Question

Ratios and Financial Planning at East Coast Yachts In 1969, Tom Warren founded East Coast Yachts. The company's operations are located near Hilton Head Island,

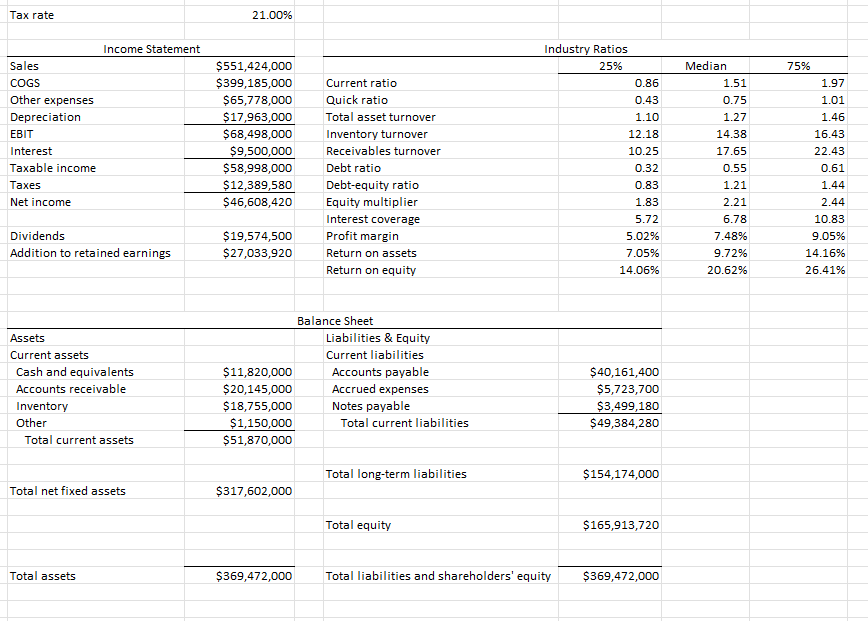

Ratios and Financial Planning at East Coast Yachts In 1969, Tom Warren founded East Coast Yachts. The company's operations are located near Hilton Head Island, South Carolina. The company has manufactured custom midsize, high-performance yachts for clients, and its products have received high reviews for safety and reliability. The company's yachts have also recently received the highest award for customer satisfaction. The yachts are primarily purchased by wealthy individuals for pleasure use. Occasionally, a yacht is manufactured for purchase by a company for business purposes. The custom yacht industry is fragmented, with a number of manufacturers. As with any industry, there are market leaders, but the diverse nature of the industry ensures that no manufacturer dominates the market. The competition in the market, as well as the product cost, ensures that attention to detail is a necessity. For instance, East Coast Yachts will spend 80 to 100 hours on hand-buffing the stainless steel stem-iron, which is the metal cap on the yacht's bow that conceivably could collide with a dock or another boat. Several years ago, Tom retired from the day-to-day operations of the company and turned the operations of the company over to his daughter, Larissa. Because of the dramatic growth at East Coast Yachts, Larissa decided that the company should be reorganized as a corporation. Time has passed and, today, the company is publicly traded under the ticker symbol ECY. Dan Ervin was recently hired by East Coast Yachts to assist the company with its short-term financial planning and also to evaluate the company's financial performance. Dan graduated from college five years ago with a finance degree, and he has been employed in the treasury department of a Fortune 500 company since then. Larissa approached Dan about the company's performance and future growth plans. First, Larissa wants to find out how East Coast Yachts is performing relative to its peers. Additionally, she wants to find out the future financing necessary to fund the company's growth. In the past, East Coast Yachts experienced difficulty in financing its growth plan, in large part because of poor planning. In fact, the company had to turn down several large jobs because its facilities were unable to handle the additional demand. Larissa hoped that Dan would be able to estimate the amount of capital the company would have to raise next year so that East Coast Yachts would be better prepared to fund its expansion plans. To get Dan started with his analyses, Larissa provided the financial statements. The tax rate of the company is 21 percent. Dan then gathered the industry ratios for the yacht manufacturing industry.

5. Most assets can be increased as a percentage of sales. For instance, cash can be increased by any amount. However, fixed assets often must be increased in specific amounts because it is impossible, as a practical matter, to buy part of a new plant or machine. In this case, a company has a staircase or lumpy fixed cost structure. Assume that East Coast Yachts is currently producing at 100 percent of capacity and sales are expected to grow at the rate indicated above. As a result, to expand production, the company must set up an entirely new line at a cost of $78,500,000. Prepare the pro forma income statement and balance sheet. What is the new external financing need with these assumptions? What does this imply about capacity utilization for East Coast Yachts next year? What are your conclusions and recommendations about the feasibility of East Coast's expansion plans

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started