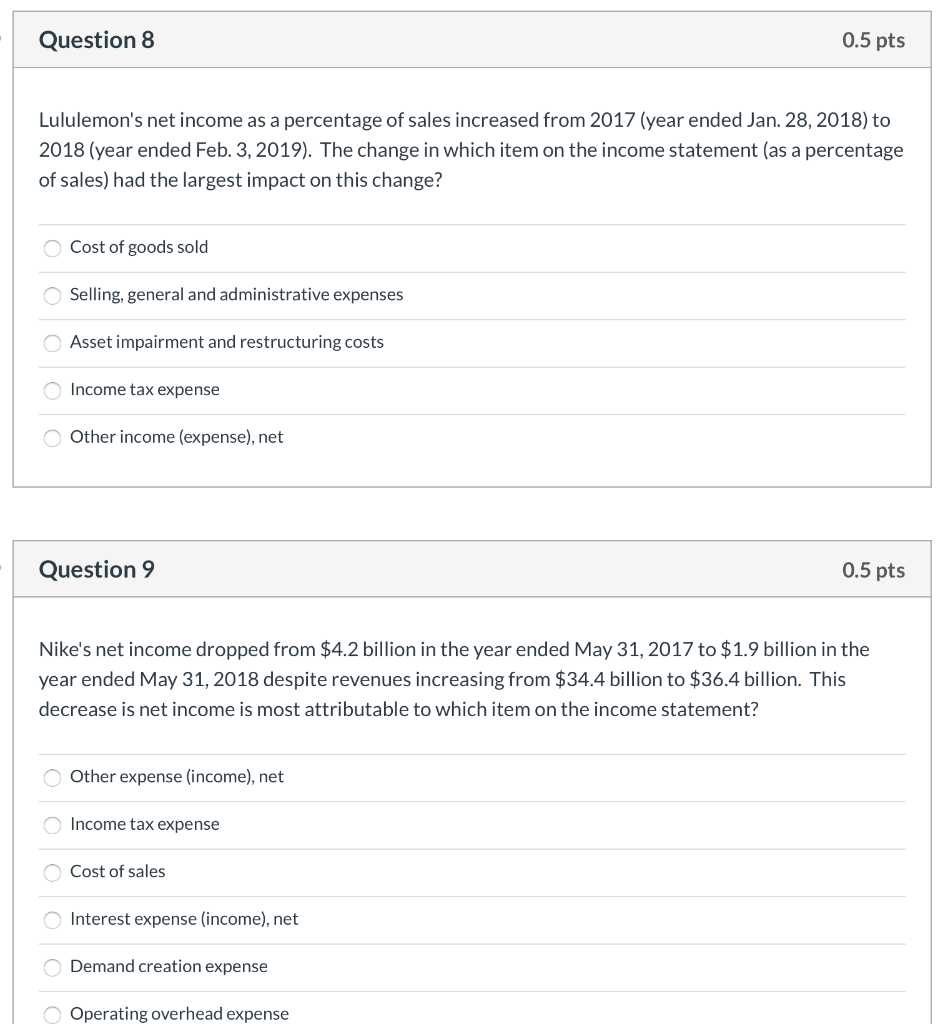

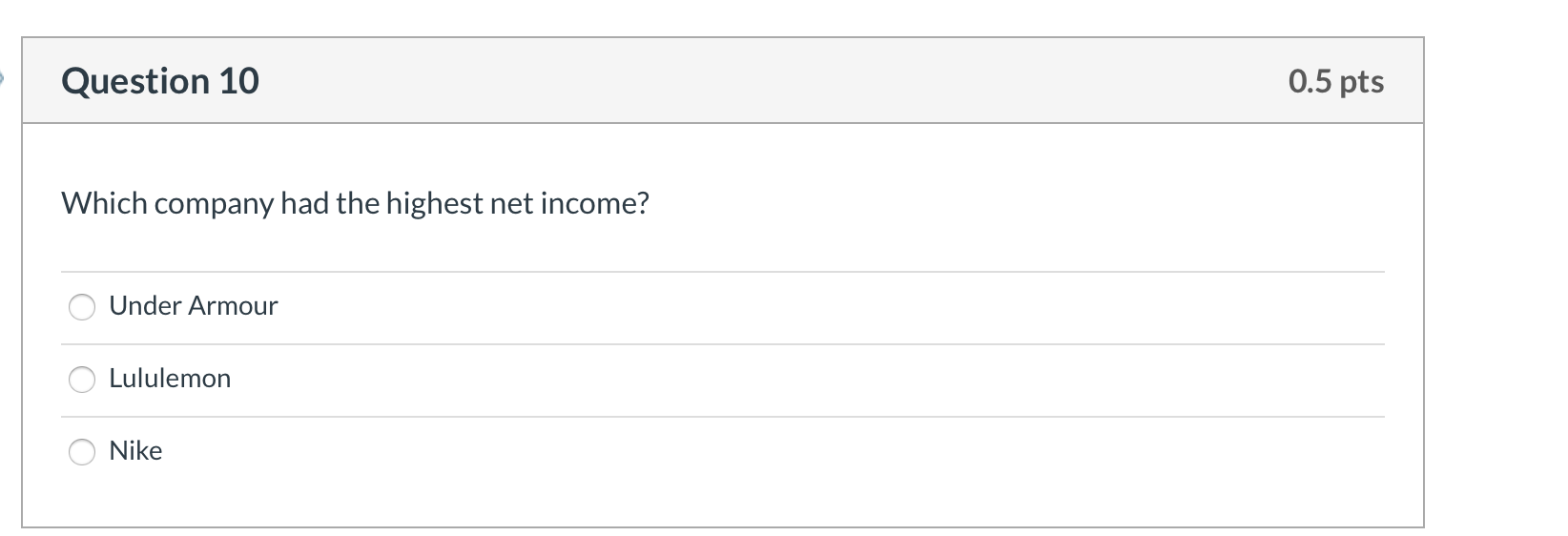

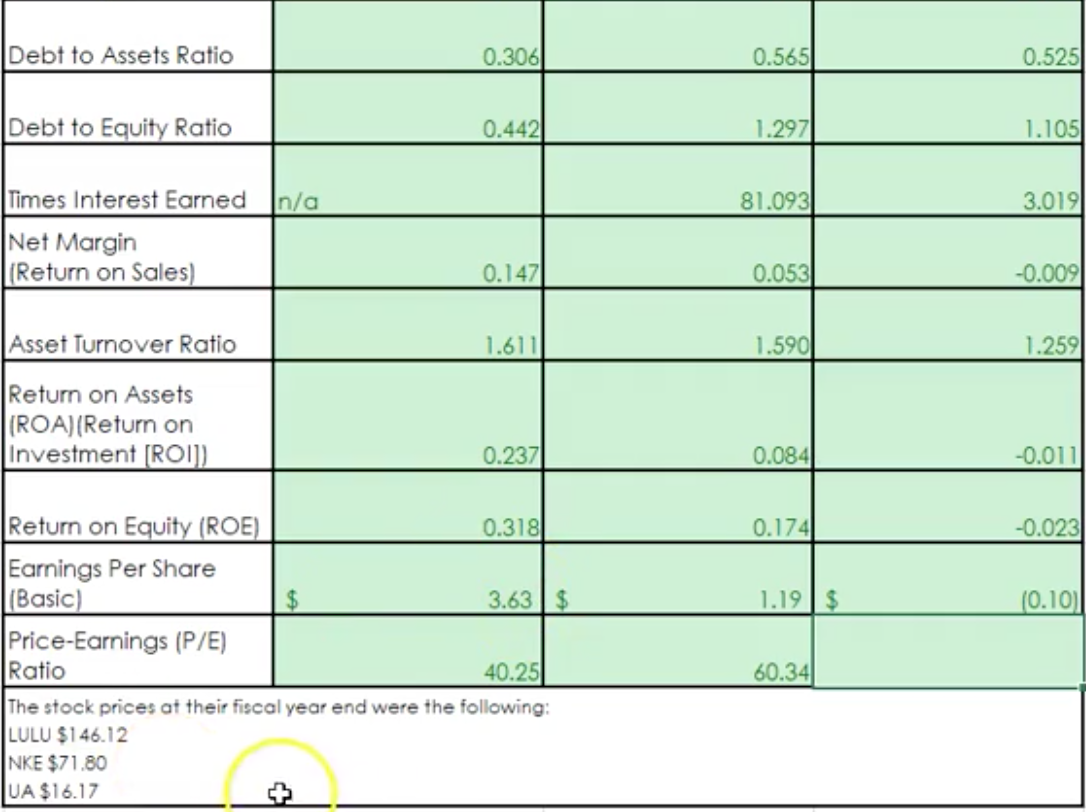

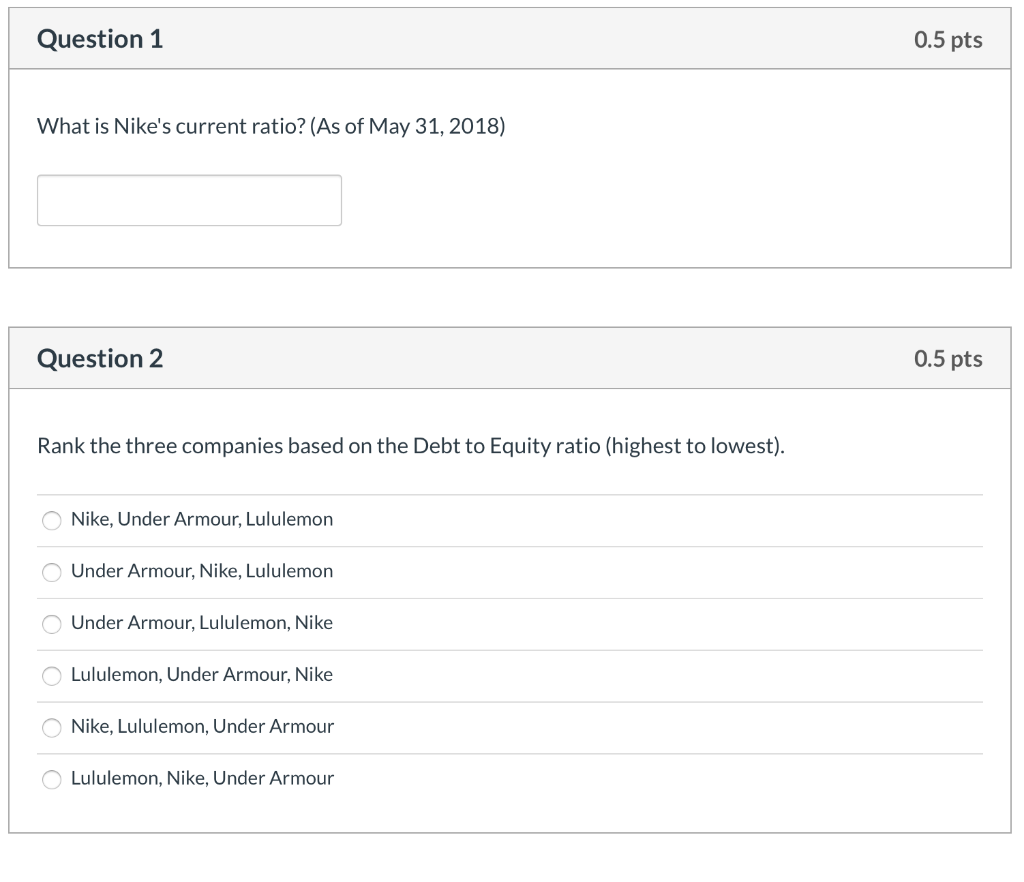

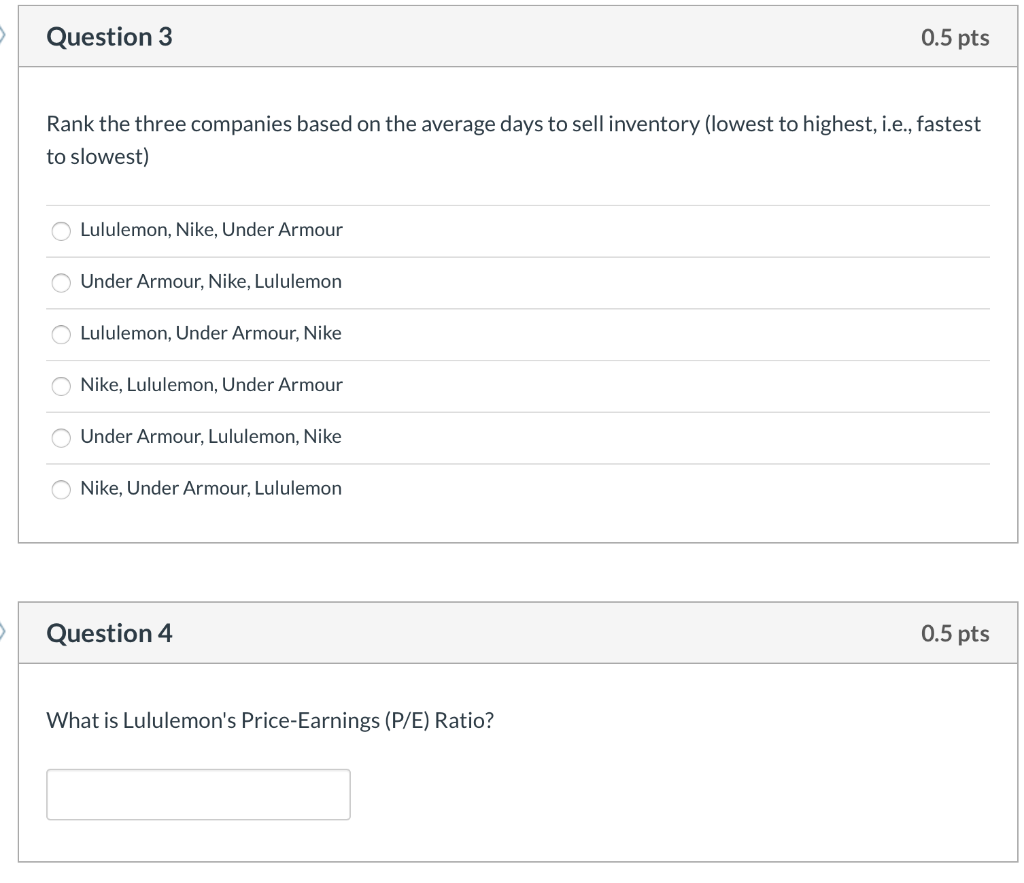

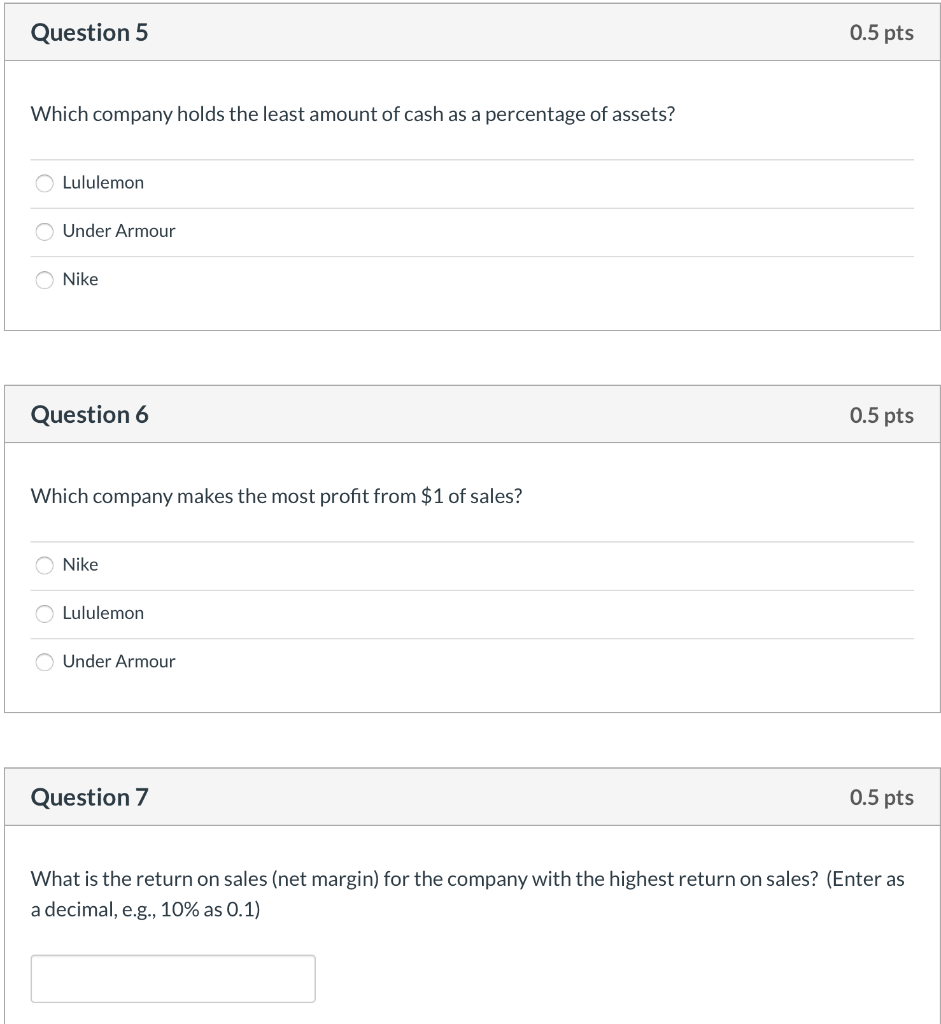

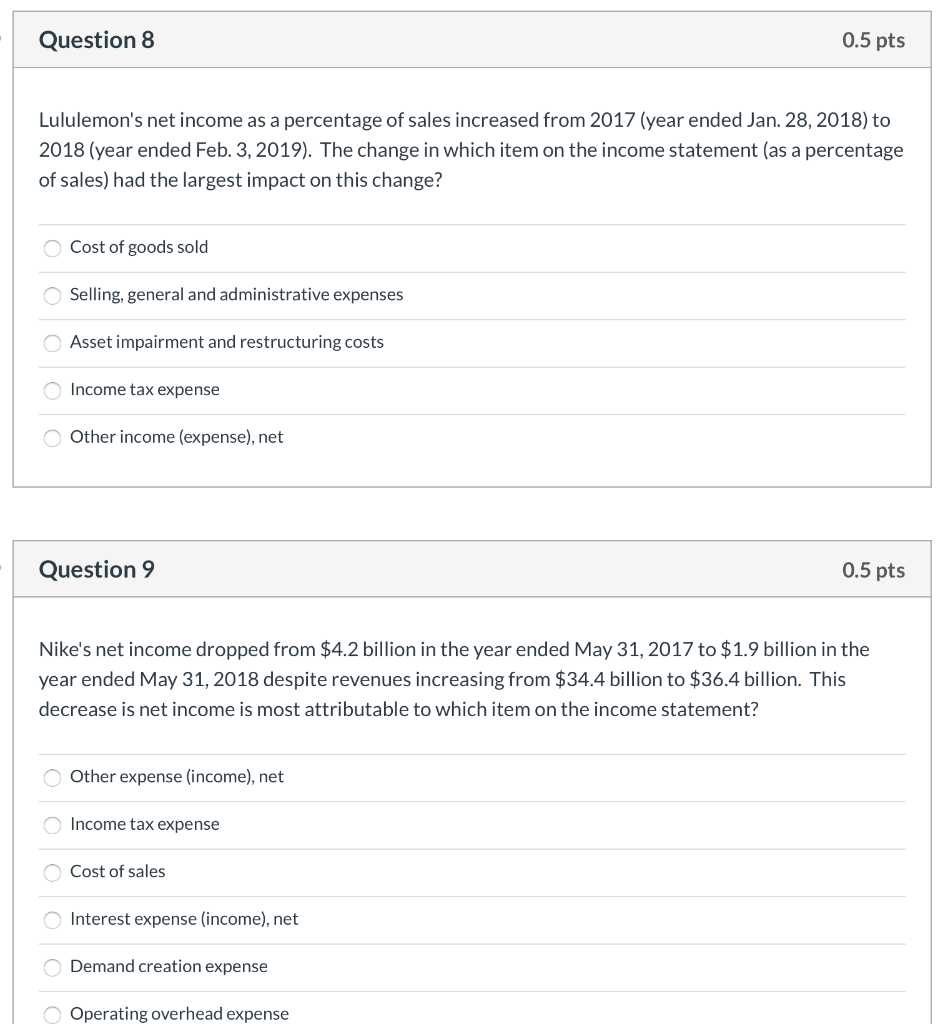

Ratio Lululemon (LULU) Nike (NKE) Under Armour (UA) Working Capital 928,805 $ 9,094,000 | $ 1,277,651 Current Ratio 2.856 2.506 1.971 1.832| 1.4481 0.919 Quick Ratio | Accounts Receivable Turnover Ratio 119.664 10.146 8.229 3.05 35.98 44.36) Average