Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Ratzlaff Company has a current production capacity of 20,000 units for December. You have been asked to analyze the below decision for Ratzlaff. Per-unit

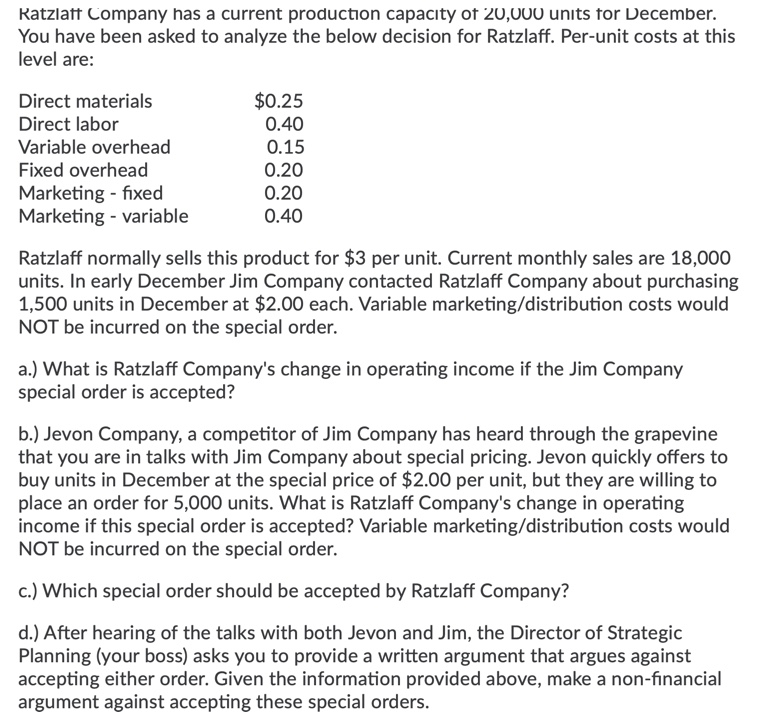

Ratzlaff Company has a current production capacity of 20,000 units for December. You have been asked to analyze the below decision for Ratzlaff. Per-unit costs at this level are: Direct materials $0.25 Direct labor 0.40 Variable overhead 0.15 Fixed overhead 0.20 Marketing - fixed 0.20 Marketing - variable 0.40 Ratzlaff normally sells this product for $3 per unit. Current monthly sales are 18,000 units. In early December Jim Company contacted Ratzlaff Company about purchasing 1,500 units in December at $2.00 each. Variable marketing/distribution costs would NOT be incurred on the special order. a.) What is Ratzlaff Company's change in operating income if the Jim Company special order is accepted? b.) Jevon Company, a competitor of Jim Company has heard through the grapevine that you are in talks with Jim Company about special pricing. Jevon quickly offers to buy units in December at the special price of $2.00 per unit, but they are willing to place an order for 5,000 units. What is Ratzlaff Company's change in operating income if this special order is accepted? Variable marketing/distribution costs would NOT be incurred on the special order. c.) Which special order should be accepted by Ratzlaff Company? d.) After hearing of the talks with both Jevon and Jim, the Director of Strategic Planning (your boss) asks you to provide a written argument that argues against accepting either order. Given the information provided above, make a non-financial argument against accepting these special orders.

Step by Step Solution

★★★★★

3.54 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

a Ratzlaff Companys change in operating income if the Jim Company special order is accepted Unit cos...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started