Answered step by step

Verified Expert Solution

Question

1 Approved Answer

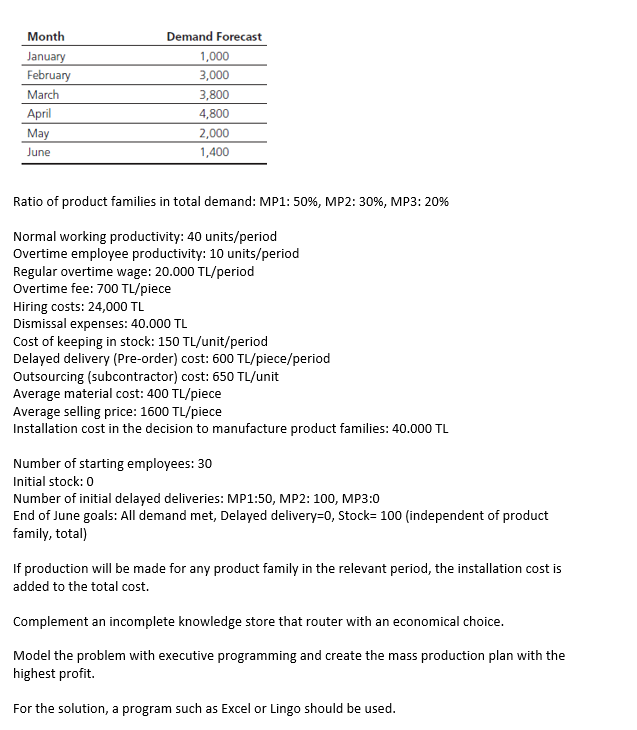

Ratio of product families in total demand: MP1: 50%, MP2: 30%, MP3: 20% Normal working productivity: 40 units/period Overtime employee productivity: 10 units/period Regular overtime

Ratio of product families in total demand: MP1: 50\\%, MP2: 30\\%, MP3: 20\\% Normal working productivity: 40 units/period Overtime employee productivity: 10 units/period Regular overtime wage: \\( 20.000 \\mathrm{TL} / \\) period Overtime fee: \\( 700 \\mathrm{TL} / \\) piece Hiring costs: \\( 24,000 \\mathrm{TL} \\) Dismissal expenses: \\( 40.000 \\mathrm{TL} \\) Cost of keeping in stock: \\( 150 \\mathrm{TL} / \\) unit/period Delayed delivery (Pre-order) cost: \\( 600 \\mathrm{TL} / \\) piece/period Outsourcing (subcontractor) cost: \\( 650 \\mathrm{TL} / \\) unit Average material cost: \\( 400 \\mathrm{TL} / \\) piece Average selling price: \\( 1600 \\mathrm{TL} / \\) piece Installation cost in the decision to manufacture product families: \\( 40.000 \\mathrm{TL} \\) Number of starting employees: 30 Initial stock: 0 Number of initial delayed deliveries: MP1:50, MP2: 100, MP3:0 End of June goals: All demand met, Delayed delivery=0, Stock \\( =100 \\) (independent of product family, total) If production will be made for any product family in the relevant period, the installation cost is added to the total cost. Complement an incomplete knowledge store that router with an economical choice. Model the problem with executive programming and create the mass production plan with the highest profit. For the solution, a program such as Excel or Lingo should be used

Ratio of product families in total demand: MP1: 50\\%, MP2: 30\\%, MP3: 20\\% Normal working productivity: 40 units/period Overtime employee productivity: 10 units/period Regular overtime wage: \\( 20.000 \\mathrm{TL} / \\) period Overtime fee: \\( 700 \\mathrm{TL} / \\) piece Hiring costs: \\( 24,000 \\mathrm{TL} \\) Dismissal expenses: \\( 40.000 \\mathrm{TL} \\) Cost of keeping in stock: \\( 150 \\mathrm{TL} / \\) unit/period Delayed delivery (Pre-order) cost: \\( 600 \\mathrm{TL} / \\) piece/period Outsourcing (subcontractor) cost: \\( 650 \\mathrm{TL} / \\) unit Average material cost: \\( 400 \\mathrm{TL} / \\) piece Average selling price: \\( 1600 \\mathrm{TL} / \\) piece Installation cost in the decision to manufacture product families: \\( 40.000 \\mathrm{TL} \\) Number of starting employees: 30 Initial stock: 0 Number of initial delayed deliveries: MP1:50, MP2: 100, MP3:0 End of June goals: All demand met, Delayed delivery=0, Stock \\( =100 \\) (independent of product family, total) If production will be made for any product family in the relevant period, the installation cost is added to the total cost. Complement an incomplete knowledge store that router with an economical choice. Model the problem with executive programming and create the mass production plan with the highest profit. For the solution, a program such as Excel or Lingo should be used Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started