Days to Collect Receivables Inventory Turnover Ratio 4.009 3.963 2.620 Average Days to sell Inventory 91.05 92.10 139.341 Debt to Assets Ratio 0.306 0.5651 0.525 Debt to Equity Ratio 044 1.297 - 81.093 1.105 3.019) Times Interest Earned In/a Net Margin (Return on Sales) 0.147 0.053 -0.009 1.500 Asset Turnover Ratio 1.5901 1.259 1.259 Return on Assets (ROA) (Return on Investment [ROI]). 0.2371 0.084 -0.011 eura -0.023 1.19 $ (0.10) Return on Equity (ROE) 0.318 Earnings Per Share (Basic) 3.63 $ Price-Earnings (P/E) Ratio 40.251 The stock prices at their fiscal year end were the following: LULU $146.12 NKE $71.80 UA $16.17 60.34 Question 1 0.5 pts What is Nike's current ratio? (As of May 31, 2018) Question 2 0.5 pts Rank the three companies based on the Debt to Equity ratio (highest to lowest). Nike, Under Armour, Lululemon Under Armour, Nike, Lululemon Under Armour, Lululemon, Nike Lululemon, Under Armour, Nike Nike, Lululemon, Under Armour Lululemon, Nike, Under Armour Question 3 0.5 pts Rank the three companies based on the average days to sell inventory (lowest to highest, i.e., fastest to slowest) Lululemon, Nike, Under Armour Under Armour, Nike, Lululemon Lululemon, Under Armour, Nike Nike, Lululemon, Under Armour Under Armour, Lululemon, Nike Nike, Under Armour, Lululemon Question 4 0.5 pts What is Lululemon's Price-Earnings (P/E) Ratio? Question 5 0.5 pts Which company holds the least amount of cash as a percentage of assets? Lululemon Under Armour Nike Question 6 0.5 pts Which company makes the most profit from $1 of sales? Nike Lululemon Under Armour Question 7 0.5 pts What is the return on sales (net margin) for the company with the highest return on sales? (Enter as a decimal, e.g., 10% as 0.1) Question 8 0.5 pts Lululemon's net income as a percentage of sales increased from 2017 (year ended Jan. 28, 2018) to 2018 (year ended Feb. 3, 2019). The change in which item on the income statement (as a percentage of sales) had the largest impact on this change? Cost of goods sold Selling, general and administrative expenses Asset impairment and restructuring costs Income tax expense Other income (expense), net Question 9 0.5 pts Nike's net income dropped from $4.2 billion in the year ended May 31, 2017 to $1.9 billion in the year ended May 31, 2018 despite revenues increasing from $34.4 billion to $36.4 billion. This decrease is net income is most attributable to which item on the income statement? Other expense (income), net Income tax expense Cost of sales Interest expense (income), net Demand creation expense Operating overhead expense Question 10 0.5 pts Which company had the highest net income? o Under Armour O Lululemon O Nike