Answered step by step

Verified Expert Solution

Question

1 Approved Answer

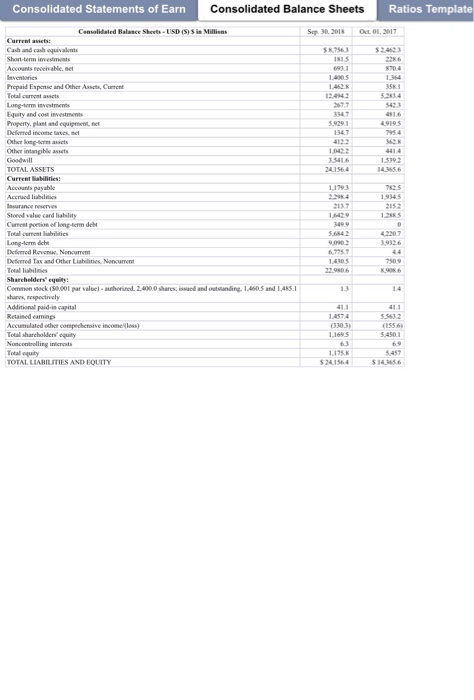

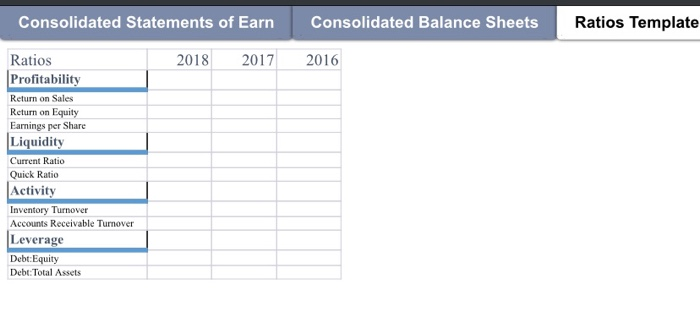

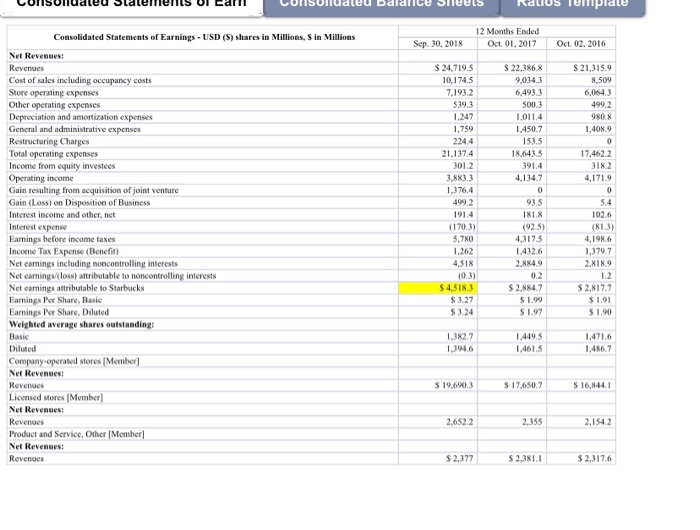

ratios for consolidated balance sheet Starbucks how do i solve for the ratio template? Consolidated Statements of Earn Consolidated Balance Sheets Ratios Template Sep 30,

ratios for consolidated balance sheet Starbucks

how do i solve for the ratio template?

Consolidated Statements of Earn Consolidated Balance Sheets Ratios Template Sep 30, 2018 O . 2017 Consolidated Balance Sheets - USD (S) Sin Millions Current Cash and cash equivalents Short-term in Prepaid Expand Other Ass, Cut Equity and cost investments Property, plant and equipment Deferred income Other long-term acts Other intangible assets TOTAL ASSETS Accued liabili Stowalue and liability Current pro long-term de Long-term debe Deed Revenue Noncur Deemed Tax and Other Liabilities. Noncur Common stack (50.001 par value) - hired. 2.000.0 shares, issued and outstanding. 1.450.5 and 1.465.1 Additional paid-in capital Accumulated other compechensive incomess) Tehacholders guilty Tauty TOTAL LIABILITIES AND LOUITY Consolidated Statements of Earn Consolidated Balance Sheets Ratios Template 2018 2017 2016 Ratios Profitability Return on Sales Return on Equity Earnings per Share Liquidity Current Ratio Quick Ratio Activity Inventory Turnover Accounts Receivable Turnover Leverage Debt:Equity Debt: Total Assets LUISUnualeu Statements Ul Carl LUISUllualeu baidlice Sheets Rallos Template Consolidated Statements of Earnings- USD (5) shares in Millions, S in Millions 12 Months Ended Oct. 01. 2017 Sep 30, 2018 Oct. 02. 2016 $22,386.8 9,034.3 6,493.3 500.3 1,011.4 1.450.7 153.5 18.643.5 391.4 4.114.7 $21.3159 8.509 6,0643 4992 980.8 1.4089 17.462.2 3182 4,171.9 Net Revenues: Revenues Cost of sales including occupancy costs Store operating expenses Other operating expenses Depreciation and amortization expenses Gencral and administrative expenses Restructuring Charges Total operating expenses Income from equity investees Operating income Gain resulting from acquisition of joint venture Gain (Loss) on Disposition of Business Interest income and other net Interest expense Earnings before income taxes Income Tax Expense Benefit) Net camings including noncontrolling interests Net eaming loss) attributable to noncontrolling interests Net camnings attributable to Starbucks Earnings Per Share, Basic Earnings Per Share, Diluted Weighted average shares outstanding! $24.719.5 10.174.5 7.193.2 5393 1,247 1.759 224.4 21.137.4 301.2 3.RR33 1.376.4 4992 191.4 (1703) 5.780 1.262 4.518 (0.3) $4 SIR $ 3.27 $ 3.24 5.4 93.5 181.8 (925) 4,1175 1.432.6 2849 0.2 $ 2.8847 $ 1.99 S 1.97 102.6 ( 1.3) 4.1986 1.379.7 2.818.9 1.2 $ 2.817.7 $1.91 $ 1.90 1.3K2.7 1.3946 1,449.5 1.461.5 1.4716 1.486.7 $ 19,603 $ 17,650.7 S 16,144.1 Diluted Company operated stores (Member) Net Revenues: Revenues Licensed stores (Member) Net Revenues: Revenues Product and Service, Other Member Net Revenues: Revenues 2,6522 2,355 2,1542 $ 2,377 $2,381.1 $2.317.6 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started